ETF Insights | February 1, 2025 | S&P 500 Materials Sector

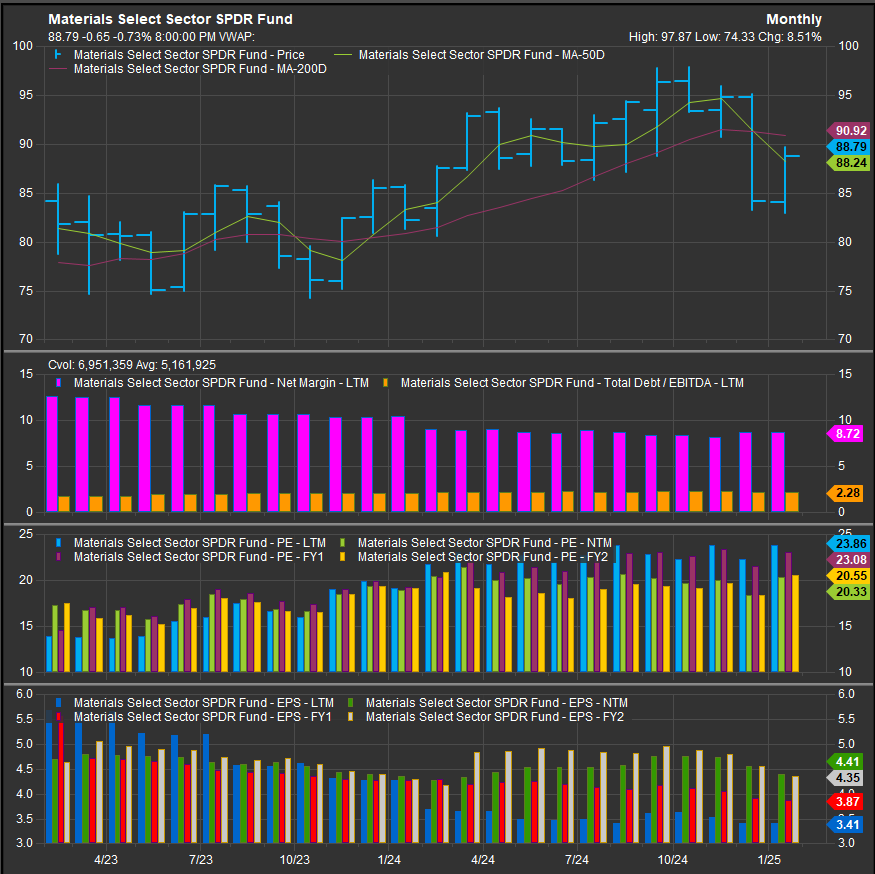

S&P 500 Materials Sector Price Action & Performance

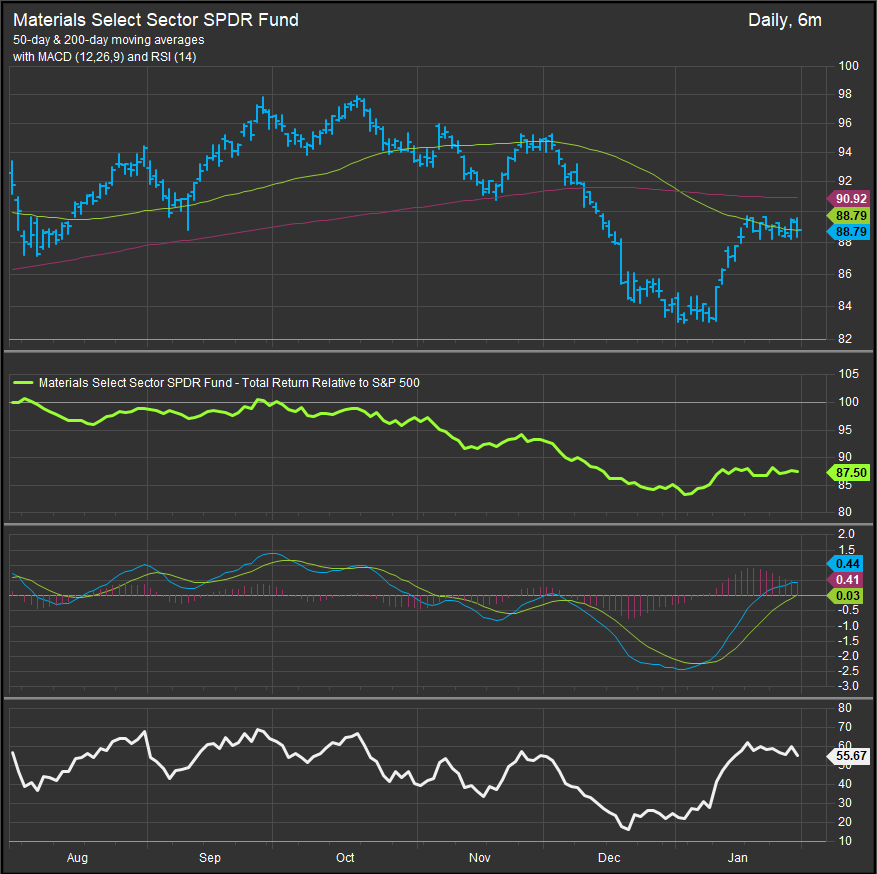

The S&P 500 Materials Sector rallied in January from deeply oversold conditions in late December. Price (chart below, top panel) is now consolidating below the 200-day moving average. January’s bullish price action wasn’t enough to change the chart in a positive way. Oscillator work (panels 3 and 4) shows the MACD study losing steam and the RSI rolling over short of overbought conditions. This falls short of triggering out bullish reversal indicators at the sector level. If rates continue to rise and eventually force investors out of the Growth trade, we could see Materials coming back in favor, but until we see sustained evidence, we will stay on the short side.

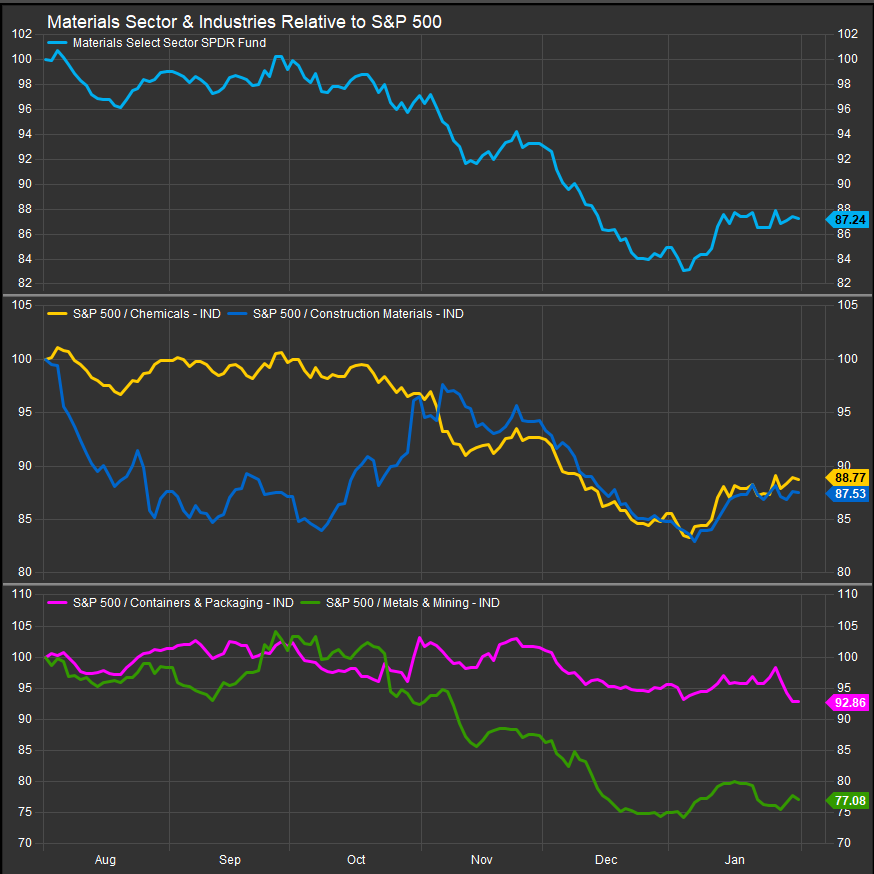

S&P 500 Materials Sector: Industry Performance Trends

January saw price and relative performance firm for materials sectors, but this still has the look of a “dead cat” bounce. For those not familiar, the term derives from the idea that “even a dead cat will bounce if it falls far enough”, and is used to warn against short-term outperformance in terrible stocks.

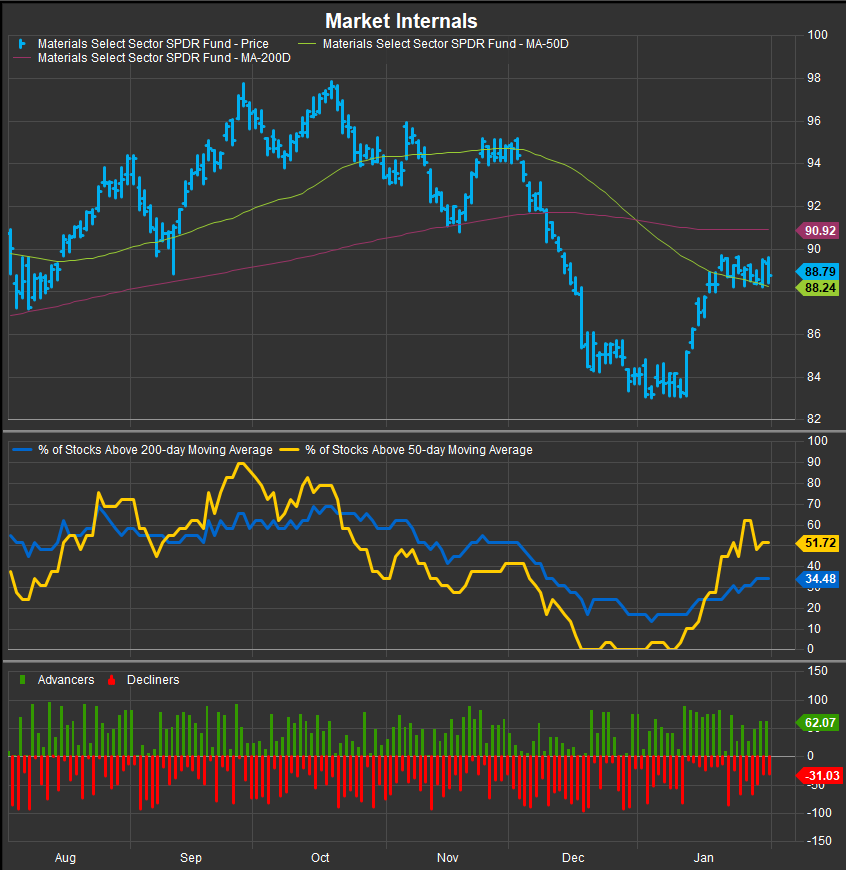

S&P 500 Materials Sector Breadth

Materials stocks hit a complete wash out at the turn of the calendar with the % of stocks above their 50-day moving average hitting zero on multiple occasions. January finally saw a bounce, but internals remain underwhelming with price consolidating below a downwards-sloping 200-day moving average. This is not a pretty technical picture!

S&P 500 Materials Sector Top 10 Stock Performers

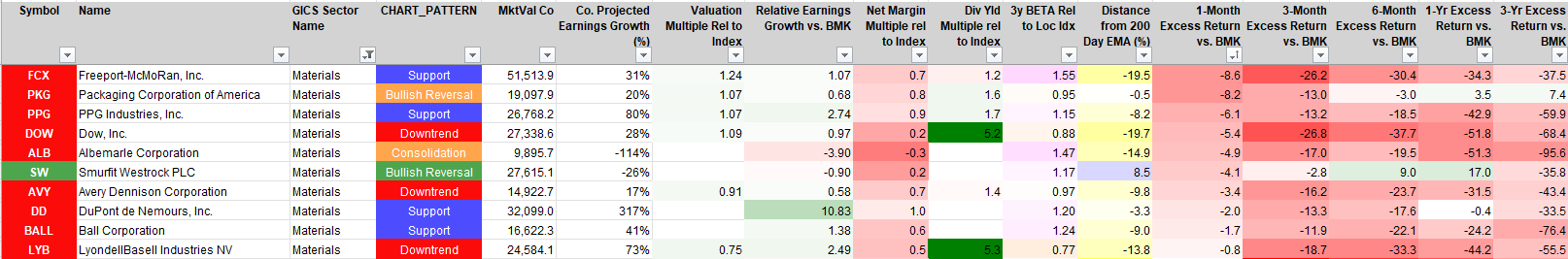

The January bounce had us upgrading APD, but hasn’t been enough to signal sustainable trend change. There are very few outperforming stocks within the sector and no real pockets of strength.

S&P 500 Materials Sector Bottom 10 Stock Performers

PKG was one of the best stocks in the sector until its recent earnings miss. None of these stocks are compelling accumulation opportunities at this point.

S&P 500 Materials Sector Fundamentals

The chart below shows S&P 500 Materials Sector Margin, debt/EBTIDA, Valuation and Earnings. Margins have stabilized at the sector level, but the trajectory of earnings has shifted bearish and forward year earnings multiples are showing no discount to the broad market which is historically a rich multiple for the sector.

Economic & Policy Developments

January brought significant macroeconomic and policy shifts that affected the U.S. materials sector, particularly in chemicals, construction materials, containers & packaging, and mining.

The Federal Reserve maintained interest rates at its January FOMC meeting, with a hawkish tilt in its statement, reinforcing expectations that rate cuts may not occur until mid-2025. This weighed on construction and materials demand, as higher borrowing costs continued to pressure real estate development and infrastructure projects. However, moderating inflation and a still-resilient labor market helped maintain steady industrial activity, which supported commodities and key inputs like cement, copper, and aluminum.

Trump’s Trade Policies Created Volatility: The administration reaffirmed its stance on broad tariffs, proposing 25% duties on metals from Canada and Mexico, along with 10% tariffs on Chinese and European imports. These policies heightened concerns for U.S. manufacturing and materials companies reliant on global supply chains, particularly in steel, aluminum, and packaging. While the market initially shrugged off the announcements, later headlines suggested potential exemptions or delays in implementation, creating uncertainty for pricing and supply chain decisions.

Industry Specific Impacts

- Chemicals: The Dow Chemical (DOW) earnings miss highlighted weak global demand and pricing pressure across key segments. The company also announced ~$1B in cost-cutting initiatives, including 1,500 job reductions to offset declining margins. On the policy front, China’s slower-than-expected economic recovery dampened chemical exports, while ongoing U.S. regulatory shifts on environmental policies could impact long-term production costs.

- Containers & Packaging: The sector faced tariff-driven cost concerns, as imported raw materials—aluminum, steel, and resins—could become more expensive under new trade policies. Packaging Corporation of America (PKG) guided below expectations, citing slower volumes and rising input costs. Meanwhile, consumer demand shifts continued to favor sustainable packaging, with companies investing in recyclable and biodegradable materials to align with ESG mandates.

- Construction Materials: Higher interest rates weighed on residential and commercial construction, affecting demand for cement, aggregates, and building materials. Caterpillar (CAT) reported weaker sales and dealer destocking trends, though infrastructure spending remained a relative bright spot. In metals, Alcoa (AA) projected lower 2025 alumina production due to capacity curtailments, while Lundin Mining (LUN) outlined three-year production targets reflecting steady demand but ongoing cost pressures.

- Mining & Metals: Freeport-McMoRan (FCX) posted lower-than-expected earnings, though copper prices surged 6.1% in January, driven by China’s 22% increase in copper imports. However, supply chain disruptions—including new sanctions on Russian exports and Middle East refinery outages—exacerbated market volatility. Gold miners outperformed, with gold prices rising 7.3% to $2,832.30/oz, driven by inflation concerns and central bank purchases.

2025 Outlook

The U.S. Materials sector faces a mix of economic resilience, policy uncertainty, and global demand shifts heading into February.

Federal Reserve policy remains a key driver, with markets anticipating rate cuts by mid-year. While higher borrowing costs continue to weigh on construction materials and industrial demand, infrastructure spending and steady consumer activity provide some offset.

Trump’s proposed tariffs on metals, chemicals, and packaging materials create uncertainty for input costs and supply chains, though reports of potential delays or exemptions could limit near-term impact. Earnings from key mining, steel, and chemical companies will offer insight into pricing power, cost pressures, and production guidance for 2025.

We aren’t seeing technical or fundamental inputs supporting the Materials sector at present.

In Conclusion

While interest rates remain high enough to complicate the Fed’s mandate, we aren’t seeing anything that tells us a replay of 2022 is around the corner. As a result, we enter February with the Materials Sector as a zero-weight position in our Elev8 Sector Rotation Model Portfolio resulting in an underweight exposure of -2.05%.

Data sourced from Factset Research Systems Inc.