As schools close for the year and we enter winter vacation season, this is an excellent time to look back on the financial markets in 2024 and take a moment to reflect before we plunge into another year identifying and positioning around the dominant economic, fundamental and price trends that will define 2025.

2024 will go down as a strong year for the Bull, with the S&P 500 6 trading days away from printing a >20% gain while currently sporting a simple return of 24.37% for the year and a total return of over 26%. The Feds coy attitude in its most recent meeting aside, equity investors were happy with policy implementation in the 2nd half of the year and inflation has cooperated enough to get us to this point.

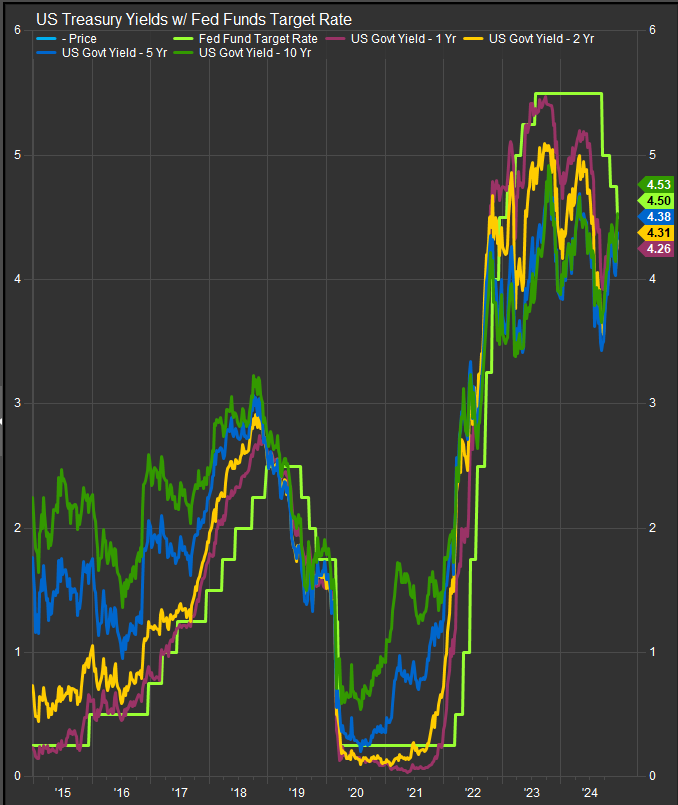

Yields will likely finish the year as a concern for equity investors as the 10yr Treasury Yield started out 2024 at 3.88% and currently sits at 4.53% despite the celebrated demise of inflation in September when the Fed started easing its policy rate. We’ve written extensively about rates this year as rising rates have historically been a headwind to Growth stocks which accounted for a significant chunk of positive returns for the equity market. We think policy from the incoming Trump administration is likely to exacerbate inflationary pressures in the form of tax cuts, and a more aggressive protectionist approach to international trade. We also think the current fundamental position of the US Consumer is vulnerable to increased financing costs from rising rates as we have noticed that credit delinquencies are starting to move higher on credit card balances, home and auto loans.

From a technical perspective, performance trends that defined the present bull market in 2023 and the first half of 2024, namely Semiconductors, Mag7, and GLP1 pharmaceuticals are now mature and Semiconductors in particular have lost upside momentum and enter 2025 in a vulnerable position. The Mag7 has shown resilience though its membership now seems to be taking turns outperforming rather than remaining a block with Tech Sector members NVDA, MSFT and AAPL showing a declining level of enthusiasm from buyers as 2024 comes to a close.

On the other hand, Commodities and low vol. exposures finished the year as laggard performers. Commodities prices have exhibited persistent weakness despite inflationary pressures remaining somewhat sticky. We expect elevated potential for rotation as the calendar turns to 2025. We think interest rates have potential to derail the bull if they move materially above the Fed policy rate in 2025 as they will put pressure on the central bank to pivot away from supporting the economy and back into a hawkish stance. Currently the 10yr Yield is above the Fed target rate with the former at 4.53% and the latter at 4.5%. We would feel better about the bull’s continuing prospects if rates rolled over to the downside.

Market internals for the S&P 500 show that investors have become very cautious in the last month of 2024 and the average stock is getting sold. The chart below shows we hit potential “wash out” levels for the S&P last week with only 18% of S&P 500 constituents above their 50-day moving average on December 19. So far in this cycle these “breadth lows” have been seen as accumulation opportunities and the market has gone on to new highs. We think equity weakness to start 2025 would be a bearish signal given that dynamic. You will likely see articles about the “January Effect” where the month’s performance often augurs that of the entire year. We think this year’s setup plays into that dynamic. We will be putting our outlook pieces together for January over the next week, and, despite the backdrop of the longer-term bull trend, we are likely to enter 2025 on somewhat cautious footing given rising rates and weakening equity market internals.

We hope our readers have an opportunity to relax with family and friends over the next week. We will be back with our weekly cyclicals starting with Factor Friday on January 3rd of 2025, but please check ETFsector.com for our daily market updates through the next two weeks for a quick update on everything that transpires. Happy New Year from all of us at ETFsector!!

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Year in Review: Sectors

With less than 7 trading days to go in 2024, the Communications Services Sector has the lead in performance and poll position for the home stretch. Discretionary stocks have been on fire since August and finished the year as one of three outperforming sectors along with the Comm Services Sector and the Financial Sector. Low Vol. and Commodities adjacent sectors lagged the broad market with Materials, Energy, Healthcare and Real Estate the weakest performers. Our process doesn’t recommend out of favor exposures without some evidence of buying in the near-term which has served us well in 2024. We will be looking for evidence of leadership rotation in 2025 given our marginal indicators are starting to line up against Growth and Consumer led outperformance. We balance that against the sector performance chart below which gives us no inclination whatsoever that Commodities or low vol. sectors are going to turn around.

We would need to see bullish price action in Commodities prices to improve our outlook on Energy and Materials stocks and more selling from these near-term oversold levels on the S&P 500 to turn negative on equities. At present we find that there are threats to the bull, but we aren’t seeing a clear path for a different leadership profile as of yet. Put another way, investors may be getting a bit uncomfortable with the setup for US equities, but our charts tell us, they are even more uncomfortable with exposure to anything else at present. This is the structural dynamic to financial markets that can buttress existing trends and make them last longer than expected.

Thank you for reading us in 2024. We look forward to offering more ideas, insights and research in 2025 as we develop new tools to help you succeed in your endeavors.

Data sourced from Factset Research Systems Inc.