February 17, 2025

When a bull market trend matures over the long-term there are usually other defined trends that form coincidentally with it and help to define its narrative and its nature. The current long-term bull trend has a few signature qualities we can all recognize. It has developed on the back of Mega Cap. stock outperformance as well as Small/Mid and ex-US underperformance. Rates have generally moved sideways, and commodities prices have been in a downtrend coincident with the bull cycle.

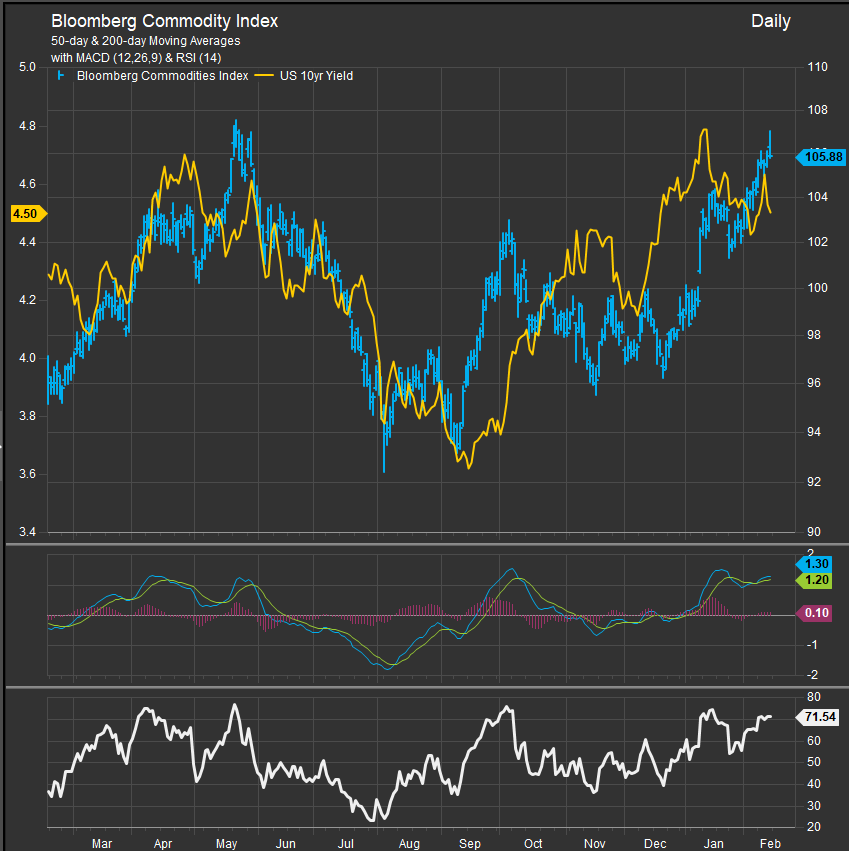

As we advance into 2025, we are starting to see some cracks in the pillars of this bull market, but so far, the Mag7 cohort and the Tech Sector have done enough to create an uneasy equilibrium. One thing we’ve found to be curious is the near-term divergence between interest rates and commodities prices. Near-term commodities prices have been testing up towards long-term resistance between the 107-110 level. Rates had front run this move breaking out in mid-January but have since pulled back and are in the middle of their 6-month range (chart below).

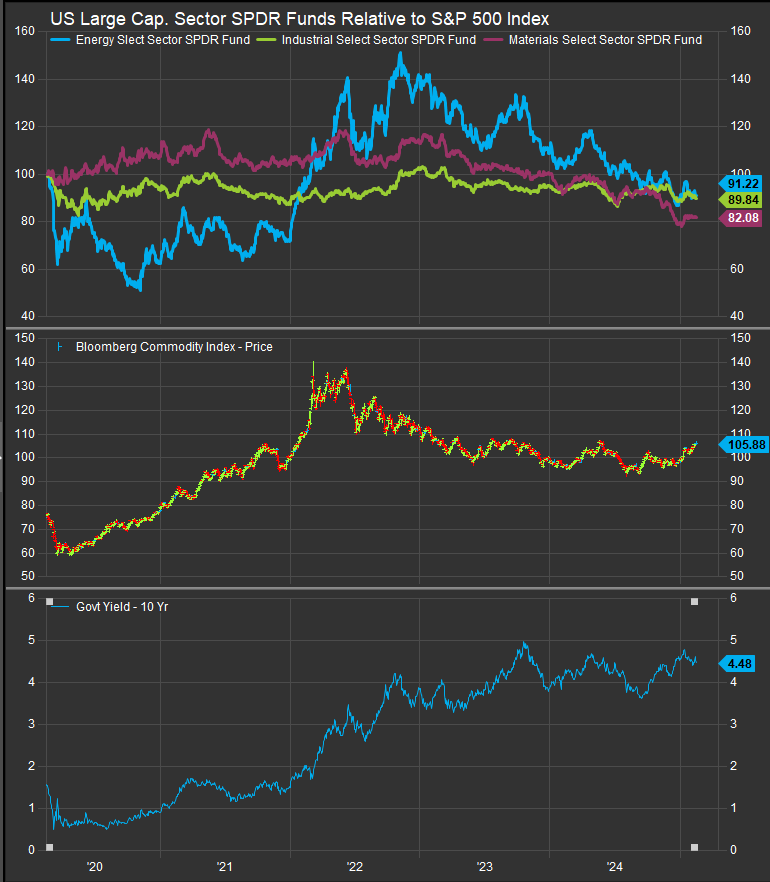

Given the action in rates, we are expecting commodities prices to roll over below their May peak. If they do not, and keep rising, that would be where things get very interesting. When looking back 5 years on commodities, interest rates and commodity adjacent sectors (Energy, Materials and Industrials), we can see the relationship was highly correlated between 2019 and 2022. That relationship has broken down since the bull market started, with commodities prices retracing roughly 40% of their 2022 gains while interest rates consolidated near cycle highs (chart below).

If commodities pivot higher from here, we would expect a corresponding pivot higher in commodity sectors, but we also would expect rates to continue higher unless those rising input prices and the inflationary dynamic they cause starts finally harming the economy. Rising commodities prices and falling rates in combination could end up telegraphing a very negative outcome for equities.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.