Equity prices have surged over the past two weeks and now equities sit just 2% below all-time highs after a 10% correction from July 16th through August 5th. Buying has been spurred by economic data that continues to thread the needle between inflation and recession, offering enough solid news on employment with continued benign CPI readings.

Investors now expect interest rate policy easing in the 2nd half of the year while retail sales recently posted a 1% MoM gain and unemployment ticked lower on the latest jobless claims report, all while the CPI printed a 2.9% reading YoY for July.

This all seems to the good, but we will be confronting the “feedback loop” dilemma in the next weeks and months ahead. By this, we are referring to the interplay between interest rates and equities that has underpinned market performance over the past year. Referring to the chart below, we can see that at the previous two market lows of significance in the trailing 12-month period the Yield on the 10yr Treasury (Chart: Bottom Panel) has been at intermediate term highs, and equities have climbed the following correction in yields. That dynamic is now likely to change if our equity rally represents a belief that economic expansion is the most likely outcome. If the economy is expanding and equities are moving to new highs, the rational move is to sell bonds and buy stocks, BUT, that’s where it gets tricky, because a big part of the reason we’re buying is because we expect yields to continue falling. A key from the chart perspective is the yield on the 10yr Treasury itself. Moving below 3.80% would violate support and confirm the prevailing inter-market dynamics between bonds and stocks that have prevailed in this cycle.

Our worry is that earnings eventually take a hit in the scenario where rates stay low/lower for a prolonged period of time. Robust earnings are a manifestation of underlying demand which is likely inflationary. Lackluster earnings which would keep Fed. policy where investors prefer, is not a recipe for materially higher prices from here in the near-term.

We’re going to take a look at Consumer Fundamentals, Credit and Interest Rates this week with a view that rates need to go lower for upside in these fundamentals to continue to provide real relief for consumers.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

ETF’s/The Week in Review

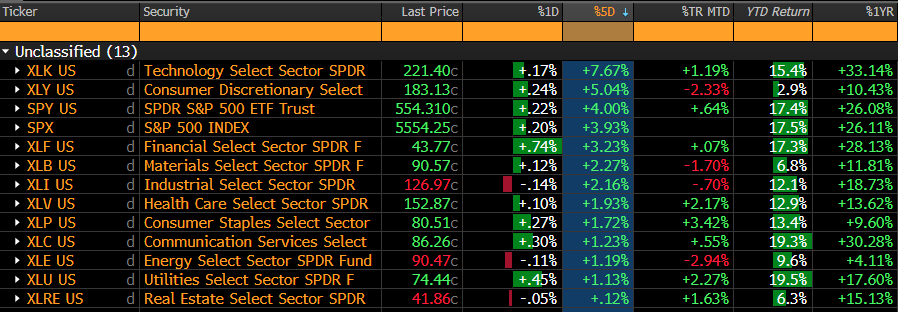

Sectors

The week saw XLK and XLY roar back from the brink of the abyss and now vie for leadership moving forward with earnings and economic releases robust enough to stave off recessionary concerns while soft enough on the pricing side to generate a 2-handle on the monthly CPI report. The whip-saw higher in XLK and XLY further muddies YTD leadership from a thematic perspective. One could come away with a “strange bedfellows” idea in that Financials, Tech, Comm. Servies and Utilities are your leading sectors in a year where the S&P 500 is up 17.3%, well above long-term expected return.

Taking a Deeper Dive on Consumer Fundamentals

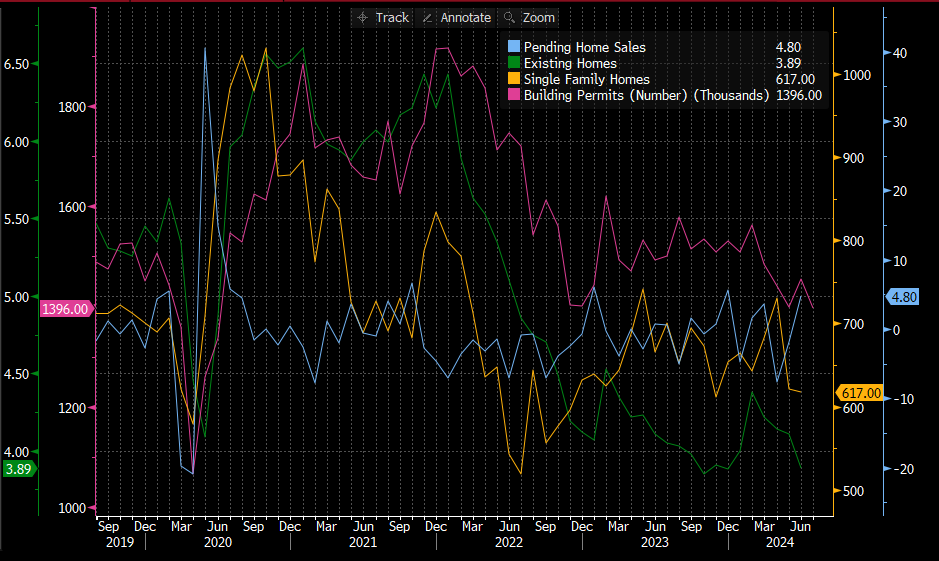

One of the secular themes for the US consumer has been housing. The demand for and affordability of housing are two key gages of our economy. On the demand side we have a structural imbalance in favor of builders/owners/sellers as there is far more demand for quality homes than homes available to buy in most locations. On the other hand, affordability is hampered by several constraints. Cost of labor has reset higher since the pandemic. Cost of material and supply chain efficiency have both moved in deleterious directions. Financing costs have been higher over the past 3 years. So, despite demand for homes, it is more expensive to build and more expensive to finance both buying and building than it was 3 and 5 years ago.

The chart below shows the 30yr prime mortgage rate. Currently at 6.49%, it is benchmarked to the 10yr Yield, so the latter needs to continue lower to continue providing support for the consumer.

We can see from the next chart why it’s so vital for rates to move materially lower to benefit the consumer and the housing market. While pending home sales have ticked higher recently, existing home sales are at 5yr lows, single family home sales are at 5yr lows and building permits are also at 5yr lows.

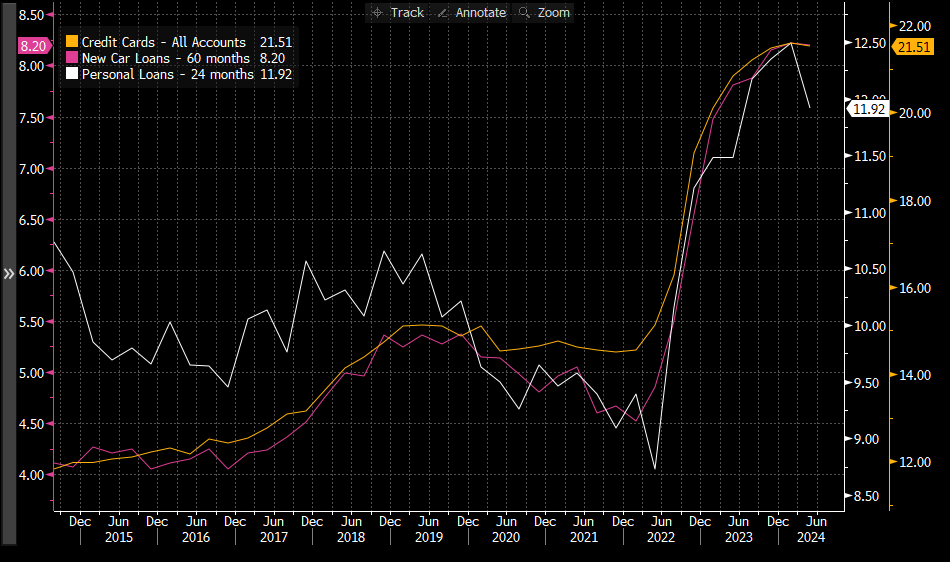

Moving deeper into consumer credit we can see credit card, car loan and personal loan rates continue to be materially elevated above pre-pandemic levels. Any hesitancy from the Fed. in easing or movement out of the bond market to chase equities higher would arrest these nascent salubrious trends.

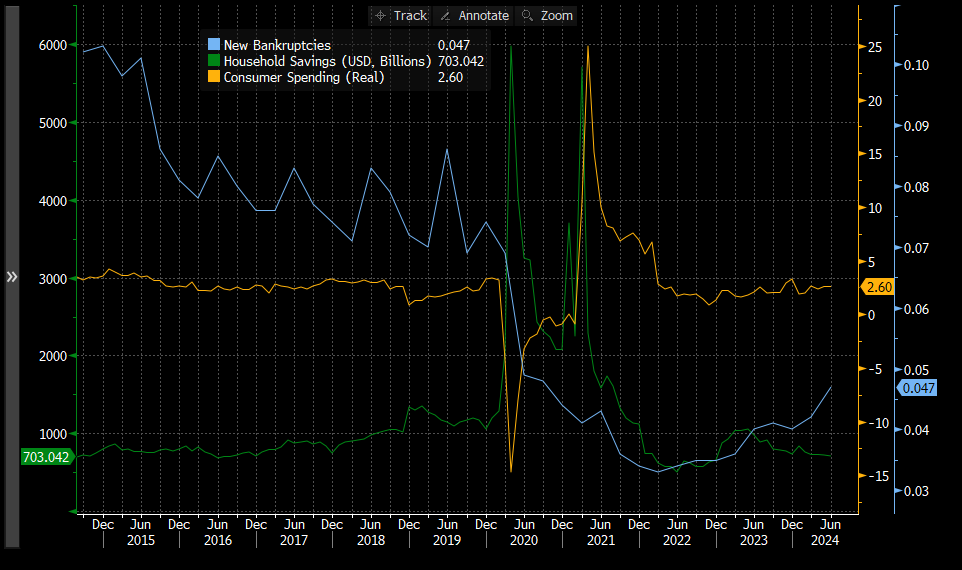

Finally, looking at the consumer balance sheet, we see that the slight uptick in consumer spending over 2023 and 2024 has come at the expense of savings. To add poignancy, personal bankruptcies have ticked higher reinforcing the endgame of these dynamics if they play out over longer periods of time.

We think the direction of interest rates will play an extremely important role in what happens next for equities. We would expect lower rates from here to favor the Consumer, Momentum and Growth. We would expect higher rates from here to support Value and Safety.

Source: Bloomberg