I was in Washington DC this past week with my family. My father grew up there in the 1940’s and 50’s while his father was posted state-side, the latter a minister in the foreign service. My three children (the great grandchildren) were to learn about their family history and see the seat of the federal government. I hadn’t been to our nation’s capital in more than a decade, and I was struck by the elegance and well-preserved history alive in the city. The buildings (many under renovation), the monuments, the row houses, the densely packed neighborhoods, the modernist and neo-classical buildings all belie the hostile discourse around our politics and policy in this country.

My grandfather, Horace Gates Torbert Jr., reached the peak of his career as a member of the Nixon Administration. A Republican, he was a staunch foe of communism and a proponent of the war in Vietnam. He was not, however, one to dismiss the concerns of those who opposed the war. He understood why they had their views, and he knew well that their concerns were valid, and that war was at its very essence an inhumane activity. He advocated for the mission as he felt it must be done with humility and vulnerability as he spoke on college campuses domestically to address student concerns, his own sons perhaps among two of the most concerned.

I don’t bring up this brief vignette of my grandfather to advocate for or against the United States military agenda. Such is for the current generation of soldiers and statesmen to decide. I only do so to point out how different the tone and behaviors of our public discourse is today than just a generation ago. Debates, whether they be in politics between right and left, or globally between Russia and Ukraine, China or Taiwan, North Korea or South, Israel or Palestine, there is very little genuine interlocution. Very few are interested in an actual exchange of ideas. They identify with a side, and they are compelled to advocate for that side’s agenda as a binary. This agenda is right and good because I am right and good. Branding and marketing have taken this approach as well. We all face enormous pressure to curate our identity in very stark and obvious ways so that others can identify us and can see what “side” we are on.

Our various media platforms are completely geared towards this. Our news media is a helpless pawn in this behavioral dynamic as well. They must satisfy our capriciousness for quick “gotcha” takes and a point of view that is controversial enough to generate enough interest or outrage to be relevant. That is where we are and where we continue to go. It is something that alarms us as it doesn’t center the best outcome as the logical goal of our endeavors as a society.

At ETFsector.com, we are very much interested in a perspective on markets that cuts through thesis and agenda. Our macro and technical analysis-based approach to sector investing is designed to identify the trends in force in the status quo and supply an easily understandable framework for identifying trend and trend change. We are not offering and defending a thesis, or advocating for a process where we think we know more than the market. We will not tell you when the trend should break, just when we think it is breaking or it has broken. We want to learn from the market and build the fact that we don’t know what’s coming next into our intellectual approach so we can react as appropriately as possible to new developments.

We don’t have all the answers, but we think an open mind and a healthy respect for what has come before are keys to being ready for what’s next.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

ETF’s/The Week in Review

What’s Hot!

Sectors

The last 5 day % return and the MTD % return columns tell the story of 2024. The Tech sector is big and it is beating the market, and it is basically the only thing that is (with a nod to XLC which has been the very good YTD itself). Bearish strategists are starting to call “bubble” and will likely try to line-up against XLK, NVDA and anything else that is valued “too richly”. I was around back then in the “Tech Bubble” days. It was a very low-tech time compared to now, but it was also a time where the valuation gages of the stock market were far more stretched than they are now. I’m sure at some point there will be another big bear market, but I think pulling all your money out of the market because someone is telling you that we are in a massive bubble is a bad idea. First of all, bubbles happen when people stop telling you to get out of the market because it’s a bubble. Second, because bubbles are where the most money can be made. Do you not want to be in the stock market when there is a mania? You don’t want to own stocks that are getting bid to the moon? My point isn’t that there aren’t risks of big drawdowns in stock investing. My point is that there are always bears calling for investors to exit bull markets. Use price, momentum, breadth, earnings and your understanding of the business cycle to call the exit. Being shrill about valuation is a sucker’s game.

Where is the Breadth? Examining the Financial Sector

Last week we took a look under the hood of the Industrials Sector, and we found mounting economic headwinds and an oversold sector with poor breadth characteristics. We see a similar setup for the Financial Sector from the technical perspective. Breadth is washed out in the near-term with just 24% of stocks above their 50-day moving average. The sector is uptrend oversold on the oscillator work and MACD is on the cusp of signaling negative trend change. Our Elev8 Sector Rotation model is long in both sectors for tactical reasons. The established equity uptrend with interest rates in consolidation is historically supportive of higher beta cyclical exposures and we try to enter positions on tactical near-term weakness. So far, this approach hasn’t paid off for XLF or XLI. Prolonged weakness will force us to cover our longs if price falls below the April 2024 low near $39 on the chart.

- XLF (200-day m.a. | Relative to S&P 500 | 12, 26, 9 MACD)

- Price is at support with the relative already giving a sell signal. MACD is on the cusp of indicating downtrend vs. consolidation. Price below $39 would tell us to take our long in. Such is the game when trying to “buy low”

- XLF—each industry within the sector is on the cusp of YTD relative lows. We’ve seen this as a potential buying opportunity, but the clock is ticking for the buyer

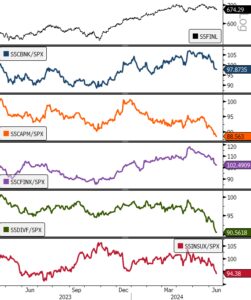

- Banks Relative to S&P 500

- Capital Markets Relative to S&P 500

- Consumer Finance Relative to S&P 500

- Diversified Finance Relative to S&P 500

- Insurance Relative to S&P 500

- Sector Breadth for XLF is deteriorating as well.

- % of stocks above their 50-day m.a. is an oversold reading at 23%

- % of stocks above their 200-day m.a. has been decaying in 2024

- 52-wk new highs are starting to give way to 52-wk new lows

Economic Trends are becoming headwinds for Financials

Financials have lagged since the advent of the current bull market in early 2023 for a few reasons. The first was induced by the Fed as banks were well positioned for equity volatility at the beginning of 2022 sitting in long-term treasuries until the Fed did a policy about face and started hiking rates dramatically from 1.5% à 5%. This degraded the mark-to-market value of every bank’s balance sheet and precipitated the 1Q2023 bank run from which the sector has had trouble recovering. Now we are seeing a flagging consumer start to weigh on the sector just as interest rates are starting to relent and move lower. Will softening rates provide relief before the credit markets fully deteriorate? That is the big question. Our current look sees the marginal trend for Financials worsening fundamentally as the near-term correction is at oversold levels.

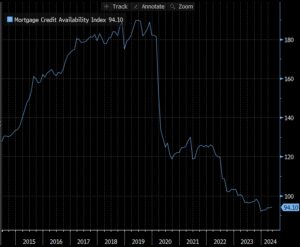

Mortgage Credit Availability is Constrained

We can see Mortgage Credit Availability plunging into contractionary territory after a boom from 2015-2020.

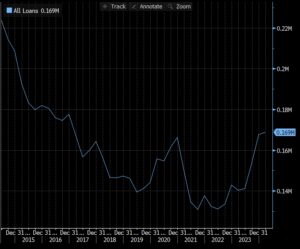

Charge-offs are on the Rise

Charge-offs for Commercial Banks Loans, Consumer Loans and Loans Secured by Real Estate are all on the rise since 2023 with all 3 series now above pre-pandemic levels.

Delinquencies are on the rise as well

GDP and PCE have been Flat over the Longer term

With credit starting to show some early signs of stress it is important to note that GDP and PCE Growth is also tepid at best. With XLF profiling as a value oriented play on the equity markets it is then not too surprising that investors are leery to embrace it. Value typically does its best work for a portfolio in times of abundance and that’s not quite where we are in this cycle despite the records hit on the tape last week.

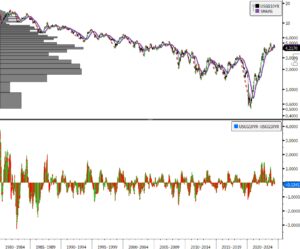

RATES

Rates continue to be lower, which is likely why our cyclical sectors face some near-term headwinds. A bounce up to retest the downtrend resistance line above 4.5% is possible, but fundamental data increasingly shows slowing. The real question is when equity investors will start to forecast a boon from lower financing costs as unemployment is still low in aggregate. We are introducing our sector coincident return tables for uptrends and downtrends in interest rates in this week’s market letter. As mentioned above they will be permanent fixtures on our research page.

- US 10yr Yield (200-day m.a.)

- A dip below the 200-day moving average in May confirms the near-term downtrend and sets up a potential test of long-term support. Congestion abates below 4.06%

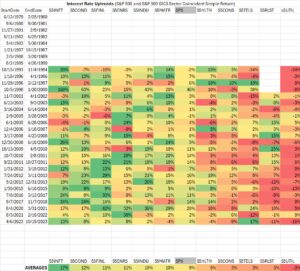

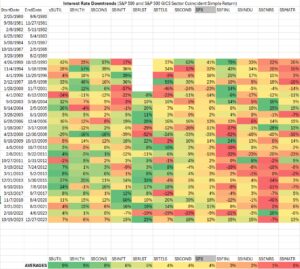

S&P 500 with Sectors (Coincident Returns with Interest Rate Uptrends)

These tables will be fixtures on our ETFsector.com/Research page, a resource to help you think about sector investing relative to trend in interest rates. These trends are identified using historical moves in the US Generic 10yr Treasury Yield

S&P 500 with Sectors (Coincident Returns with Interest Rate Downtrends)

These tables will be fixtures on our ETFsector.com/Research page, a resource to help you think about sector investing relative to trend in interest rates. These trends are identified using historical moves in the US Generic 10yr Treasury Yield

All Data Sourced from Bloomberg