Before recapping an exciting week in the financial markets and implications for our favorite sector ETF’s, I wanted to take a moment to welcome you to etfsector.com and to introduce myself as your host for many interesting discussions to come.

As you’ve inferred from the by-line my name is Patrick Torbert. I’m excited to share my approach to securities selection with you. It is an approach that combines learnings from my career in finance (more on that later) with the idiosyncrasies of my personality. Understanding the role the personal plays in investing is a bit of an undiscovered country academically. It is the professional who must grapple with the unique hand they’ve been dealt as to their perception and their emotional make-up. Most literature talks about markets as if they are efficient and theorizes about expected returns, resultant equity risk premia, portfolio risk as measured by beta and decision making within a framework where these are base-line assumptions. I will not be talking to you in this way. I am leery of those who assure themselves that “prices follow earnings” and that “fundamentals” are the most important driver of stock performance. While those things may be true (certainly they are true at times), people say those words because they believe in theories, and starting off by limiting yourself to theories is a way to always avoid confronting the reality of financial markets.

“Oh ho”, you say. “Here’s a fool who thinks he knows reality and claims the rest of us are barking up a wrong tree with our theories. This oughta be good…”

Here’s how I would start. Stocks (or any other financial instrument really) go up when there are more market participants with more money interested in buying them than selling them. If you agree with that premise, then you have agreed to the fact that stock prices are moved by crowds rather than by individual company fundamentals. The implications are enormous. For once you’ve accepted that stocks are moved by crowds, you no longer need to tether yourself to specific economic outcomes in order to have comfort investing in prevailing trends. You need rather to assess the motivation of the crowd and look for signs that motivation is strengthening or weakening. Is the crowd becoming greedier (upside momentum accelerating), or more fearful (upside momentum diverging or price falling)? In this frame the stock price, the path of the price over time and its derivatives are indicators. This is in sharp contrast to a fundamental lens where stock price is supposed to be merely a derivative of the fundamentals of the underlying operating co as the market discounts towards fair/intrinsic value.

I come to you a 22-plus year veteran of Fidelity Investments where I most recently had the pleasure of advising equity, multi-asset mutual funds and SMA’s as an equity analyst, multi-asset analyst and advisor on macro strategy. My process involves researching historical sector, industry and sub-industry performance vs. a multitude of identifiable macro trends. This research has helped me develop a sensitivity profile for each sector in the context of bull and bear markets, rising or falling interest rates, rising or falling commodities prices and rising or falling USD values. This research has furnished me with a historical playbook for sector investing that allows me to infer which sectors are likely to benefit based on where the macro picture is heading (what are the trend in equity, fixed income, commodities, currency) and how investors have historically traded sectors during similar regimes in the past.

I will be hitting on themes of behavioral finance and market structure often as I try to help you navigate your portfolios each day, week and month. These inputs can help us identify the biggest trends in performance and identify when price has done something significant to signal change. Last week’s price action was positive, but not a conclusive break-out from April’s consolidation. The bull still needs to show follow-through. Onward.

–Patrick Torbert, CMT | Chief Strategist, etfsector.com

ETF’s/The Week in Review

What’s Hot!

We will make a habit of kicking things off with a recap of Sector SPDR performance over the past week. XLU was the leader responding to a reset lower in longer-term interest rates attributed to a soft unemployment report at the beginning of the month. Cross currents have popped back up almost immediately to keep inflation expectations on the table and to put investors in the mood to position for recession, or at least something different than the Mag7. As a result we’ve seen some rotation into the Utes and into some of the more Value and pro-cyclical oriented sectors of the equity market as well as heavily discounted areas like banks (XLF) and REITs (XLRE). Discretionary and Energy have been hit hardest over the past week.

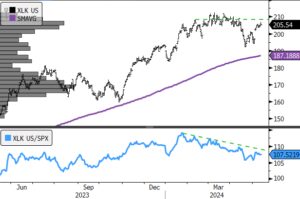

XLK (200-day m.a., XLK Relative to SPX)—A positive first step, but short of a decisive break-out. The tactical short gets covered at 205 on a horizontal upside break-out.

XLK is attempting to trace out a bullish reversal that will be confirmed above $215 with a key bullish “tell” at the $208 level on the chart. A latent move above that isn’t news driven would show the speculative impulse for Tech remains intact, a key level to watch this week.

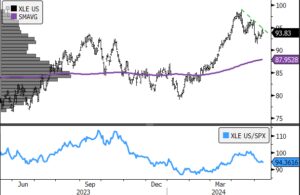

XLE (200-day m.a., XLE Relative to SPX)—Sector and barrel are rallying from oversold levels, but the near-term downtrend remains intact

I have been long the XLE in May, looking for investors to position for more sustained inflation by adding esposure to commodities plays like XLE and XLB. XLE is oversold and would hit a tactical sell signal this week if it can’t break out above resistance on the chart.

Performance Highlights (lowlights)

Thematic Equity

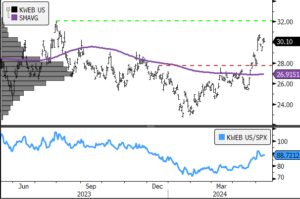

KWEB (200-day m.a., KWEB Relative to SPX)—Bullish Break-out, but tactically overbought. Likely to consolidate below the $32level. Ideal to cover shorts on near-term profit taking, a likely occurrence considering we will undoubtedly get some Fed mumbo-jumbo on inflation concern later this month.

A bid for KWEB represents a new phase of the bull market that started in the US in 2023. Bottom fishing in high-beta EM stocks confirms an important aspect of the bull…that it cashoun lift even the boats that have been riding lowest in the water. This dovetails with recent strength in REITs as they too have been under enormous pressure despite US equities trending higher. The key will be to see if XLK can join party. There is a chance that new areas of speculation are perking up because there is exhaustion in the established areas. This is why it’s important to watch key bellwether stocks and ETF’s to evaluate the magnitude of the current consolidation. We want to see riskier areas of the market bid on weakness. So far, the near-term behavior is constructive, but unconfirmed, so bets should be more restrained. As we noted in the daily trading note, NVDA’s earnings on 5/22 will be a key potential pivot for XLK and this bull market more broadly.

Thematic Lowlights

2024 has been a tough year for concept stocks. These typically need a strong bull-trend and access to low cost of capital. The former is facing a challenge, the latter is certainly not a reality at present. The ARK Innovation fund is at least intriguing at support here, having based for > 12 months. The rest need more time to ripen.

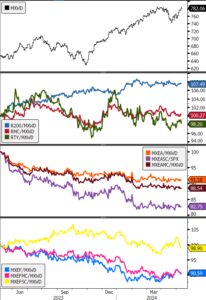

Domestic Vs. International

The trade is really US Mega Cap. (Russell 200) vs. everything else. Here’s 12-month relative performance of US (2nd panel), EAFE (3rd panel) and EM (4th panel). Tactically knowing when to bet the field vs. the champ is gold. The correction from late January to late April 2024 offered a chance for ex-US equities to outperform. Follow through has not been impressive and it is hard to make the case for ex-US over US equities as anything more than a tactical idea at present.

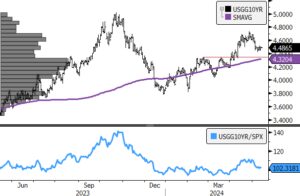

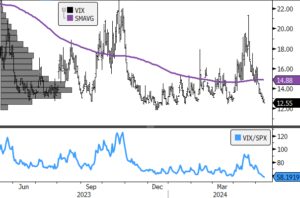

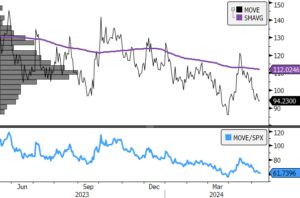

Vol. Oversold in the near-term

Both the VIX and the MOVE indices are at near-term oversold levels. Equities are attempting to bottom from a near-term oversold level and the “sticky inflation” narrative has pushed US yields lower. This dynamic is likely to represent a continued feedback loop as long as the bull trend for equities lasts. The Fed will continue to respond to strong economic data and aggregate earnings releases with hawkish language on monetary tightening until there is an unambiguous turn in the CPI data. So far we haven’t seen that, so a print above 3.7% likely pushed XLK and XLC lower in favor of a mix of min vol. and Cyclicality. That would favor a short XLK/XLC long XLU, XLP. We have those bets on this month in our sector portfolio.

US 10yr Yield has rolled over aiding Growth and Min Vol. strategies, but is nearing support and a key test at the major moving averages. Below support at 4.32% would strengthen the case that yields are putting in a top and the tightening cycle may be coming to a close.