Happy Memorial Day! Those who have sacrificed for our great country, we sincerely thank you!! We pursue our fortunes in the global financial markets only because of a commitment to peace and civilization. You who have put your lives on the line for these ideals are the foundation of what we all have.

And now a stark transition from the grandiose to the more random…

I was alerted to a meme at some nebulous point in the past several months. It was a Tik-Tok video documenting surprise at how much men think about the Roman Empire. Apparently, lots of men think about the Roman Empire a lot. Or, at least, they think about it a lot more than the women framing this particular Tik-Tok think is necessary or relevant to living a good life in 2024.

From my own perspective, I was blissfully unaware of how odd it might be to think about the Roman Empire, for I am one who personally does think about it often. I was a classical studies major in my wayward undergraduate pursuits and found the history of ancient Greece and Rome very compelling as fact and as myth. It is a cultural tradition that underpins much of what exists today, but it also highlights a phenomenon we all experience as we navigate the journeys of our own lives.

One aspect that stands out is the poetic concept of “in medias res”. This was brought to my mind by the aforementioned meme, and I offer it as something intriguing from an idiosyncratic (at best) education. “In medias res” means “in the middle of things”. It was a literary technique ascribed to epic poetry like the Iliad, the Odyssey and, for the Romans, The Aeneid. These sweeping epic poems that encompassed years of plot machinations always started “in the middle of things”. The full story that shaped motivation and described the full narrative arcs of the important characters would be fed out by the poet throughout the length of the work, but the sequence was not linear in its development.

Why does this matter? Why are you reading this in a market letter? The realization is that we all come to the markets “in medias res”. We all are observing a continuum and we wield investment strategies designed to take advantage of certain outcomes within that continuum. But often the lenses we use don’t start at the beginning of the biggest trends and don’t appreciate how long they can continue. Making tactical sector calls on a month-to-month basis is an example of this. There is a process of making tactical calls over 4-5 weeks based on the near-term data releases, marginal change in factor values or near-term overbought and oversold indicators, but the longer-term and larger trends are the real money-makers.

“Throughout all my years of investing I’ve found that the big money was never made in the buying or the selling. The big money was made in the waiting.” Jessie Livermore

This week we will start taking deeper dives into the big fundamental themes motivating our sector trades. An appreciation of the longer-term narratives may help us position to capture the biggest pieces of the pie and may help us be patient enough to do so. We will start with the Consumer Discretionary Sector as it offers a rich lens through which to view the economy.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

ETF’s/The Week in Review

What’s Hot!

Sectors

Large Cap. Sectors outperforming the broad market narrowed to 2 over the past week. Technology and Comm Services led, driven by Mega Cap. exposures NVDA, ADI, AAPL, GOOG/L, META. This highlights the biggest winning themes underpinning the current bull market, AI, cloud-computing and social media marketing. The Energy Sector has swung out of favor, as supply overhangs have become evident in the near-term against a back-drop of presumed structural demand destruction for fossil fuels. Discretionary is in the laggard bucket as “higher for longer” rates are dampening home and auto sales. Those stubbornly elevated rates are also squeezing the consumer balance sheet and forcing ever more affluent households to substitute value oriented products for premium. This is also putting pressure on Staples, as the consumer balance sheet can no longer afford price increases so lower margin businesses that aren’t capturing new market share are putting up lackluster results. Industrials and Materials sectors have been riding a tailwind of “on-shoring/re-shoring” as geo-political factors force the dis-integration of the global supply chain. This has spurred Growth, but raised cost by increasing demand for labor which shrinks margins across several service focused industries in Consumer and Healthcare Sector.

From the “in medias res” angle, we are being told by the bearish crowd that sticky inflation is a symptom of being in a “late cycle” economic environment that results from a mature business cycle that last had recession in early 2020 due to the pandemic. What seems to escape many amongst the white-shoe set is the two consecutive quarters of contracting GDP in 2022 that the stock market discounted to the tune of almost -28%. That robust bear market with its qualifying GDP contraction could easily have been seen as its own recession. But our market mavens were held up by a falling unemployment rate. It was falling rapidly because it had sky-rocketed to >15% during the mass of pandemic induced lay-offs and closures. So, the models run by our most powerful economic ministers are deeply out of phase with the behavior of the stock market. Keep in mind that the market is the reality we need to pay attention to in order to make money. The direction of rates is key to the direction of the market.

Where are we in the Business Cycle Really?

Economic Contraction measured in QoQ US chained dollars (SAAR) shows 2 quarters of contraction at the beginning of 2022 followed by a bottoming in the equity market over the 2nd half of that year and a new bull market in 2023, confirmed by new all-time highs.

If we look at Continuing Jobless claims, we can see what an outlier the pandemic job loss was relative to the past 24 years. Note 2009 where job loss claims peaked at 6.635M claims in the teeth of the Global Financial Crisis and an epic domestic housing market correction vs. the pandemic where continuing claims hit a high of over 21M claims and an unemployment rate topping 15% (U-3). It seems odd and borderline disingenuous to discount 2 quarters of GDP contraction due to such an anomalous period where the job market is adding jobs only because it was forced to shutter them due to a completely exogenous event.

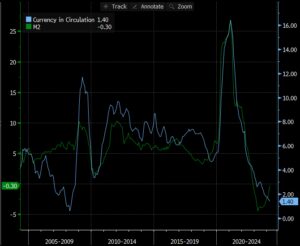

What you have as a result of the anomalous pandemic event is a relatively new bull market equity cycle with a Fed that is playing a recession playbook. From this view, this is the cause of equities loss of momentum in 2024. A look at M1 and M2 money supply shows the Fed tamping down liquidity, and the consumer following suit until very recently. If inflation abates, we could see a re-emergence of consumer spending in lower financing costs and potentially in lower input costs from falling commodities prices.

Consumer Discretionary Deep Dive: Showing Signs of Fatigue

With rates staying stubbornly high we are seeing the Consumer start to tap out. Car sales, home sales and retail sales are 3 important gauges, and each is showing some emerging worry. The trends have been a headwind to the consumer in the near-term, but longer-term there is some hope for the inventory cycle to re-align.

Automobiles

Looking at the past 10years of passenger car production and inventory shows us we may finally be reaching some equilibrium after years of structural decline. In the near-term inventory creeping higher is a headwind, over the longer-term it sets the stage for cooling prices. The blue line going down and the green line going up would be a boon for auto makers and the XLY.

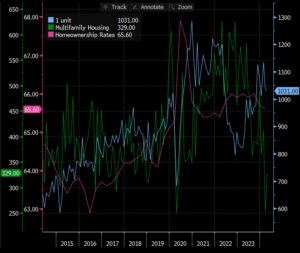

Housing

The housing market is another area that is becoming problematic for the consumer. In the aftermath of the pandemic, the US home-ownership rate reached a peak of 68% as city dwellers migrated to suburban and rural areas. However, now that financing costs have risen, homeownership rates are on the decline again. What might be more troubling is mult-family construction starts are near decade lows and historically those dwellings correlate much more tightly with high rates of ownership. A move toward fabricating more affordable housing is likely needed to get the trend in the right direction to bolster the economy.

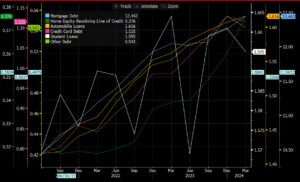

Financing Costs are Creeping Higher

The driver of stagnating sales and consumer spending is a ramp up in debt. Here’s a look at the last 3 years of various types of debt accumulating on the consumer balance sheet. Unless the fed reverses course on its interest rate policy, these trends higher are likely to eventually suffocate Growth as persistent high costs continue to burden consumers with debt. Keep in mind these debts are rising against a back-drop of full employment. If the trend forces the consumer to capitulate on spending we could see a deleterious cycle of lay-offs and increased bad credit against a higher cost of capital. That’s a position we haven’t been in in a while.

Price Action

The chart of XLY reflects a generally negative view of the Consumer Discretionary Sector. The sector has lagged the broad market by almost -30% since equities peaked in 2021. ETFsector’s process has the Discretionary Sector rated an underweight as May wraps up. We’d need to see price give us a buy signal above the $185 level and a reversal in the relative trend for a technical perspective. Interest rates would need to head lower given the macro-economic pressures on household balance sheets and a shift in the Fed’s policy priority from fighting inflation to nurturing the economy would be salubrious.

- Price would need to move ABOVE $185 at minimum to get us to start covering our short in the sector

RATES

The US 10yr Yield has bounced off its 200-day moving average and has held support at the 4.35% level. Overhead resistance remains at 4.75%. Given deteriorating consumer conditions, I would expect rates to be flat to lower over the intermediate-term, and I expect if they do move lower, we could see a more protracted bull market and a re-emergence of the consumer, but it is highly unlikely given the current signs of stress that the consumer can continue on absent a change in the Fed’s policy outlook.

- US 10yr Yield (200-day m.a.)

- No downside capitulation yet, but the longer-term pattern is taking on some distributional characteristics, and we could see a “double-top” if yields make a move towards 5% again.

All Data Sourced from Bloomberg