It has been two months since the S&P 500 printed its all-time high on July 16th, 2024. We sit <1% away from a new high and confirmation of the bull trend that originated in early 2023. At times of consolidation, we look to bellwethers of risk and safety to assess what is likely to come next. Our 10yr bond yield is falling and has made new 52-wk lows this past week. Correspondingly, lower vol. sectors are now overbought after a strong 3 months of outperformance. At the same time XLY has shown real signs of bullish reversal while XLK has done enough to take the idea of a turn-around seriously. We continue to dislike commodity linked sectors, Energy and Materials, and we look to see if XLF can recover its outperformance trend after some profit taking last week.

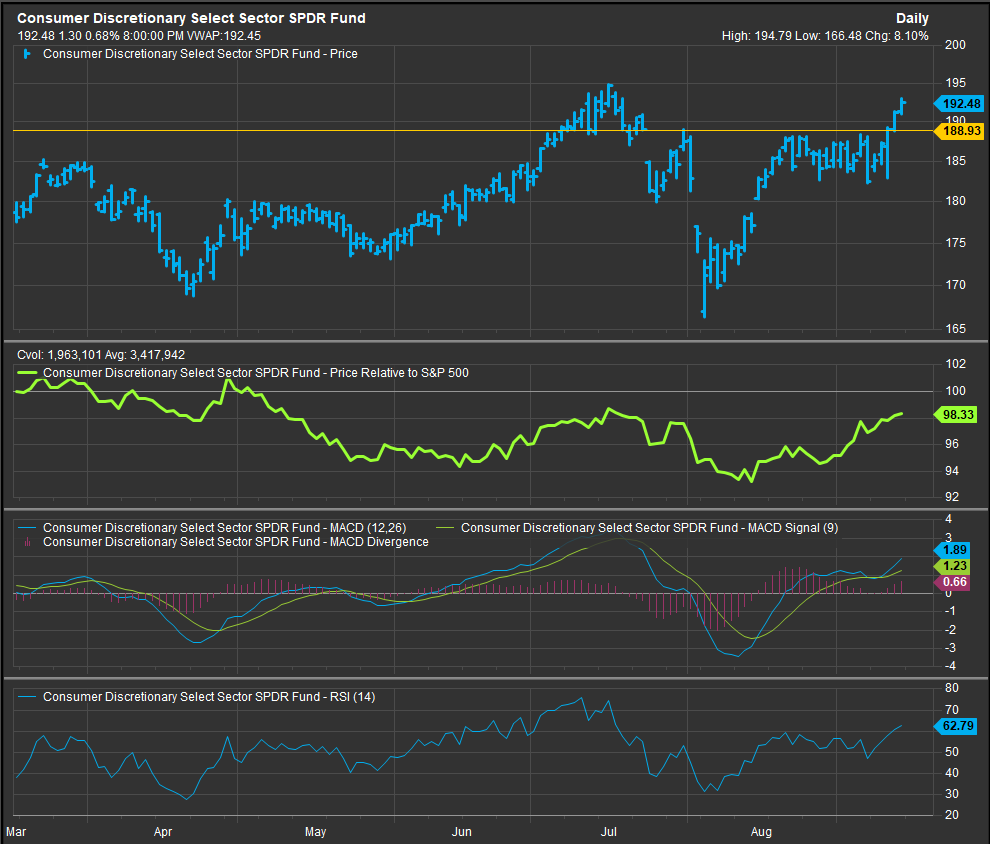

We think of all the potential barometers of bullishness and bearishness, the behavior of the Consumer Sector is likely the most pivotal. Not just for the obvious earnings-related implications of near-term improvement, but because of what it will mean for investors outlook on AI and the technological platforms that are driving capital-G Growth as a style in this cycle.

AI is no doubt a powerful technology, but at the end of the day, it must enable some level of enhanced and sustainable prosperity to justify its own hype. Earnings multiples have expanded for many entrants in the space, but the customer is the same customer we’ve always been. Better, cheaper, fitter, happier, more productive etc. etc. etc. Point being, other stocks need to be able to benefit in the age of AI, need to be seen to have higher end potential to earn and thrive and regular people who eat and wear and drive and live in, need to come forward with an ability to do all these things more easily because of AI. The private equity, tech bro phase of this thing is running out of time. The results phase appears to be starting is the way I see it at present.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

Sector ETF’s/The Week in Review

Sectors

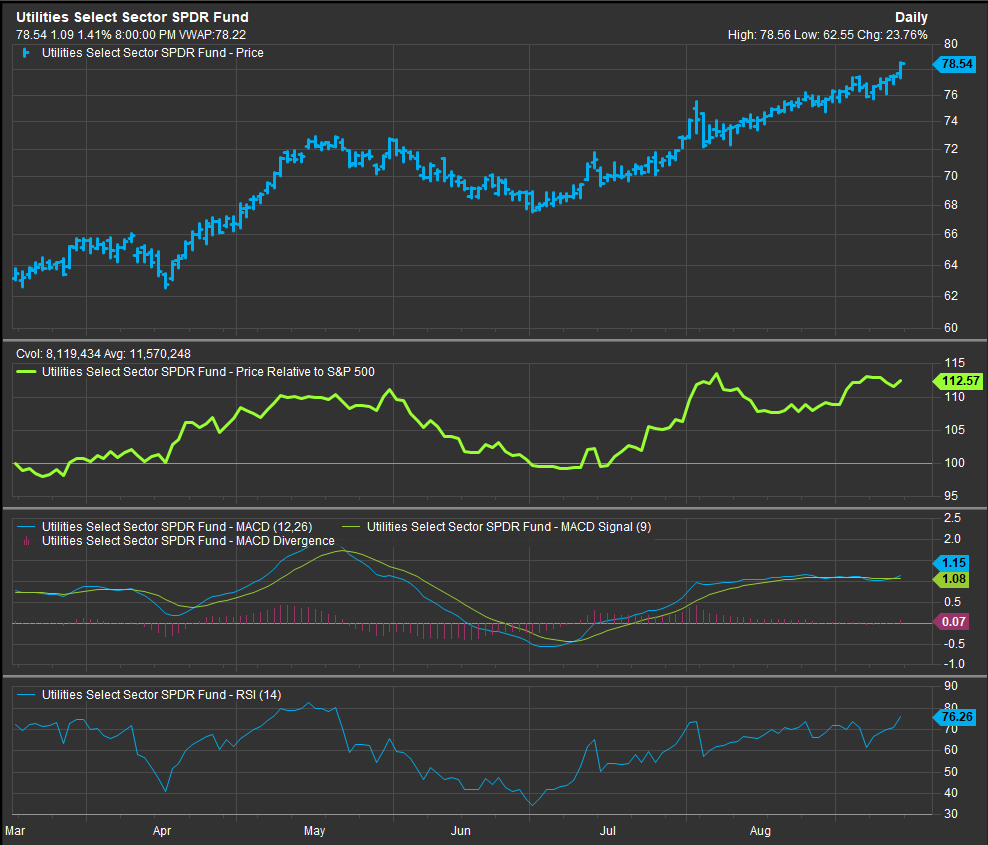

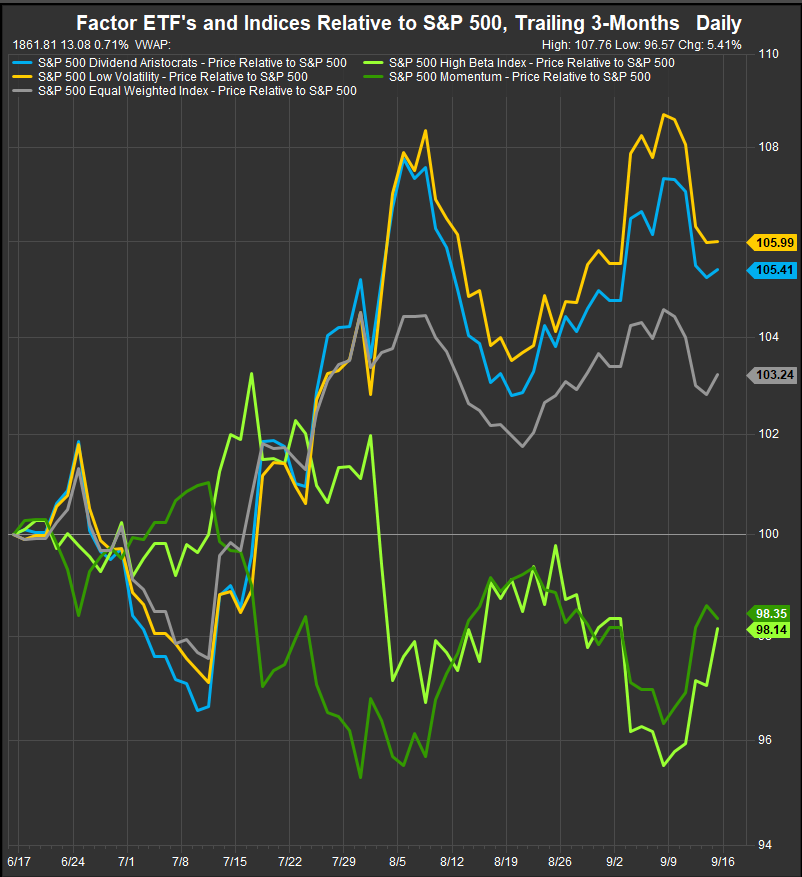

Technology shares led through the week ending September 13. Energy, Financials and Staples shares lagged as XLF saw profit taking after briefly moving to the top 12-month performance among sectors to start last week. Utilities continued a strong 6-month run. The upcoming week will be a test for XLU as the SPDR is overbought near-term on price.

However, low vol. and dividend factor benchmarks have pulled back. If last week was a hopeful thrust in a bigger defensive push, low vol. could snap back towards highs this week. Whichever way the bellwethers go, we will take our cue. XLY and XLU are going to be important for signal this week.

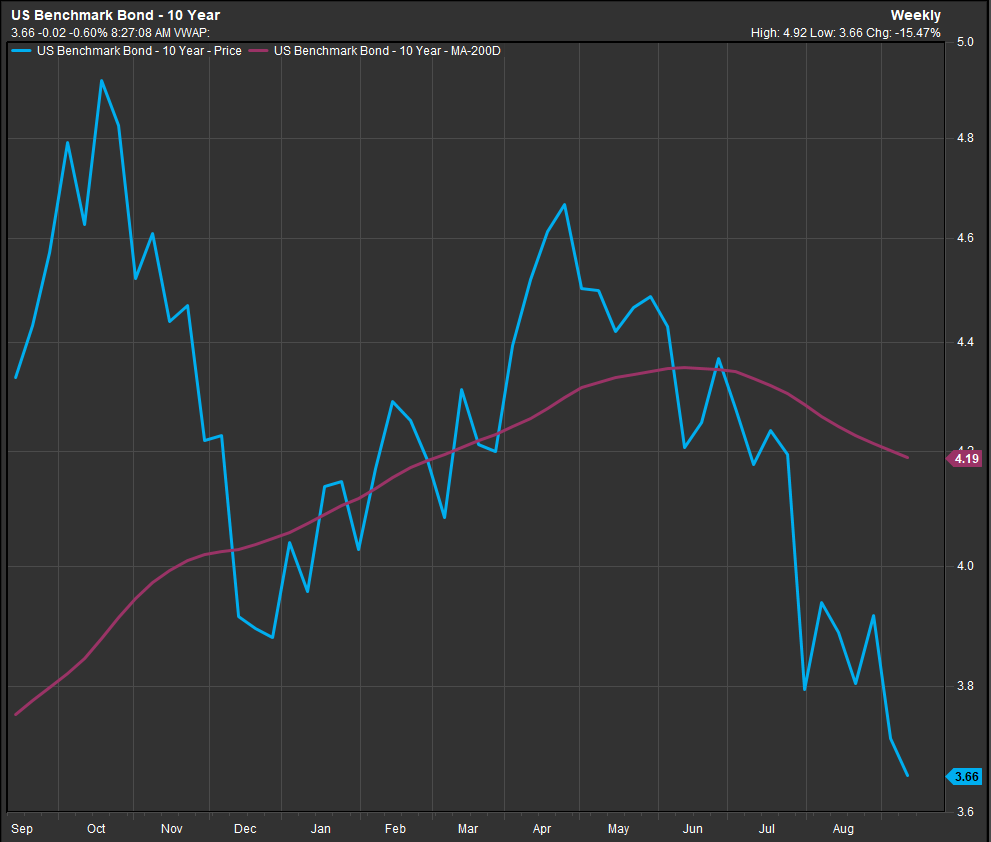

The US 10yr Yield made new 6-month and 12-month lows this past week. High div., low vol. sectors like XLU have seen performance improve materially since the 10yr Yield peaked in April. We’re now at a point of truth for the economic data to show us some “softness” in our landing. The Fed has accommodated the bullish scenario by moving to a dovish stance. Now we need to see data that isn’t too alarming from which a recovery can be built. Manufacturing has been in contraction for several months as the Yields hint. The job market has been steady, but the consumer needs to show that lower rates are a material benefit. Equities are discounting some improvement there.

As the Mag7 go, so does our view of their sectors: AMZN at resistance

AMZN has a key test this week as it approaches resistance on its price chart. With price currently just above $186, the key level to breach is near $192. A move above establishes the expectation of bullish reversal and ultimately a move above $230 in the bull scenario. We are looking for an opportunity to close our tactical short in the sector and move to a tactical long (-2%–>+2% vs. S&P 500 Weight). We think if AMZN breaks out, XLY likely follows suit.

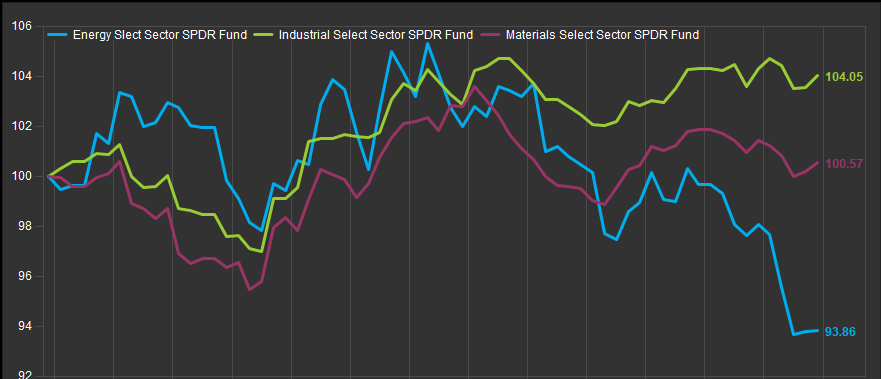

XLB>XLE

We don’t like either XLB or XLE at present, but XLB is in much better shape based on our technical process and is potentially setup for positive mean-reversion. The Energy sector still looks like a clear laggard. We have preferred Industrials, but it hasn’t justified the extra allocation. Industrials are >8% of the S&P 500 while Materials are just over 2%. We may begin expressing our distaste for commodities linked sectors through XLI going forward if Industrial stocks don’t start giving us a better reason to own therm.

- XLI, XLB and XLE Relative to S&P 500, June 17 – September 13

Source: FactSet Data Systems