COMMENTARY:

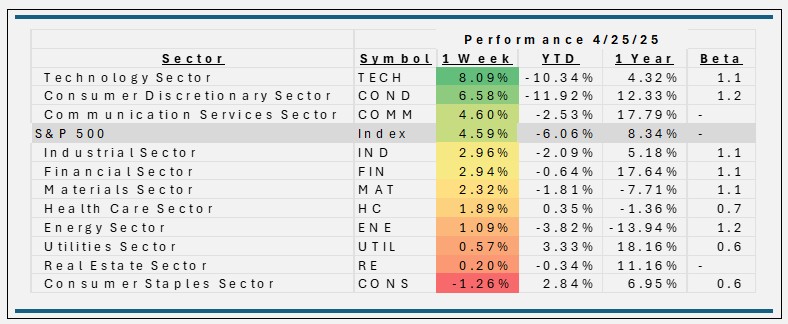

- The S&P 500’s weekly gain of 4.6% was powered by robust tech earnings, broad corporate outperformance, optimism around trade policy, and supportive economic signals. However, underlying caution remains due to ongoing tariff uncertainties and mixed economic data.

- Technology led the way, gaining 8.0%, shaped by tariff relief, broader market recovery, and strong earnings potential in select high-growth firms. Monolithic Power Systems rose 10.0%, followed by Broadcom, which was up 5.6%.

- Upbeat earnings drove the S&P Consumer Discretionary Index’s 6.6% weekly gain, hopes for easing trade tensions, a rebound in consumer spending on durable goods, and resilient labor market data. The rebound in Tesla (+18.1%), which is 16% of the index, was a major contributor, along with Hasbro (+15.8%) and Caesars Entertainment (+11.5%).

- Consumer Staples was the only sector in the red this week, falling 1.3%, dragged down by sector rotation into growth stocks, cautious earnings outlooks from major companies. Investors showed a clear preference for riskier, higher-growth areas of the market, leaving defensive sectors like consumer staples behind. Kimberly-Clark (-7.8%) and Procter & Gamble (-5.6%) were a drag on the sector overall.

- Overall, only three sectors outperform the broader S&P 500 index this week. Year to date, Utilities are up the most (+3.3%), with Consumer Discretionary down the most (-11.9%).

ETF TIDBITS:

Record ETF Launch Activity Despite Market Volatility:

April saw a continued surge in new ETF launches, with 63 debuts and dozens of fresh filings just this month. This keeps pace with an average of 75 new funds per month in 2025, up from 59 per month in 2024. The new offerings include leveraged products tied to major stocks like Exxon Mobil, thematic ETFs focused on nuclear energy, and innovative funds targeting arbitrage opportunities in Bitcoin-related strategies. This robust pace of innovation comes even as broader market volatility, driven by tariff concerns and shifting trade policy, has increased.