COMMENTARY:

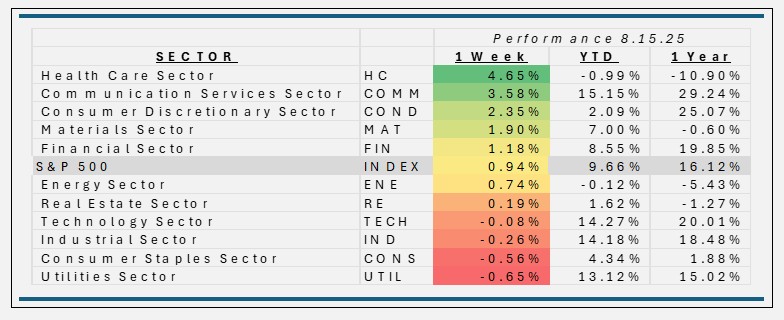

- Overall, the S&P500’s weekly gain of 0.94% reflected a balancing act between strong corporate earnings, mixed inflation data, stabilizing consumer indicators, evolving Fed policy expectations, and sector-specific moves tied to trade and regulation. Resilience from “dip buyers” amid pockets of caution further contributed to the index’s strength.

- Health Care was the top performing sector this week up 4.6% and was powered by UnitedHealth’s outsized move (21.2%) after Berkshire Hathaway significantly increased its stake. broad sector earnings strength, and defensive rotation against macro uncertainty. Eli Lilly (+12.0%) Johnson & Johnson (+1.9%), and AbbVie (+4.4%) also drove returns, benefiting from positive earnings and strong fundamentals.

- Communication Services’ 3.6% gain was powered by strong quarterly results and bullish sentiment for digital platforms. Earnings beats by Meta (+2.1%), Alphabet (+1.4%), and Netflix (+2.3%) accounted for the lion’s share of returns, with defensive rotation, stable macro trends, and continued optimism for growth helping the sector shine.

- Utilities came in last this week falling 0.7%, most affected by rising rate anxiety and investor rotation to growth sectors. The slightly negative moves dominated the sector, with no standout positive contributors such as Constellation Energy (-4.0%) and Consolidated Edison (-3.6%). The defensive utility sector lagged amid market risk appetite and mixed macro signals

- Year-to-date, nine of the eleven sectors have produced positive results with only Health Care and Energy still in the red.

ETF Tidbits:

- Strong Inflows into U.S. Equity ETFs on Fed Rate Cut Hopes: Despite some inflation data causing mixed signals, U.S. equity funds attracted weekly inflows driven by optimism about a potential Federal Reserve interest rate cut later in the year.

- Momentum ETFs Leading Gains in 2025: Momentum-focused ETFs continued to outperform broader markets, benefiting from strong showings in growth and technology stocks. The S&P 500 Momentum Index rose about 30% in the year ending June 2025, nearly doubling the broader S&P 500’s.

- ETF Listings and Innovations: New ETF launches and strategies, including leveraged and thematic ETFs focused on artificial intelligence and clean energy, gained investor interest, supporting expanding options in the marketplace.

- Bond and Fixed Income ETFs Impacted by Rising Yields: Rising long-term Treasury yields due to inflation worries and debt issuance muted appetite for some fixed income ETFs, affecting total returns and driving cautious positioning.