COMMENTARY:

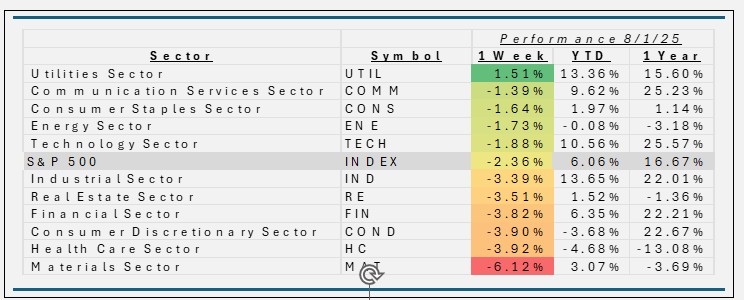

- Just when you thought all the S&P Sectors were close to a positive YTD return, this week ruined that. Performance of the S&P500 for the week ending August 1, 2025, fell by 2.4%. Driven by heightened trade tensions due to newly announced tariffs, weaker-than-expected employment data signaling an economic slowdown, shifting expectations for Federal Reserve policy, and sharp declines across key stock sectors, all contributing to a spike in volatility and risk-off sentiment among investors.

- In summary, the Utilities sector was the only one with a gain for the week (+1.5%) propelled by strong performance from its largest holdings—especially Vistra Corp. (+8.3%), Constellation Energy (+7.1%), and NRG Energy (+7.1%). The sector experienced a classic defensive shift among investors seeking stability amid economic uncertainty, lower interest rates, and market volatility.

- Material got hammer this week, the sector fell 6.1%, yet still holds on to a positive YTD return of 3.1%. A handful of smaller constituents underperformed significantly this week. These included Eastman Chemical (-24.6%), Albemarle (+18.9%), and Int’l Paper (-16.5%). However, the decline was driven by steep losses in its large-cap constituents—especially those exposed to global trade and sensitive to commodity prices—as escalating tariffs, a weakening jobs market, and rising volatility put the sector under heavy pressure.

- Health Care and Consumer Discretionary both fell 3.9%. They both underperformed due to a turbulent week driven by tariffs, disappointing jobs data, risk-off market rotation. Eli Lilly dropped 6.2%, and United Health Care fell 15.4%. On the Consumer front, Amazon (7.2%), Tesla (-4.3%) and Booking Holdings (-4.4%) contributed to that sector’s drag.

- 2025 year-to-date through early August, the S&P 500 sits at a 6% gain. Performance was mixed with cyclical sectors like Financials and Energy doing well, defensive sectors performing steadily, and some traditionally stronger growth sectors experiencing headwinds from trade-related news, slowing employment growth, interest rate expectations, and risk-off rotations YTD.

ETF Tidbits:

- Cryptocurrency ETFs saw notable outflows: Bitcoin and Ethereum ETFs experienced their second-worst daily outflows of 2025 on Friday, with $812 million withdrawn from Bitcoin ETFs and $153 million from Ethereum ETFs. This followed significant regulatory advances including SEC approval of in-kind redemptions that allow ETFs to swap shares for actual crypto assets, reducing costs and improving tracking.

- Broad market volatility impacted ETFs: Equity ETFs, including large-cap S&P 500 ETFs (, faced pressure as markets fell sharply due to new tariffs and weak U.S. jobs data that raised recession concerns and pushed investors toward defensive assets.

- Sector rotations influenced ETF flows: Defensive sectors saw inflows as investors shifted from cyclicals amid tariffs, with utilities and staples gaining while materials, consumer discretionary, and health care ETFs struggled due to trade tensions and weaker economic data.

- Active and thematic ETFs remain in focus: Momentum factor ETFs continued to show strong performance year-to-date, reflecting investor interest in trend-following strategies. Emerging thematic ETFs in areas like AI, digital assets, and defense also attract attention amid shifting market conditions.

- ETF Innovation and regulatory updates: The SEC’s Project Crypto aims to modernize regulation for on-chain markets and crypto tokens, which could further support innovation and issuance of new crypto-related ETFs.