COMMENTARY:

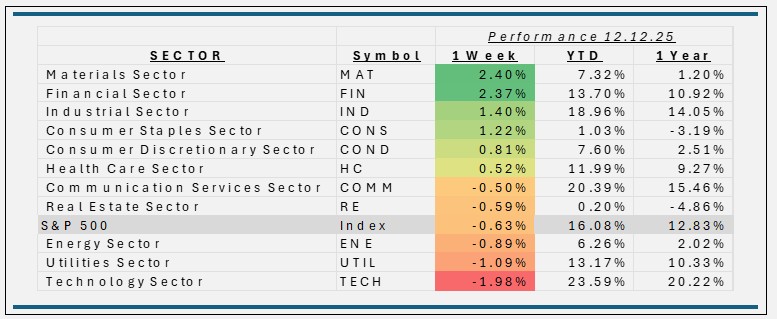

- The S&P 500’s 63‑bp weekly decline through 12/12/2525 reflected a rotation out of mega‑cap tech and AI‑linked names as investors reassessed stretched valuations and the profitability of large AI buildouts. This pullback came despite an otherwise supportive macro backdrop, including the Federal Reserve’s 25‑bp rate cut earlier in the month, which policymakers framed as a response to cooling inflation and rising concerns about labor‑market softening—comments that opened the door to additional easing in 2026.

- The materials sector’s 2.4% gain this week was driven by a rotation into cyclicals as investors positioned for improving industrial demand and easing financial conditions, with the Fed’s recent rate cut helping lift rate‑sensitive, commodity‑linked equities by lowering discount‑rate pressure and supporting expectations for a 2026 manufacturing rebound. Linde PLC was up 4.2% and Newmont mining gained 9.3%. Other names in chemicals and metals also showed strength, which benefited from higher commodity pricing and renewed optimism around global growth.

- Financials were up 2.4% for the week, reflecting a rotation into cyclicals as investors responded to improving macro conditions and the Federal Reserve’s recent 25‑bp rate cut, which supported bank net‑interest‑margin expectations and boosted sentiment across lenders, insurers, and capital‑markets firms. JP Morgan Chase was up 1.1%, credit card companies Visa (5.0%) and Mastercard (+4.8%) were in the top performers.

- The technology sector’s 2% decline was the worst performing sector this week, and reflected a broad pullback in mega‑cap growth and AI‑linked names as investors reassessed valuations following months of strong outperformance. The sector’s decline was amplified by softness in key index heavyweights, particularly semiconductors and software, such as NVIDAI (-4.0%) and Broadcom (-7.8%).

ETF Tidbits:

The biggest storyline across equity ETFs is the SEC’s move toward allowing ETF share classes of mutual funds, a structural shift that could reshape product design and distribution.

– Commissioner Uyeda called the initiative a “long‑overdue step” toward modernizing the regulatory framework for ETFs.

– Reuters reported that the SEC has paved the way for asset managers to add ETF share classes to mutual funds, potentially unlocking dozens of new equity ETF launches and expanding access for retail investors.

– CNBC noted that more than 50 asset managers have petitioned for this relief, with major firms preparing for approval that would “break down a wall” between mutual funds and ETFs.