COMMENTARY:

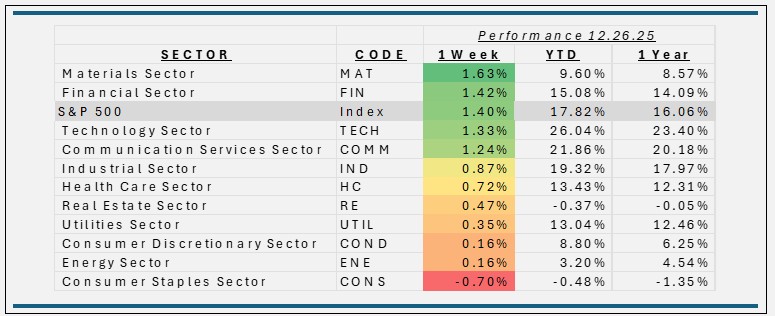

- The S&P 500 added 1.4% in the holiday‑shortened week ending December 26, extending a strong year‑end rally as investors balanced upbeat economic data with a calmer interest‑rate outlook. Fresh GDP figures showed the U.S. economy growing faster than expected, reinforcing the soft‑landing narrative that has supported markets throughout 2025. Tech remained a key driver, highlighted by another high‑profile AI deal, while gold and silver hit record highs as investors continued to seek diversification late in the year.

- Materials outperformed this week, up 1.6%, as gold and silver surged to record highs and lifted the mining industry. Newmont (NEM) was the standout, jumping 7.4% and contributing meaningfully to sector gains. A stronger‑than‑expected U.S. GDP reading reinforced demand expectations for industrial metals, adding another tailwind to the group.

- Financials also posted solid gains, rising 1.4% as stable interest‑rate expectations and resilient economic data boosted confidence in banks and insurers. A clearer path toward gradual Fed rate cuts in 2026 supported large, diversified banks, while higher long‑term yields benefited insurance companies. Together, these macro drivers helped financials participate in the broader year‑end rally and finish the week on firm footing.

- Consumer Staples was the week’s weakest sector, slipping 0.7% as investors rotated toward more cyclical, growth‑oriented areas of the market. Strong GDP data reduced demand for defensive sectors, while rising commodity prices raised concerns about margin pressure for packaged‑goods and household‑product companies. Within the group, Philip Morris (PM) was a rare outperformer, gaining 3.7% for the week, but most large staples names, particularly food, beverage, and household‑product companies all finished lower.

- These themes capped a year defined by resilient consumer spending, steady progress on inflation, and powerful momentum in AI‑related sectors. As we look toward 2026, investors are optimistic but selective—expecting moderate growth, gradual Fed rate cuts, and continued leadership from quality companies with strong cash flows and exposure to long‑term innovation.

ETF Tidbits:

U.S. ETF news was quiet in the holiday‑shortened week, with no major launches or regulatory developments. Broad equity ETFs posted solid gains, while metals‑linked ETFs stood out as gold and silver hit record highs, driving modest sector‑specific interest.