COMMENTARY:

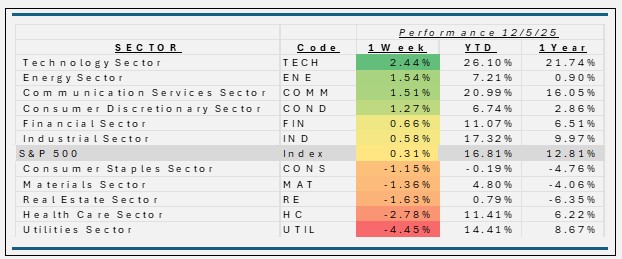

- The S&P 500’s 0.3% rise this week reflected a market in “wait-and-see” mode ahead of the Federal Reserve’s December meeting, with modest gains supported by growing conviction a rate cut is likely. Also, softer inflation and labor data kept the market steady. At the stock level, performance was again driven disproportionately by the “Magnificent Seven,” with mega‑caps providing much of the index’s incremental upside given their outsized weights.

- The technology sector’s 2.4% gain was driven by a renewed bid for mega‑cap growth ahead of the Federal Reserve’s December meeting, as markets increasingly priced in at least one near‑term rate. Investors rotated back into large technology platforms and AI leaders, with outsized contributions the heaviest weights: NVIDIA, Apple, Microsoft, and Broadcom, which together represent well over 40% of the sector and led advances on optimism around AI, cloud demand, and resilient iPhone and services revenue.

- The roughly 1.5% rally in the energy sector was driven primarily by a rebound in oil prices and a much stronger outlook for refining margins. Crude prices gained on growing rate cut expectations which tends to support demand and depress the dollar — along with renewed supply-concerns tied to geopolitical tensions, especially between the U.S. and Venezuela. This environment clearly benefited integrated oil majors and refiners — especially names like Exxon Mobil, Chevron, and Marathon Petroleum, which made them among the biggest contributors to the sector’s weekly gain.

- The 4.5% slide in the utilities sector appears to have been driven mainly by a combination of rising interest-rate sensitivity and shifting investor sentiment away from defensive, yield-oriented stocks — even as broader markets edged slightly higher. Traditional utilities companies seem to have led to the weakness: firms such as Duke Energy, Southern Company, and Dominion Energy, underperformed other long-established, regulated-power utilities likely drove much of the sector’s negative return.

- Year-to-date returns show clear leadership from growth and rate‑sensitive sectors, with Technology and Communication Services well ahead of the S&P 500, while classic defensives and cyclicals generally lag. At the same time, more defensive or commodity‑linked areas such as Consumer Staples, Materials, and Real Estate have barely kept pace or are flat to negative, indicating limited enthusiasm for slower‑growth, rate‑sensitive, or inflation‑exposed businesses.

ETF Tidbits:

U.S. ETF marketplace was dominated by record flows and a surge in metals and “fear trade” products. U.S.-listed ETFs had already pulled in around $1.27 trillion in net inflows year to date, with November alone bringing in roughly $148 billion. Precious‑metals ETFs were another major story, with silver and gold funds seeing some of their strongest weekly inflows of the year as silver prices hovered near record highs and gold‑backed ETF holdings hit new month‑end records, reflecting demand for inflation hedges and tail‑risk protection.

On the regulatory front, a key headline was the U.S. Securities and Exchange Commission signaling that it would block proposals for ultra‑leveraged 3x–5x ETFs, effectively drawing the line at 2x leverage under its derivatives framework. The decision targeted new leveraged products tied to single stocks and crypto, underscoring regulators’ concern about retail investors taking excessive risk through complex ETF structures