COMMENTARY:

- The S&P500 index fell 0.98% this week but remains in positive territory year to date. Some economic headlines created headwinds for the markets, including a CPI report that showed slightly hotter-than-expected inflation, with core inflation rising at an annual rate of 3.3% in January. Retail sales data for January showed a 0.9% decline, marking the biggest monthly decrease in a year. PMI surveys indicated a sharp slowing of business growth in the U.S, falling to a 17-month low.

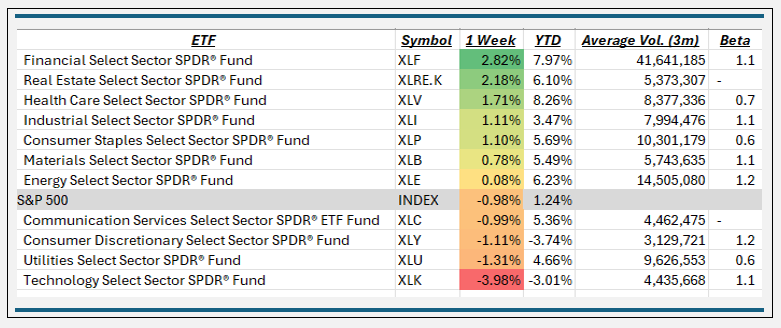

- Financials (+2.8%), Real Estate (+2.2%), and Health Care (+1.7%) were the gold, silver, and bronze medalists this week, all outperforming the broader S&P500 Index for the period.

- The top individual names in those sectors were: Berkshire Hathaway (+7.3% at a 13% weighting in Financials), American Tower Corp (+7.4% at a 9% weighing in Real Estate), and Eli Lilly (+5% with a 13% weighting in Healthcare),

- Most of the sectors in the S&P were in positive territory this week regarding overall performance. Four sectors underperformed the index, with Technology taking the hardest hit, down almost 4% for the week. Three of the “Mag-7” stocks dragged the sector down this week, resulting in a year-to-date decline of 3%, with Apple (-1.5%), Nvidia (-7.0%), and Microsoft (-2.8%) contributing. The MAG7 stocks experienced their longest selloff in nearly a year, with six consecutive days of decline leading up to February 28th. There was also evidence of a market rotation away from technology stocks, with investors moving towards more defensive sectors like utilities and healthcare.

ETF TIDBITS:

State Street Global Advisors launched the SPDR Apollo Private Credit ETF, which was developed in collaboration with the alternative investment firm Apollo Global. This ETF is significant as it’s the first broad private credit market exchange-traded fund.

Over the past week, nearly $3 billion has flowed out of spot bitcoin ETFs, marking the worst period of outflows since their launch a year ago, according to data from Bloomberg. This selling pressure has coincided with a sharp decline in the price of Bitcoin and other cryptocurrencies. In contrast to crypto ETFs, investors have been pouring money into gold ETFs. Over the past week, gold funds have seen around $4 billion in inflows and more than $5 billion since the start of the year.