COMMENTARY:

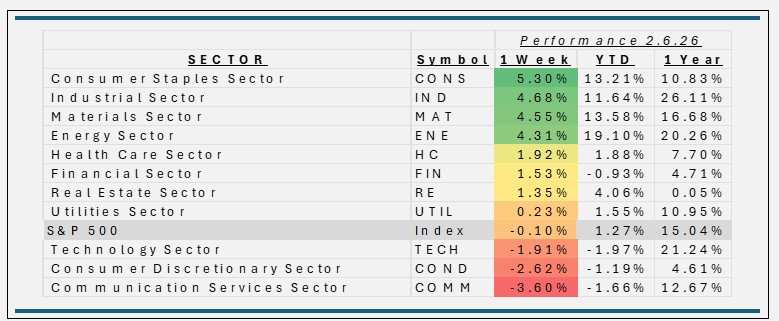

- The S&P500 was basically flat this week, down only 10 basis points. Only three sectors were down, Technology (-1.9%), Consumer Discretionary (-2.6%), and Communication Services (-3.6%), The remaining sectors outperformed led by:

- Consumer Staples Sector outpaced the broader market, rising about 5.3% for the week ending February 6, 2026. The Impressive gain this week wasn’t about a breakout in consumer demand or blockbuster news in the staples space — it was largely about market psychology, sector rotation, and investors seeking stability relative to retreating growth names. In uncertain patches like this, the staples sector’s defensive traits can make it a haven for capital seeking steadier returns. That compares with modest to negative performance in the broad S&P 500 and sharp weakness in tech and discretionary segments. Consumer staples’ core companies (food, beverage, household & personal products) benefit from persistent demand even in uncertain markets.

- The Industrial Sector delivered a strong gain for the week, rising approximately 4.7%, outperforming the broader market. The sector benefited from this shift as investors favored companies tied to infrastructure, manufacturing, transportation, and defense, areas supported by ongoing capital spending and long-term investment themes. While economic data remained mixed, expectations for continued infrastructure investment and reshoring activity helped reinforce confidence in the sector’s earnings outlook.

- Both Materials (+4.6%) and Energy (+4.3%) also posted strong gains.

- Materials benefited from improving sentiment around global manufacturing activity, and infrastructure spending. As market leadership broadened beyond technology, investors increased exposure to sectors tied to construction, metals, and chemicals, areas that tend to perform well when expectations for economic activity stabilize or improve.

- Energy stocks advanced as oil prices firmed and investors focused on supply discipline and cash-flow durability across the sector. With geopolitical risks, OPEC+ production management, and steady global demand supporting crude prices, energy equities attracted interest as both an inflation hedge and a value-oriented opportunity.