COMMENTARY:

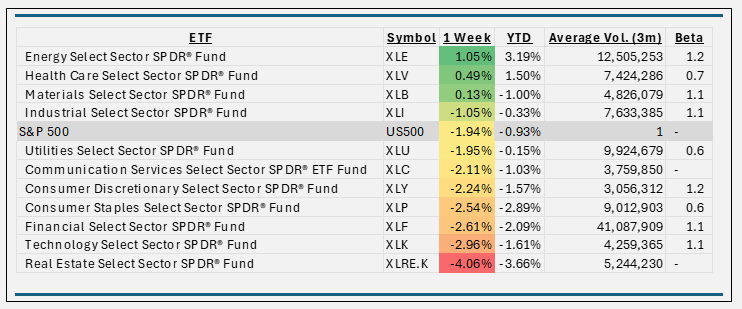

- The S&P500 gave up its prior week’s gain and fell 1.9%. These returns may be driven by investors’ concerns that inflation doesn’t continue its downward trend toward the Federal Reserve’s 2% target. Two key readings will greet investors in the week ahead on that front. Expect two reports this week on wholesale inflation, followed Consumer Price Index (CPI).

- Energy takes an early lead gaining 3.2% YTD and was up 1.0% this week, as oil and natural gas prices have edged higher. Only five of the 22 constituents in the index were down. Two notable gainers were Texas Pacific Land (+7.4%) and Devon Energy (+6.0%).

- The only other two sectors with a positive return for the period were Health Care (+.50%) and Materials (up 13 basis points).

- Real Estate continues its slide falling 4.0% this week. The US housing market is seeing affordability and inventory constraints projected in 2025. All but one of the 31 holdings in XLRE fell this week. Simon Property Group was up 1.4%, however, detractors fell much further with BXP down 9.0% and UDR off 6.9%.

- Technology (-3.0%) and Financials (-2.6%) suffered this week. Apple, Nvidia, and Oracle pulled the Tech Sector down as they collectively are over 30% of the exposure. Credit Card companies Visa (-2.3%) and Mastercard (-1.9%) impacted the performance of the Financial sector.

ETF TIDBITS:

Allianz Investment Management amplified its suite of buffer ETFs with the launch of two new funds: AllianzIM 6 Month Buffer10 Allocation ETF (SPBX) & AllianzIM Buffer 20 Allocation ETF (SPBW) As buffer ETFs, both of these AllianzIM funds seek to offer capital appreciation with an added bulwark of downside mitigation.

Alger released the Alger Russell Innovation ETF (INVN), the latest addition to Alger’s growing fund line-up. The Alger Russell Innovation Index looks to cultivate a portfolio of U.S. equities that the market has not yet recognized as innovative companies.