COMMENTARY:

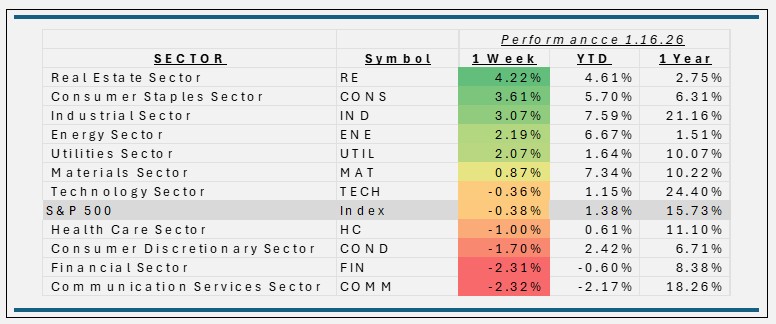

- For the week ending January 16, 2026, the S&P 500 slipped about 0.4% as investors balanced encouraging corporate earnings with ongoing economic and policy concerns. Strong results from technology and semiconductor companies supported the market at times, but mixed earnings from financials and uncertainty around Federal Reserve policy kept sentiment cautious. Investors also rotated toward more defensive areas of the market, reflecting some nervousness about the outlook. Overall, the modest pullback highlights a market still supported by solid fundamentals, but sensitive to interest rates, policy signals, and earnings surprises—conditions that may continue to drive short-term volatility.

- Real Estate climbed about 4.2% as investors responded to favorable interest-rate dynamics and improved property market fundamentals. Lower Treasury yields and expectations of future Fed rate cuts boosted REIT valuations through cap-rate compression and stronger income prospects, while solid demand in housing, logistics and other property types supported key names like Welltower, Prologis, American Tower and Simon Property Group.

- Consumer Staples sector climbed by about 3.6% as investors sought defensive exposure amid broader market volatility and modest economic data, boosting demand for stable, essential goods names. Top holdings like Procter & Gamble, Coca-Cola and Costco benefited from steady consumer spending and dividend appeal, while inflows into staples reflected a rotation toward reliable cash flows and lower-risk stocks as earnings season unfolds and rate expectations shift.

- Communication Services sector lagged the most this week, falling about 2.3% as profit taking and weaker earnings/operational cues weighed on major names. Top holdings like Meta, Alphabet and Verizon faced pressure from slowing ad-spend growth, operational challenges (e.g., outages and downgrades at Verizon) and broader tech volatility, while defensive rotation and mixed macro data dampened sentiment. The pullback reflects cautious positioning amid rate uncertainty and rotation away from growth-oriented media and telecom stocks.

ETF Tidbits:

U.S. ETFs saw a constructive tone this week, with flows and performance driven largely by renewed interest in digital assets and continued strength in high‑beta growth segments. Macro data remained supportive, helping stabilize risk sentiment and fuel inflows into thematic and leveraged strategies.

Crypto‑linked ETF flows rebound sharply U.S. spot Bitcoin ETFs logged four consecutive days of net positive inflows totaling about $1.7B. XRP‑linked ETFs also saw 10 straight weeks of inflows, helping stabilize prices despite legislative uncertainty.

On the regulatory side, Congress delayed a couple of important crypto‑related bills, which keeps the rules of the road a bit unclear for now. The SEC also made some leadership changes and announced updates that could eventually affect fund companies.