COMMENTARY:

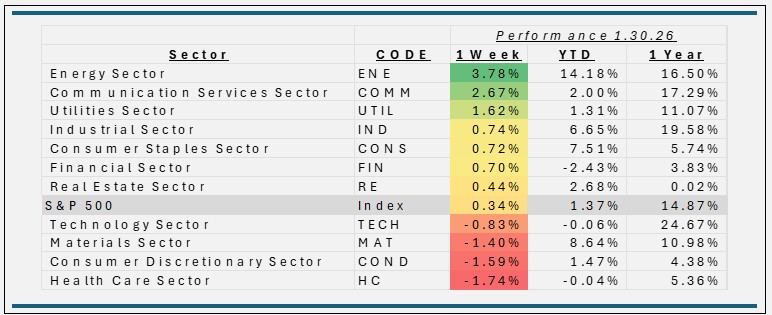

- US equities posted a modest gain last week, with the S&P 500 up about 0.3%, helped by solid earnings and a stable macro backdrop. The Federal Reserve left rates unchanged and avoided a hawkish surprise, reinforcing expectations that policy is on hold near term while keeping the door open to cuts later in 2026 as inflation trends lower. Earnings were the primary driver. Mega cap technology and AI exposed companies delivered strong results and constructive guidance, supporting key growth and communication services segments. Positive reports from select consumer, industrial, and energy names highlighted resilient profitability beyond the largest index constituents, modestly broadening market leadership.

- Energy stocks rallied strongly last week, with the sector up about 3.8%, as crude prices jumped on a renewed geopolitical risk premium and weather-related supply disruptions. Brent moved toward four-month highs near the low 70s, driven by escalating tensions with Iran and concerns over potential disruption through key shipping lanes, while a major US winter storm temporarily curtailed production, tightening near term balances. Individual stock gains were led by its largest integrated and upstream constituents, including Exxon Mobil, Chevron, and ConocoPhillips, which are most leveraged to higher crude benchmarks. Refiners and services names such as Valero, Phillips 66, and SLB also benefited from stronger product cracks and an improved E&P spending outlook.

- Communication Services advanced about 2.7% last week, supported by strong mega cap earnings and a constructive backdrop for digital advertising and streaming demand. Within the Communication Services Sector, gains were led by its largest holdings—Meta Platforms, Alphabet, and Netflix—which responded positively to robust fourth quarter results and guidance highlighting resilient ad budgets, user engagement, and new AI driven monetization initiatives. Telecom and cable constituents, including Comcast and T Mobile, added to the move as investors focused on steady subscriber trends and improving free cash flow profiles.

- Health care underperformed last week, with the sector falling about 1.7% as investors reacted to softer earnings and policy related concerns across key industries. Downside leadership likely came from major managed care names, particularly UnitedHealth Group, which faced pressure after signaling revenue headwinds and ongoing uncertainty around Medicare reimbursement. Other large holdings, including diversified pharma and med tech bellwethers, traded mixed as investors reassessed 2026 growth expectations against a backdrop of reimbursement and regulatory risk.

ETF Tidbits:

- ETF flows in January surpassed roughly 100 billion dollars and were on pace to near 125 billion by late month, exceeding the prior January record and signaling very strong demand for ETFs to start 2026.

- Flows have been particularly strong into active fixed income ETFs, AI‑ and defense‑oriented thematic ETFs, and products offering diversification beyond the S&P 500 and Nasdaq 100, such as equal‑weight and sector funds.

- A wide slate of US ETF launches between January 22–29 spanned emerging‑markets debt, commodities, AI and crypto‑adjacent thematics, equity income/buffer strategies, and short‑term Treasuries.