COMMENTARY:

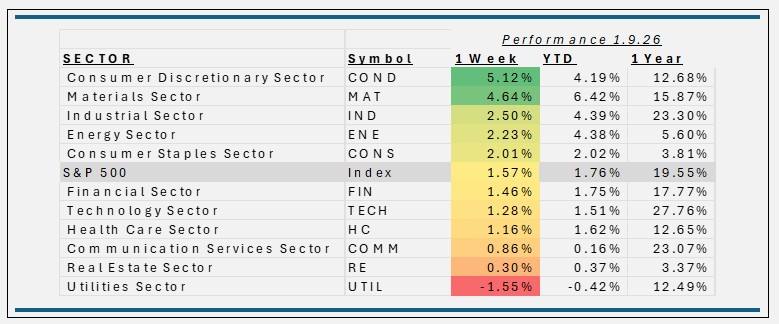

- The S&P 500 advanced 1.6% for the week ending 1/9/26, as markets responded positively to a combination of easing inflation signals, stabilizing interest rates, and renewed confidence in earnings growth. Softer economic data reinforced expectations that the Federal Reserve can remain on hold, keeping financial conditions supportive for risk assets. Leadership expanded beyond mega-cap technology into cyclicals and financials, reflecting improving risk sentiment and optimism that the economy can achieve a soft landing without a material slowdown in growth.

- Consumer Discretionary rose 5.1% and was underpinned by signs that the U.S. consumer remains resilient in the face of mixed economic data. Investors rotated into cyclical and consumer-sensitive stocks as confidence rose around sustained consumer spending and easing financial conditions, with expectations that stable interest rates and robust retail activity would support demand for non-essential goods and services. Mega-cap discretionary names such as Amazon (+9.2%) and Home Depo (+8.3%) helped drive the sector’s outperformance, benefiting from stronger underlying e-commerce trends, diversification into high-margin services, and improved logistics efficiencies that boosted profit outlooks. This sector leadership highlighted investor willingness to embrace cyclical exposure early in the new year as part of a broader market rally.

- Materials gained 4.6% helped by a confluence of macro and commodity-specific factors that lifted cyclical industrial demand and raw material prices. Elevated copper and other base metal prices, supported by supply disruptions and robust demand tied to infrastructure buildouts and the energy transition, helped underpin sentiment across the group. Geopolitical and trade dynamics, including tariff-induced pricing power for key commodities and infrastructure investment prospects, also buoyed the outlook for producers. Linde PLC (+3.5%) and Newmont Mining (+7.7%) led the way this week.

- Utilities lagged broader markets, sliding approximately 1.6% as investors rotated away from traditionally defensive, yield-oriented sectors toward higher-beta cyclicals amid firming macro data and shifting rate expectations. While much of the broader market rallied on a mixed jobs report and hopes for eventual Fed rate cuts, stronger than expected labor market resilience and fading near-term rate-cut odds put pressure on rate-sensitive utilities stocks as yields ticked modestly higher. Within the sector, heavyweight NextEra Energy (-1.4%) and other core components such as Constellation Energy (-6.5%) underperformed relative to cyclical peers, contributing to the sector’s drag as investors favored parts of the market with clearer near-term earnings momentum.

ETF Tidbits:

While no major new ETF-specific regulations have been introduced so far in 2026, SEC notices and approvals suggest a constructive regulatory tone focused on modernization, product expansion, and accommodating investor demand rather than tightening oversight. The U.S. ETF market continues on its path of product innovation and regulatory approvals with momentum carrying over from late 2025. Notable developments include major issuers filing new crypto-linked ETFs, including spot Bitcoin and Solana products, signaling growing institutional acceptance and clearer regulatory pathways for digital assets. The SEC also have recently approved multiple ETF share-class applications, expanding flexibility for asset managers to offer ETF and mutual fund structures side by side, a move viewed as structurally supportive for industry growth