COMMENTARY:

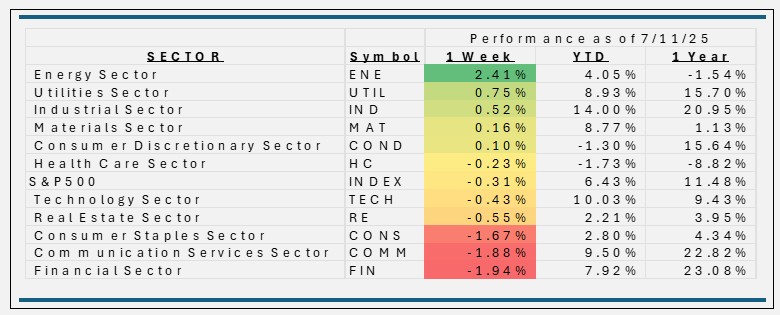

- The S&P 500’s modest decline of 31 basis points for the week ending July 11, 2025, was driven by heightened trade policy uncertainty, anticipation of Q2 earnings reports, and concerns about rising inflation due to new tariffs. While the market absorbed much of the tariff news without severe disruption, sentiment turned cautious, particularly in sectors sensitive to trade and interest rates. Investors are now looking at corporate earnings and economic data for direction as the second half of the year unfolds.

- The winner by a large margin this week was the Energy sector, up 2.4% which outpace all ten others by far. The sector was powered by a combination of rising oil prices, investor rotation into energy stocks, and resilience in the face of macroeconomic and political uncertainty. The largest U.S. energy companies—Exxon Mobil (+2.9%), Chevron (+4.7%) and ConocoPhillips (+2.0%)—these three stocks make up nearly half of the sectors index exposure, were the primary drivers of their outperformance, supported by favorable sector dynamics and strong earnings outlooks.

- Financials were hit the hardest this week, falling 1.9%, driven by pre-earnings caution, Fed policy uncertainty, and sector rotation out of financials. The largest U.S. banks and diversified financials JPMorgan (-3.1%), Berkshire Hathaway (-1.9%), and Bank of America (-4.5%) were a drag the sector’s performance.

- Communications Services followed closely behind Financials down 1.8%. Partly due to sector rotation away from growth and tech, along with weakness in mega-cap communication services stocks, in particular Meta Platforms (-0.2%) and Alphabet. Media and streaming names like Netflix (-4.0%) and Disney (-3.3%) also contributed to the sector’s underperformance for the week.

- Year to date, only two sectors are slowly crawling their way out of the red, close to flat this week. Consumer Discretionary (-1.3%) and Health Care (-1.7%) are the only two sectors in negative territory.

ETF TIDBITS:

- Risk asset ETFs remained popular despite volatility.

- Income and specialty ETFs drew attention for their innovative strategies and milestone events.

- Sector rotation was evident, with flows favoring defensives and select cyclicals, while outflows hit communication services and energy ETFs.

- Fixed income ETFs saw activity as investors tracked Treasury yield movements and inflation data.

- Inflation and Crypto ETF Flows: Inflation concerns resurfaced as tariff reprieves ended, prompting some investors to seek inflation hedges such as Bitcoin, with related crypto ETFs seeing continued inflows.