COMMENTARY:

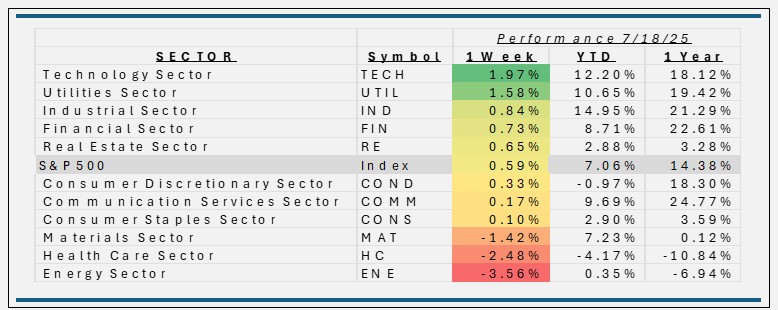

- The S&P 500 recorded a positive week (+0.59%) as confidence rebounded, led by strength in the technology sector, easing trade friction, and robust corporate results. Support from the Federal Reserve’s policy clarity and improving inflation data contributed to the equity rally and helped drive the broad index higher.

- The Energy sector, in sharp contrast, fell 3.6%. The decline reflected persistent uncertainty around tariffs and trade negotiations, as well as weaker oil prices. Investor preference also rotated toward growth-focused sectors, leaving traditional energy companies like Exxon Mobil (-6.6%) and Chevron (-3.4%) as major drags on performance.

- Healthcare was sick this week with a 2.5% decline, hurt by investor rotation into technology stocks and continued regulatory and policy uncertainty for the sector. Pressure from sector-specific earnings challenges was apparent, with UnitedHealth (-7.0%) and Eli Lilly (-2.7%) standing out among the underperformers.

- Technology was the top-performing sector, rising nearly 2%. The gains were fueled by a semiconductor rally—led by Nvidia (+4.5%), Microsoft (+1.3%), and Broadcom (+1.3%)—and were amplified by easing U.S.-China tensions, lower inflation data, and continued investor enthusiasm for artificial intelligence. The sector leads the S&P 500 in year-to-date gains, up over 12%.

- Overall, market dynamics this week reflected a clear rotation into growth sectors, especially technology, while defensive and commodity-linked areas lagged under the weight of regulatory and macroeconomic uncertainty. New Crypto regulation signed into law on Friday will be an ongoing focus for investors in the weeks and months ahead.

ETF Tidbits:

Record ETF Launches and Asset Growth: The global ETF industry reached a new milestone, with 1,308 new ETF products launched in the first half of 2025 and assets under management climbing to an all-time high of $16.99 trillion by June. This represents 14.5% asset growth year-to-date, underscoring investor enthusiasm for innovative and diversified ETF solutions.

Strong Inflows Continue: Net inflows into ETFs hit $158.78 billion in June alone, marking the 73rd consecutive month of positive flows and bringing year-to-date inflows to a record $897.65 billion.

Active and Thematic ETF Momentum: Investors increasingly sought out active strategies and niche thematic exposures, as demonstrated by 654 active ETFs among the new launches, reflecting a broader industry push for flexibility, innovation, and choice in portfolio construction.

Spotlight on Digital Assets and Alternatives: The ETF space saw continued growth and mainstream adoption of digital-asset products, particularly spot Bitcoin ETFs, as well as more products targeting tangible assets such as gold—strategies often cited for diversification amid uncertainty around U.S. debt and fiscal policy.