COMMENTARY:

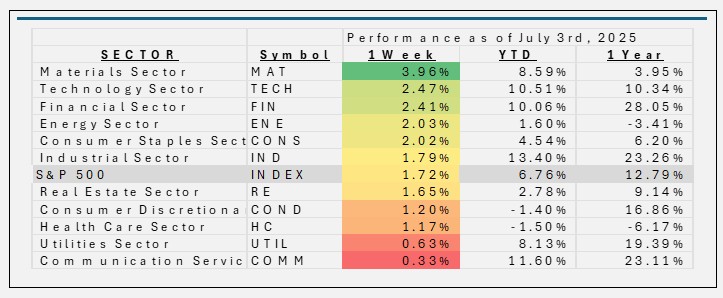

- As Americans prepared to celebrate Independence Day, equity markets delivered a fitting display of resilience and optimism. The S&P 500 notched a 1.7% gain, closing at record highs and reflecting the nation’s enduring economic strength. Sector leadership was broad, with materials, technology, and communication services all posting robust advances ahead of the Fourth of July holiday.

- Materials gained 4.0% and took the top spot this week. Rising commodity prices and strong sentiment in industrial and basic materials. Upbeat earnings and outlooks from sector leaders. Newmont Corporation (+1.2%), Linde plc (+2.4%) and Sherwin-Williams (+3.6%) were notable outperformers.

- Technology rose 2.5%. Continued momentum in artificial intelligence and positive tech earnings and sector leadership and rotation into growth stocks. NVIDIA, Microsoft, & Apple, together make up about 40% of the sector all made significant gains this week.

- Communication Services came in last place this week but was still up. Meta Platforms. Google, and Netflix benefited from Strong digital advertising and media results, sector rotation into growth and digital names, and improved macroeconomic outlook and investor sentiment.

- As fireworks lit up the sky for the Fourth of July, markets reflected a spirit of optimism and renewal. Strong economic data, sector leadership from technology and materials, and a positive macro backdrop set the stage for a celebratory week on Wall Street. The S&P500 is up over 6% year to date, and only two sectors are down halfway through the year, Consumer Discretionary and Health Care.