COMMENTARY:

- The S&P 500’s 0.4% weekly decline was primarily driven by escalating Middle East tensions and the resulting surge in oil prices, which raised concerns about inflation and global economic stability. Sector-specific news and ongoing uncertainty about Federal Reserve also contributed to the market’s cautious tone.

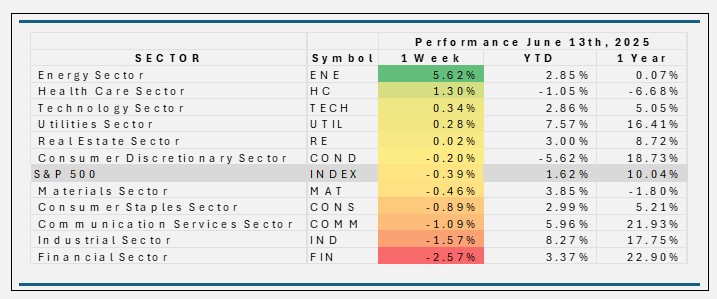

- Six of the sectors outperformed the broader S&P500 while five under performed. Energy led the way. Conversely, the Financial sector fell the most for the week.

- Energy’s 5.6% weekly gain was driven by a surge in oil prices amid heightened Middle East tensions, ongoing supply constraints, and strong institutional inflows into the sector. The largest contributors to return were Exxon Mobil (+7.5%), Chevron (+4.1%), along with other major US energy producers.

- Health Care was up 1.3% due to investor rotation into defensive sectors amid market volatility, with top contributions from large-cap pharmaceutical and health care companies like Eli Lilly (+6.4%), Johnson & Johnson (+1.3%), and AbbVie (0.7%). The sector’s resilience and stable earnings profile made it a relative outperformer in a risk-off environment.

- Financials fell 2.6% for the period, impacted by geopolitical tensions, rising interest rates, and sector-specific headwinds, with the largest negative contributions coming from major banks and diversified financials such as Berkshire Hathaway (-1.2%), JPMorgan Chase ( -0.3%), and Bank of America (-2.0%).

- The markets are generally back, year-to-date, only two sectors remain in the red, Health Care (-1.0%) and Consumer Discretionary (-5.6%).

ETF TIDBITS:

Theme Notable Impact/Headline

- Geopolitical risk Surge in oil, gold, defense, and shipping ETFs

- Sector ETF flows Energy, defense, and safe-haven ETFs outperformed

- Index ETF flows Major inflows to S&P500 broad market benchmark ETFs

- Fee competition Schwab cuts ETF expenses