COMMENTARY:

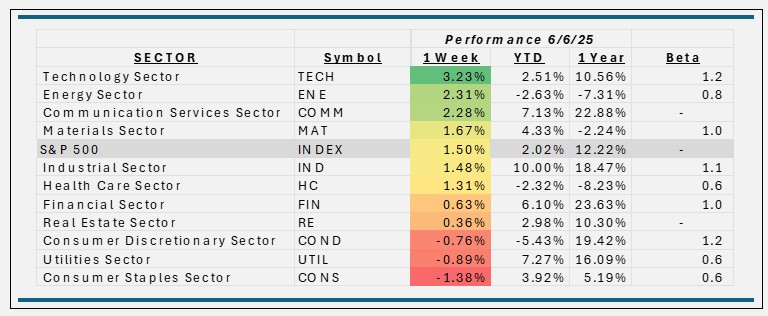

- The S&P 500’s 1.5% gain for the week ending June 6th was driven by robust jobs data, easing trade tensions, and strong performance from leading technology stocks, with investor sentiment buoyed by signs of economic resilience and hopes for a favorable resolution to ongoing trade disputes.

- The “Magnificent Seven” names which include Microsoft (+2.2%), Nvidia (+4.9%), Apple (+1.5%), were major contributors to the technology sector’s gains. In particular, Microsoft and Nvidia, which together make up over a third of technology sector exposure, were standout performers. These companies reported robust earnings growth and continued to benefit from strong demand in artificial intelligence, cloud computing, and digital advertising.

- Energy’s 2.3% gain for the week was driven by a rebound in oil prices, renewed investor appetite for value and cyclical stocks, and strong contributions from its largest holdings—particularly Exxon Mobil (+1.9%), Chevron (+2.6%), and ConocoPhillips (2.2%). The absence of major supply disruptions and relative calm in global energy markets contributed to a more stable outlook, which supported energy equities.

- Consumer Staples, 1.4% decline was driven by rising rate concerns, a rotation out of defensive sectors, mixed company outlooks, and declines in major holdings like Procter & Gamble (-3.5%), Coca-Cola (-1.0%), and Walmart (-1.3%). Some major consumer staples companies reported mixed quarterly results or issued cautious outlooks, citing margin pressures from ongoing cost inflation and competitive pricing environments. This dampened investor sentiment toward the sector.

- This week four sectors outperformed the broader S&P500 Index, (TECH, COMM, ENE, & MAT), the remaining seven sectors underperformed. Year to date, all but three sectors have recovered from being in the red. Energy, Health Care, & Consumer Discretionary still have some work to do to get into the green.

ETF TIDBITS:

- The week’s ETF headlines were dominated by record-breaking S&P 500 ETF gains, posting its strongest May performance in more than three decades. Technology sector outperformance, renewed interest in defense and health care ETFs, robust flows into dividend strategies, and a wave of new ETF launches, reflecting a dynamic and rapidly evolving marketplace. The U.S. ETF market saw 15 new offerings launched between May 29 and June 5, each targeting different strategies and sectors, underscoring the continued innovation and expansion in the ETF industry.