COMMENTARY:

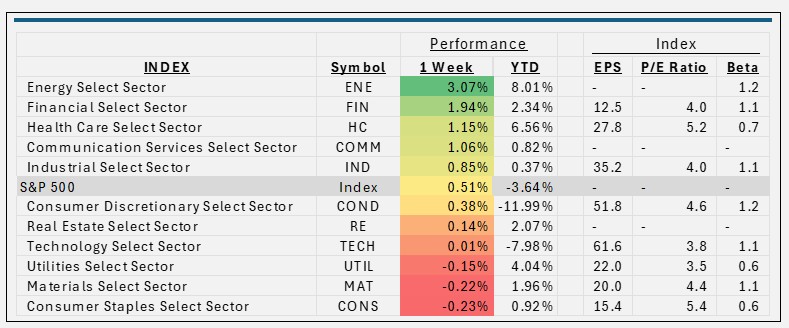

- The S&P 500 index got some help during Wednesday and Friday’s trading sessions to stop five weeks in a row of losses, to eke out a fifty-basis point gain for the week. The index has been swimming against the tide of the “Mag-7” stocks showing their worst-performing quarter in two years.

- The Energy Sector won for the second week in a row, up 3.0%. The U.S. dollar weakened during the week, making oil and other commodities priced in dollars more attractive to international buyers. This provided a tailwind for energy prices and supported sector performance. Marathon Oil gained 6.2%, and Hess Corp, up 5.7%, helped float the sector.

- Financials took the second spot up 1.9%. The Federal Reserve left rates unchanged but eyed future possible cuts later in the year. P. Morgan contributed gaining 4.0% and Apollo Global Management rose 6.8%.

- Materials, Utilities, and Consumer Staples were all off about 0.2% and were the worst-performing sectors for the week. These three were the only sectors of the eleven in the red this week.

- As we close into the end of Q1, year-to-date the S&P500 is down 3.6% so far, with Energy on top at 8.0%, and Consumer Discretionary down 12.0%.

ETF Tidbits:

Market Volatility Drives SPDR Gold ETF Assets to new heights as State Street’s gold fund(s) SPDR Gold Trust (GLD) and the SPDR Gold MiniShares Trust (GLDM) attract $5.4 billion in 2025 inflows as investors seek shelter from uncertainty.

Innovator Capital Management launched the Innovator Equity Premium Income – Daily PutWrite ETF (SPUT) on the NYSE Arca. Most option-income ETFs today use covered call strategies. SPUT, however, sells puts instead of calls. However, selling puts usually brings in higher premiums and does not limit the potential for positive returns from the portfolio’s stocks. For a put seller to receive the premium, the underlying asset’s price must hold steady or increase. (source VettaFi.com)