COMMENTARY:

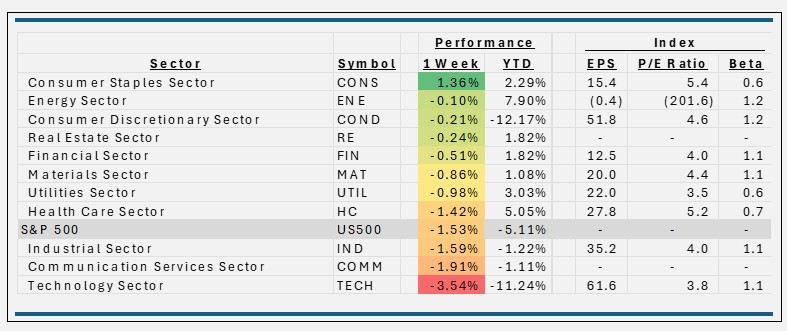

- The S&P 500 fell this week, down 1.5%, as investors waited for clarity on the tariffs due to go into effect on April 2nd. Rising inflation and weakening consumer sentiment also contributed to market declines.

- Consumer Staples was the only sector with a positive return this week, up 1.4%, as investors seek to rotate into more defensive positioning. Dollar Tree, which is only about a percent of the sector’s exposure, gained the most, up 9.0%, and Costco Wholesale Corp, the largest constituent in the group, rose 2.2%.

- Technology fell the most, dropping 3.5%. Many major tech firms, including chipmakers and cloud providers, depend heavily on imports and exports, making them vulnerable to trade disruptions. Only eight of the 69 constituents had positive returns for the week. Super Miro Computer (-18.7%), Broadcom (-11.8%), and Oracle (-7.5%) were all in the red for the period.

- Industrials (-1.6%) and Communication Services (-1.9%) rounded out the three sectors to underperform the broader S&P500 Index this week.

- As we close out the first quarter of 2025, Consumer Discretionary has suffered the most, down 12.2%. The top dog so far this year is Energy, gaining 7.9%.

ETF Tidbits:

Some ETF Providers are going abroad, as a number of non-US ETF have been recently listed. Vanguard has launched a fixed-income-focused ETF, the Vanguard Global Government Bond UCITS ETF. Janus Henderson has launched a UCITS vehicle for non-US investors: the Janus Henderson Tabula USD AAA CLO UCITS ETF (JAAA LN). YieldMax ETFs has announced the launch of its first UCITS ETF for investors in Europe, in partnership with HANetf, The YieldMax Big Tech Option Income UCITS ETF.