COMMENTARY:

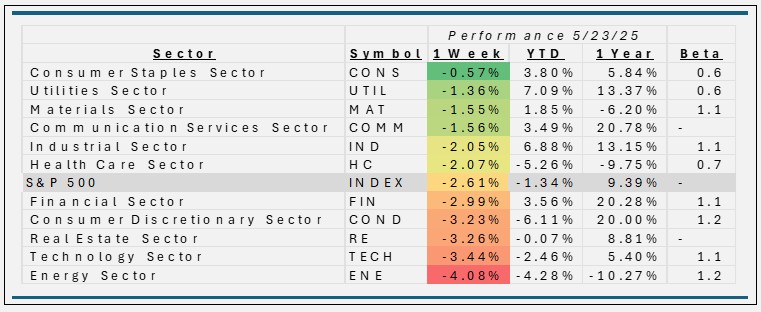

- The S&P500’s performance this week was primarily influenced by a combination of macroeconomic factors and market sentiment; the index fell 2.6%. Key drivers included: Anticipation of signals from the Federal Reserve regarding future interest rate policy, as inflation data remained a central focus. Several large-cap companies reported earnings, with mixed results, leading to sector rotation and uneven performance across the index. Investors rotated out of cyclical and growth-oriented sectors (like consumer discretionary and financials) and showed limited enthusiasm for defensive sectors.

- Consumer Staples was off about 60 basis points but was the best performer for the week. Lamb Weston Holdings and Brown-Forman were off the most 6.1% and 6.0% respectively. The best performer in the group was Dollar General which gained 8.4%.

- The sector that was hit the hardest was Energy, which dropped 4.0% for the week, primarily due to a sharp decline in oil prices, weaker demand for petroleum products, and ongoing market volatility. Only two stocks in the sector had positive returns Expand Energy (+1.7%) and The Williams Companies Inc (+0.3%). The two names that fell the most were Texas Pacific Land (-11.0%), and Phillips 66 (-10.0%). Together these two laggards represent over 5% of the energy index.

- All eleven sectors were in negative territory this week, offsetting the prior week when all sectors were up. This is what we call volatility! Year to date the S&P500 sits at -1.3%.

ETF TIDBITS:

Key ETF Marketplace News Headlines: Week Ending May 23, 2025

- The ETF industry is bracing for an “absolute tsunami” of new products, with as many as 3,000 ETFs expected to launch in the coming weeks. This surge is driven by a new SEC rule allowing mutual fund managers to create ETF share classes for existing funds.

- Over $400 billion has flowed into ETFs so far this year, with core index-tracking funds on track to break annual inflow records. The ETF market is expected to surpass 7,000 products soon, nearly doubling its current size

- Active ETFs are projected to represent over half of all new launches in 2025, as investors seek more flexible, tax-efficient vehicles that can adapt to changing markets. Thematic and alternative asset ETFs are also gaining traction, offering exposure to niche strategies and new asset classes.