COMMENTARY:

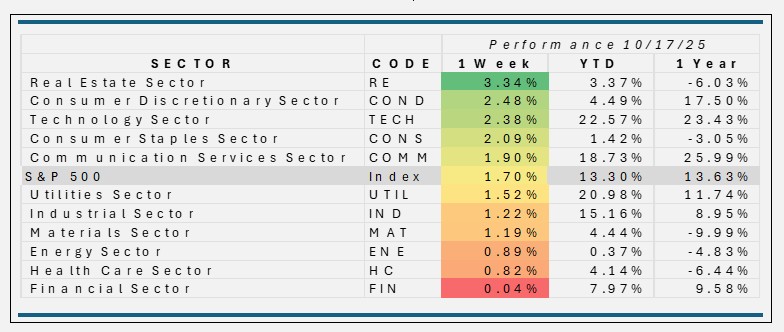

- For the week ending October 17, 2025, the S&P 500 rose 1.7%, and all the U.S. equity sectors advanced, led by real estate, consumer discretionary, and technology. S&P 500 Index gained on improved risk sentiment as investors grew more confident after President Trump signaled that U.S.–China trade talks were back on track, easing global trade anxiety. Falling Treasury yields: A pullback in yields supported equity valuations and rotation into growth and real estate stocks.

- Real Estate (+3.3%) was helped by a drop in 10-year Treasury yields: Lower yields boosted REIT valuations and dividend appeal for income-oriented investors. Also, rebounding commercial property sentiment: Investors priced in better leasing activity and reduced recession risk. Prologis (+11.6%) surged on strong logistics demand data, and American Tower (+2.5%) gained on stabilized capex outlook from telecom operators. Helping boost the sector.

- Consumer Discretionary (+2.5%) rallied because of retail sales data beating expectations, signaling continued consumer resilience heading into Q4. In addition, improving China headlines boosted multinational exposure, including automakers and luxury names. Tesla (+6.2%) gained on positive delivery and margin commentary. Home Depo (+4.3%) also contributed to the drive.

- Technology (+2.4%) continues to be led by AI momentum and strong earnings guidance continued to lift semiconductors and cloud leaders. Mega-cap names—especially Apple, Microsoft, and Nvidia—helped the index notch its best week since August

- In summary, this week’s broad advance reflected easing recession fears, improved global sentiment around trade, and yield-driven rotation favoring interest-sensitive sectors. Tech and consumer discretionary benefited from growth optimism. All sectors are in the green YTD.

ETF Tidbits:

- For the week ending October 17 2025, the U.S. ETF market is characterized by renewed investor inflows, record levels of fund launches, major shifts in structure and strategy, and a backdrop of intensifying competition and regulatory caution. While the momentum is strong, the tone of many reports suggests a need for selectivity and awareness of product-and-market risk.

- The U.S. ETF market is experiencing “explosive growth” — with 794 new ETFs launched over the first nine months of 2025, already surpassing 2024’s record. The rapid pace is raising concerns of a “bubble” or product overload: as more niche/leveraged funds proliferate, some analysts worry about quality dilution and viability of market-making

- The sheer volume of new ETFs raises two contrasting dynamics — on one hand innovation and investor choice, on the other hand increased competition, potential for over-fragmentation and risk of closures. For advisors and fund managers, launch/closure trends are key for product strategy and differentiating in a crowded market.