COMMENTARY:

- In a broader continuation of the rally: the S&P500 index closed October with its sixth straight monthly gain and reached another new all‐time high. Strong corporate earnings, especially tech Mega‐cap names delivered standout results, as they reported much better‐than‐expected profit and cloud growth. Tech and AI‐related companies are continuing to benefit from heightened investment flows and strong sector momentum.

- The decision to do a second rate cut of 0.25% this year was largely driven by signs of softening in the labor market — job growth has slowed, and the Fed perceives increased downside risk to employment. With inflation data moderating and the market expecting further easing by the Federal Reserve, there was optimism around lower future borrowing costs.

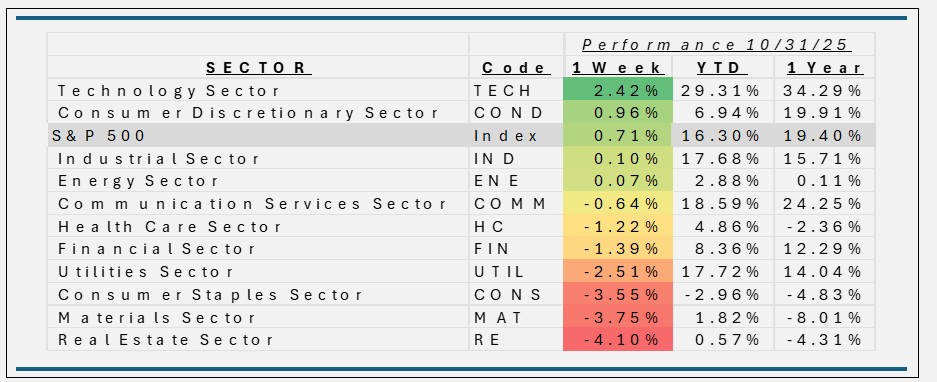

- Technology was up 2.4% this week, thanks to strong earnings from the large “mega-cap” growth names. For example, the tech/AI themes were highlighted in the rally. Nvidia (+8.7%), Apple (+2.9%), Broadcom (+4.4%) and Palantir (+8.6%) were stand out performers.

- Consumer Discretionary gained almost a percent this week, Despite the tailwinds, reports show the Consumer Discretionary sector is facing headwinds: consumer confidence has dipped, inflation remains elevated for many households, and the labor market is showing signs of softness. Amazon (+8.9%) and Tesla (5.3%) make up about 45% of the exposure and help buoy the sector.

- Real Estate stocks (and REITs in particular) that are highly sensitive to interest rates fell the most this week, by 4.1%. Institutional investors appear to be scaling back allocations to real estate for the first time in over a decade, amid concerns over rental income, and property valuations (especially offices). Stock that suffered this week include American Tower (-6.6%), Public Storage (+7.8%), CBRE Group (-6.5%)

- Materials (-3.8%) and Consumer Staples (-3.6%) showed their sensitivity to macro signals (Materials more so to growth/cycle, Staples more to defensive/consumer‐resilience). A shift in investor sentiment away from “safe” to “growth” and away from cyclicals can hit both: materials because growth is disappointing, staples because their defensive premium shrinks— appears to favor growth/tech, driven by earnings, rate expectations, etc. That means less money for traditional cyclicals and defensives.

ETF Tidbits:

- This week, the US ETF marketplace saw strong inflows across asset classes, growing optimism in crypto ETF. US-listed ETFs attracted significant capital across equities, fixed income, and crypto, reflecting a broad risk-on rally. Equity ETFs pulled in over 12.3 billion, while fixed income ETFs saw 13.2 billion in inflows and cryptocurrency ETFs drew 2.7 billion, suggesting renewed investor interest despite recent volatility.

- Many new issuers are spotlighting “yieldboost” and leveraged ETFs, especially in sectors benefiting from rate cut expectations and gold price rallies. AI-related ETF strategies are also under scrutiny, with some firms flagging risks tied to overexposure in certain tech names.