COMMENTARY:

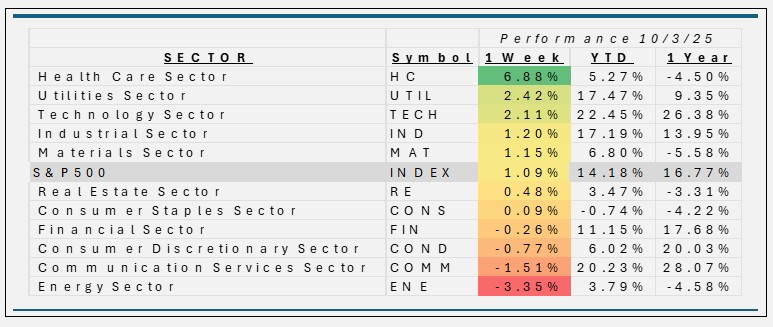

- The S&P 500 advanced 1% for the week ending October 3, 2025, but it was the healthcare sector that stole the show, and clearly ate its protein this week, surging an eye-popping 6.9%. Utilities also brought some spark to portfolios, adding 2.4%. Despite the potential impact of a U.S. government shutdown, investors took the uncertainty in stride, with markets betting that any disruptions would be temporary and unlikely to derail economic momentum. The impact was more psychological, and stocks rallied as the week wore on.

- Health Care delivered a standout weekly gain, benefiting from renewed confidence after major health insurers reaffirmed earnings forecasts and political leaders made supportive statements regarding Medicare and Medicaid. Eli Lilly gained 15.9% and Bio-Techne rose 21.4%.

- Defensive names in Utilities also performed well the sector was up 2.4%, riding a wave of investor risk aversion as volatile bond yields steered more capital toward traditionally stable sectors. NextEra Energy (+5.6%), Constellation Energy (+8.7%), and AES Corp. (+10.1%) led the way this week.

- However, not all sectors got a clean bill of health. Energy (-3.4%) fell sharply, hampered by sliding crude prices and investor unease as profit-taking hit the sector after a strong year-to-date run. Communication Services (-1.5%) also languished, with some of the largest media and internet names declining on earnings guidance concerns. The underperformance of these two sectors subtracted meaningful basis points from the S&P’s overall advance, offsetting some of the “doctor’s orders” optimism delivered by healthcare stocks.

- Closing out the week, headlines were dominated by President Trump’s vocal support for social safety net programs, which helped propel confidence in healthcare equities. Meanwhile, the market looked ahead to the S&P 500’s historically strong fourth quarter, with some pundits betting that Halloween won’t be the only treat for investors this October.

ETF Tidbits:

- Fee Wars Heat Up: A major index player announced reductions in fees across six major equity ETFs—covering FTSE, ESG emerging markets, Japan, Germany, All-World, and North American exposures. This move is expected to save investors up to $13.7 million annually as fund providers continue battling for market share through lower costs.

- Crypto ETF Developments: XRP and Bitcoin in Focus: Market anticipation grew around the SEC’s decision—expected later in October—on six proposed XRP (Ripple) spot ETFs

- Record Trading Volumes and Flows in Popular ETFs: The ETF industry continued to post record assets and high trading volumes, especially in “Magnificent 7”/AI-driven technology ETFs, reflecting investor enthusiasm for broad and sectoral products alike.

- Dividend and Income Developments: Several prominent ETFs, including bitcoin-linked and preferred stock ETFs, declared new distributions, reflecting continued investor interest in yield-producing funds.