Commentary:

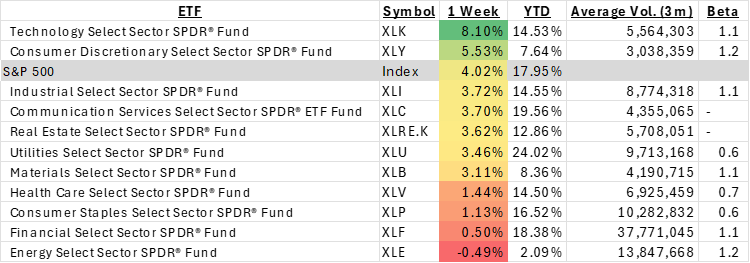

- Technology rebounded this week, leading all other sectors up 8.1%. Microsoft (+7.2%), Broadcom (+22.4%), Nvidia (+15.8%) along with other big technology stocks helped it claw back almost all its losses from last week, which was its worst week in a year and a half. These were some of the big technology stocks that struggled earlier this summer on concerns their prices had shot too high in the frenzy around artificial intelligence.

- Consumer Discretionary followed, gaining 5.5%. com (+8.8%) and Tesla (+9.3%) make up more than 38% of the ETF and were significant drivers for the sector’s performance this week.

- The S&P500 Index rose 4.0% for the period. U.S. stocks closed out their best week of the year with more gains on Friday and climbed to the cusp of their records.

- The only sector that was down was Energy. Exxon Mobile (-1.3%) and APA Corp. (-5.2%) were detractors.

ETF Tidbits:

- According to stockanalysis.com there were 21 new ETFs launched this week, eleven were Income/Bond strategies.

- Firms launching new ETFs include Neuberger Berman, Columbia Threadneedle, YieldMax, Palmer Square, and Polen Capital.