COMMENTARY:

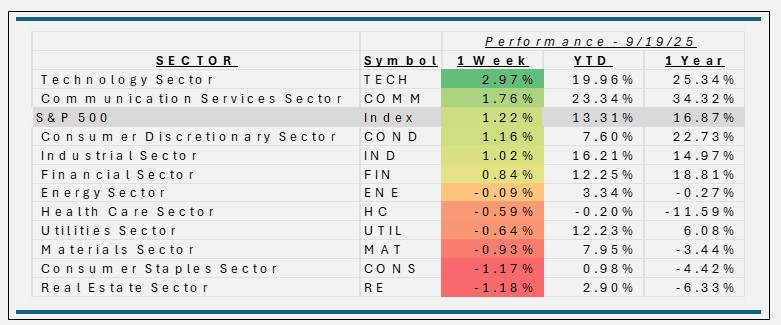

- Turns out Wall Street loves a discount—especially when it comes from the Fed. The S&P 500 rose 1.2% for the week as investors cheered the Federal Reserve’s first rate cut since December, trimming the benchmark by 25 bps. Growth-oriented sectors, particularly Technology and Communication Services, led the advance as lower discount rates boosted appetite for longer-duration assets.

- Technology (+3%) was the standout, lifted by a surge in Intel following Nvidia’s $5B strategic investment and continued strength in Nvidia (+0.3%), Apple (+3.2%), and Microsoft (+1.9%).

- Communication Services gained 1.8% and benefitted from Alphabet (+5.7%) (+crossing the $3 trillion market cap threshold, underscoring momentum in large-cap tech and AI-related themes. Both classes of News Corp (+~5%) and Fox Corp (+~4%) were all along for the ride.

- Consumer Discretionary (+1.1%) saw support from Tesla (+7.6%), which rallied after Elon Musk disclosed a $1B personal stock purchase, while broader retail names has less of an impact amid mixed consumer spending data, such as Lululemon (+6.1%) and Starbucks (+3.3%).

- On the downside, Utilities and Energy were relative underperformers as falling yields reduced the defensive appeal of income-oriented equities and oil prices eased slightly on supply concerns. Macro sentiment was dominated by the Fed’s rate cut, softer labor market signals that suggest easing may continue, and optimism around U.S.–China trade talks. With equity indexes setting fresh record highs, investor enthusiasm remained firmly risk-on.

ETF Tidbits:

The U.S. ETF market this week was driven by Federal Reserve rate cut, record equity index closes, and ongoing strong flows into leading sector and thematic ETFs.

- Thematic and IPO ETFs: Renewed demand for AI, cloud, and thematic exposure continued. The IPO of Gemini Space Station (crypto exchange) delivered headlines for the IPO-focused ETF segment, while other thematic launches targeted cloud infrastructure, robotics, and global climate transition themes.

- Bond and Income ETFs: With Treasury yields dropping on dovish expectations, fixed income and dividend/income ETFs saw increased flows. Utilities and bond proxy ETFs were particularly sought after, due to their historical resilience in falling rate scenarios.

- Generic Listing Standards for Crypto & Spot Commodity ETFs

The SEC approved new rules that allow exchanges (like Nasdaq, NYSE, Cboe) to adopt generic listing standards for commodity-based and crypto spot ETFs. This streamlines the process for new crypto ETFs — reducing or removing parts of the old case-by-case approval