COMMENTARY:

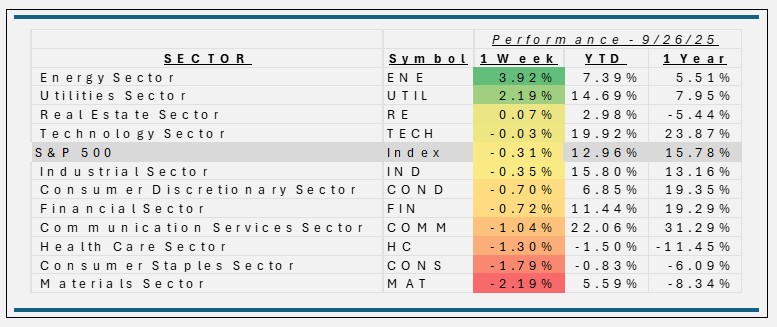

- While the market took a cautious step back, energy stocks lit up the scoreboard and utilities kept the lights on, leaving materials and consumer staples stuck in the back of the bus. The S&P 500 declined by 0.3% for the week, as investor sentiment turned cautious ahead of the Fed’s key inflation data release and mounting concerns about a possible U.S. government shutdown. Despite solid year-to-date gains, the market showed signs of fatigue amidst rising Treasury yields and political uncertainty over fiscal funding.

- Energy surged 3.9% on the back of rising crude oil prices. Major contributors included Exxon Mobil (+3.9%), ConocoPhillips (+7.1%). and Chevron (+2.5%), all contributing as oil supply concerns outweighed demand fears and helped by geopolitical tensions and OPEC+ discipline on production.

- Utilities advanced 2.2%, benefiting from their defensive reputation during periods of heightened market volatility and as yields leveled off. Key performers included NextEra Energy (+6.7%), Southern Co. (+ 3.0%), and Duke Energy (+1.6%), which attracted flows as investors rotated into less cyclical names ahead of rate uncertainty and potential fiscal disruption.

- The Materials sector slid 2.2%, reflecting weaker pricing in metals such as copper and slight declines in iron ore and gold after a summer rally. Large weights like Freeport-McMoRan (-20.5%) and Linde (-1%) struggled amidst ongoing worries about Chinese demand and softening global growth. Commodity price volatility also contributed as investor sentiment recoiled from pro-cyclical bets, despite commodity prices having seen a strong run earlier in the quarter.

- As we round out the third quarter, the rally for 2025 has broadened beyond the heavyweight technology names, with sectors like Industrials, Utilities, and Communication Services stepping up as major contributors. Defensive sectors such as Consumer Staples and Health Care have also meaningfully contributed this year, as investors rotate toward stability amid ongoing macroeconomic uncertainty.

ETF Tidbits:

- SEC Fast-Tracks Crypto ETF Approvals:

The U.S. SEC approved new generic listing standards for crypto and commodity-based exchange-traded products (ETPs), including spot ETFs for assets like Bitcoin, Ethereum, Solana, and XRP. This regulatory change cuts launch times from over 200 days to as few as 75, ushering in a wave of new ETF filings and launches across the digital asset class. - Surging Inflows and Persistent Volatility in Crypto ETFs:

Spot Bitcoin ETFs reversed prior outflows with $241M in net inflows for the week, overall, global crypto ETPs reached record assets under management, as institutional flows drove the market, but day-to-day trading showed signs of increased volatility tied to macro news and policy shifts. - Thematic ETF and Infrastructure Spotlight:

In traditional equities, thematic and infrastructure-related ETFs—especially U.S. power infrastructure, AI, and utility funds—were among the fastest growers. Q3 hot spots included energy grid, nuclear, and AI-linked ETFs, reflecting both macroeconomic policy focus and investor rotation into “future-proof” market themes amidst persistent AI enthusiasm.