COMMENTARY:

- The S&P500 was up 0.62% for the week, closing at a record high on Thursday marking its 42nd all-time high this year. China announced a wide range of stimulus measures and an uptick in consumer spending both helping push investor sentiment upward.

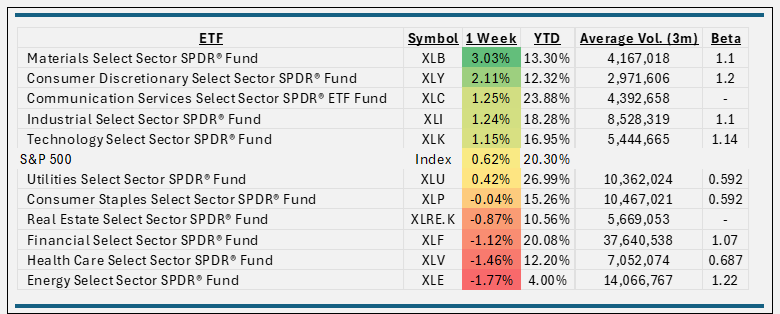

- Materials sector led the way this week, up 3.0%. Freeport-McMoRan (+15.3%) and Albemarle (+ 11.7%) were top performers and helped push the sector onto the top spot this week.

- Consumer Discretionary took the second spot up 2.1%. Casino stocks dealt a royal flush this week. Wynn Resorts (+22.5%) and Las Vegas Sands (+21.8%). With exposure to China, the companies will potentially benefit from the Chinese stimulus efforts.

- Communications Services, Industrials, and Technology were all up approximately 1.2% each.

- Five of the eleven sectors underperformed the overall S&P500 Index this week.

- Energy was the biggest laggard, falling 1.8% for the period. Diamondback Energy (-5.7%) and Marathon Oil (-5.2%) were laggards within the sector.

- Health Care (-1.5%) and Financials (-1.1%) followed Energy into negative territory this week, yet still having solid YTD returns as seen above.

ETF Tidbits:

Some new ETF listings this week:

JP Morgan – Strategic Dividends (JDIV), Texas Capital – Gov’t Money Market (MMKT), VanEck – CLO Fixed Income (CLOB), Thor Financial – Index Rotation (THIR), Simplify – Wolfe US Equity 150/50 (WUSA) & First Trust – Large Cap Target Outcome (RSSE)