COMMENTARY:

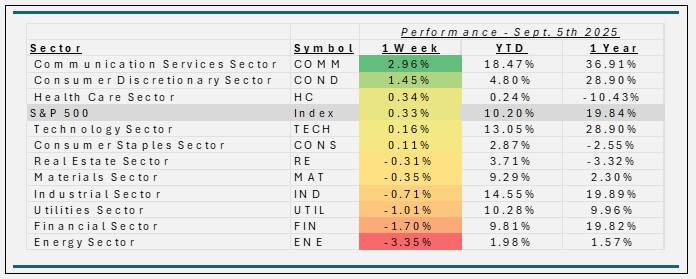

- The S&P500 hit another high on Thursday, as markets overall continued to thrive. The market gained because tech and AI stayed strong and investors expect rate cuts soon, but the weak jobs report shows the economy is cooling, which brought the market off its Thursday peak. The weekly return settles in at gain of 0.33%.

- Communication Services was the best-performing sector of the week, gaining around 3.0%, with nearly all of that move driven by a dramatic 10% jump in Alphabet (Google). A federal judge ruled in favor of Alphabet, allowing its lucrative Apple search deal to continue. Other names such as Netflix (+3.0%), Warner Brothers (+4.0%), and Fox Corp (+3.0%).

- As investors rotated away from rate-sensitive names, Financials fell 1.7% for the week. While rate cuts may support other sectors, financials underperformed because lower rates compress their net interest income—a key profit source. Brokerage firms like Charles Schwab (-4.0%) and Interactive Brokers (-3.3%) led the declines since their businesses are directly tied to interest margins. JPMorgan Chase also gave back around 3.0%, with others like Goldman Sachs and American Express falling more than 1.0%.

- Energy took the biggest hit, falling 3.4% this week, giving up last week’s gains. The performance in the sector was driven by several key market and economic factors: oil price declines due to OPEC+ output increases, sector volatility from global energy transitions, technical downtrends, and concerns over decarbonization policies. The biggest drag came from sone of the names—primarily Exxon Mobil (-4.4%), Chevron (-4.3%), and ConocoPhillips (-6.1%).

- Year to date, all eleven sectors remain in positive territory, as we head into the end of the third quarter, Communication Services are winning up 18.5%, while still positive Health Care is hovering just above positive and sites at a gain of 24 basis points.

ETF Tidbits:

Crypto ETFs: Investors pulled out massive sums from Ethereum funds, signaling caution in digital-asset markets.

ETF Flow Surged in August recorded its biggest monthly inflow of 2025, and iShares crossed the $5 T AUM milestone.

Overall, the ETF market sentiment is optimistic—but prudent. Investors are enthusiastic about AI and tech growth, yet are diversifying into bonds, gold, and quality ETFs to navigate uncertainty.