Equities continued to rally in June as weaker economic data in the form of decreasing job openings increased bets on lower rates sooner with traders now forecasting a 69% of a rate cut in September. Tech stocks led the advance with Semiconductor names up 4.5% on strength from NVDA and Taiwan Semi. The Nasdaq paced the Large Cap. advance with shares climbing 1.96% to a new record print, while the S&P 500 added 1.18% to reach its own record high. The Dow brought up the rear, still posting a gain of 0.25%.

Futures for Thursday have opened just above par as of this writing. Thursday’s economic calendar features Initial and Continuing Jobless claims with SJM the lone S&P 500 constituent reporting.

Eco Data Releases | Thursday June 6th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/06/2024 07:30 | Challenger Job Cuts YoY | May | — | — | -3.30% | — |

| 06/06/2024 08:30 | Revisions: Trade Balance | |||||

| 06/06/2024 08:30 | Nonfarm Productivity | 1Q F | 0.00% | — | 0.30% | — |

| 06/06/2024 08:30 | Unit Labor Costs | 1Q F | 4.90% | — | 4.70% | — |

| 06/06/2024 08:30 | Trade Balance | Apr | -$76.5b | — | -$69.4b | — |

| 06/06/2024 08:30 | Initial Jobless Claims | 1-Jun | 220k | — | 219k | — |

| 06/06/2024 08:30 | Continuing Claims | 25-May | 1790k | — | 1791k | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday June 6th, 2024

Thematic Thursday: Meta-Verse Investing offers a nice intermediate-term setup

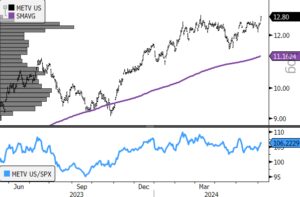

One can’t swing a dead cat these days without hitting someone involved in AI or data science. However, the less heralded technology of just a year ago, The Metaverse, is still around and latently full of potential. The chart on Metaverse themed ETF METV is looking appetizing as it has firmed in the intermediate term but hasn’t run away from the buyer. With a nice mix of US and EM Tech stock exposure, the fund is set up to do well with rates moving lower and the Fed. potentially shifting focus away from fighting inflation.

- METV (200-day m.a.| Relative to S&P 500)

- METV has formed a multi-year base, and now an early-stage bullish reversal after a rough 12-months post inception. Macro picture is supportive of the theme

Sources: Bloomberg