ETF Insights| November 1, 2024 | S&P 500

Price Action & Performance

The S&P 500 closed the month with a stumble after posting its 47th all-time high of 2024 and printing a negative monthly return of -0.91%.

Oscillator work shows the Index approaching oversold levels with an RSI reading of 41 (our signal threshold for a tactical buy is 35), and the MACD on a tactical sell signal. Given the 24% total return produced by the Large Cap. benchmark this year, the equity market could be setting up for some consolidation even though the weaker seasonal period has passed.

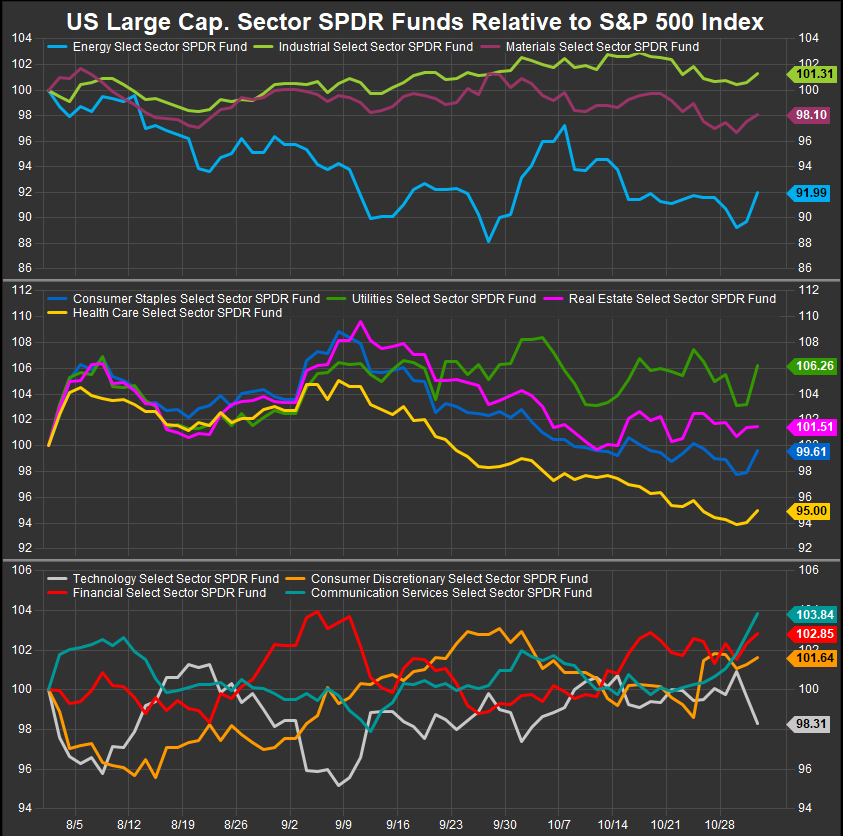

Sector performance had been tilting bullishly until the last week of the month when big Tech. earnings came in below sky-high expectations and sparked selling within the sector and other higher beta exposures. With the books now closed on October, Financials and Comm. Services and Energy were the best performing sectors while Healthcare, Staples and Materials were the biggest laggards.

Economic and Policy Drivers

Interest rate policy projections will continue to be critical to positioning, but the Fed got the easing cycle off to an unambiguous start with a 50bp cut and guidance to cut another 50bps by year end. October introduced us to one big potential fly in that ointment in the form of Yields backing up to 4.3% from lows near 3.6%. We think the tension between the Fed’s desired policy outcome and investor positioning for a faster growing economy are at loggerheads and we will need to see a clearer picture from forward economic data releases to gage where we really are. The problem for the Fed is, investors know they need to position early to perform, so they don’t share the “wait and see” sensibilities of policy makers. It’s hard to tell how long this dynamic will hinder the market. We think it will be with us as long as economic data releases remain ambiguous.

High level concerns for the equity market include a flagging consumer. Rates have been arrested to the upside, but they are still far higher than pre-covid levels. The S&P 500 Homebuilders Industry rocketed higher in July on expectations that rate cuts will help home affordability, but many other industries within the Discretionary Sector have failed to sustain any level of outperformance. We are also seeing a turgid housing market where transactions are down in many geographies due to a combination of high prices and high interest rates that are keeping many home buyers and home sellers on the sidelines. It will be interesting to monitor the interplay between equities and rates moving forward. We wonder how low rates can go if they spark a positive turnaround in consumer fundamentals and lending. Typically, if those two things firm up, rates move higher on their own, and we’ve already started to see that dynamic at work in October.

Politics and Policy will factor into positioning over the next month. Bets on a second Trump Administration would likely involve going long the Energy Sector and Materials Sector as regulatory burdens would likely be eased. The Republican party is typically perceived as being more business friendly, but their likely immigration and foreign policy platforms (Withdrawal from NATO/Restrict Immigration) are potentially very inflationary. The view here is that the three main drivers of inflation going forward will be economic policy towards China (Donald Trump’s sanctions on China pre-covid and the subsequent dis-integration of the previous global supply chain paradigm were a driver of the current inflation, we surmise), over-restriction of immigration, and the other is the vast and growing wealth inequality that exists in this country. We think policy that addresses China relations, immigration and reforms the tax code would be the most important topics to watch as far as how they will affect the stock market. We have been expecting policy positions to be staked out in more detail with the election right around the corner, but so far we remain unimpressed by the lack of specificity from either candidate.

In Conclusion

We use a weight of evidence approach to position for each month. While higher rates are a concern, our process tells us to expect them to be sideways to lower while Commodities prices are weak. Similarly, equities ended October on a sour note, but we don’t see enough evidence to move off our bullish outlook on equities over the longer-term. Our Elev8 Model remains short Commodities exposures and Underweight Low Vol. We have pulled some of our longs in given anticipated volatility around the election, but we remain constructive on the bull market and think prices will be higher into year-end than they are now.

Chart | S&P 500 Technicals

- S&P 500 12-month, daily price (200-day m.a.|14-day RSI|12, 26, 9 MACD)

Sector SPDR Relative Performance to S&P 500 | 3-month