ETF Insights | February 2, 2025 | S&P 500 Real Estate Sector

Large Cap. Real Estate Sector Price Action & Performance

The wheels have come off the bus since September for the Real Estate Sector. The chart of VNQ below shows some stabilization on price and performance in January. Oscillator work shows an absence of enthusiasm for the sector as the RSI study is peaking out far short of overbought conditions on the recent rally. The MACD signal is getting a bit heavy near the zero-line which would indicate potential positive trend change in the near-term.

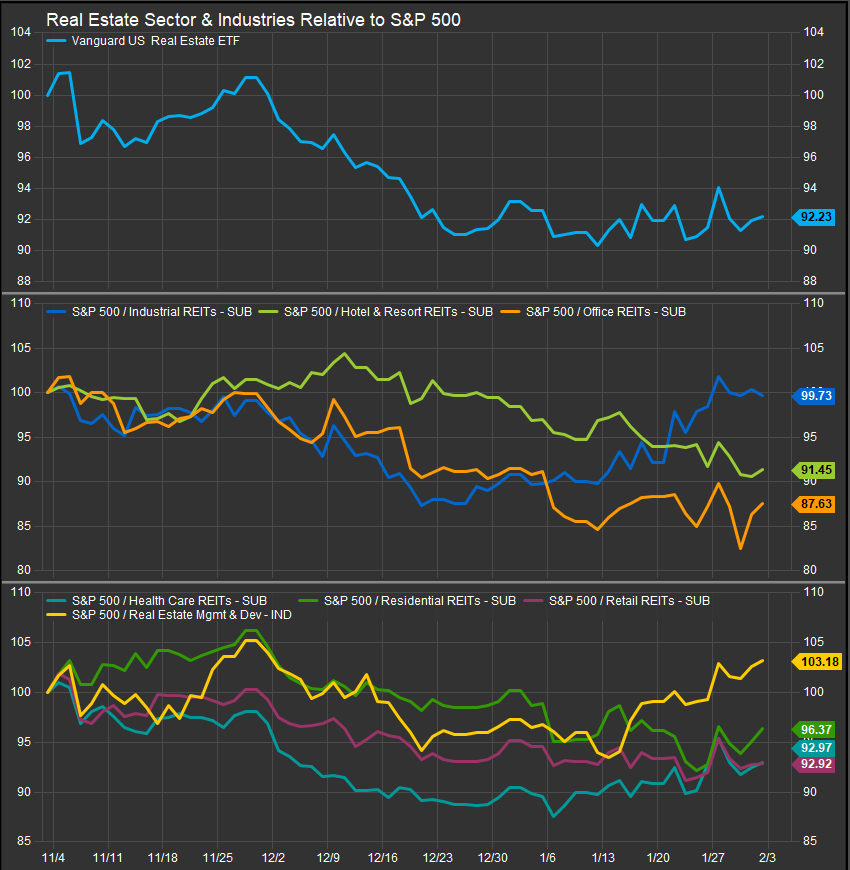

S&P 500 Real Estate Sector: Industry Performance Trends

Management & Development stocks showed signs of bullish reversal in January. That is the lone industry within the sector that historically outperforms when rates are rising. Notably, all the other industries continue to underperform on 3 and 6-month timeframes.

S&P 500 Real Estate Sector Breadth

XLRE internals are showing a weak picture. Not many stocks are getting off the mat after a month-plus of selling. The lone bright spot is the daily Advancers (chart, bottom panel) registered consecutive days with readings >90%, but we need to see more to consider an overweight position.

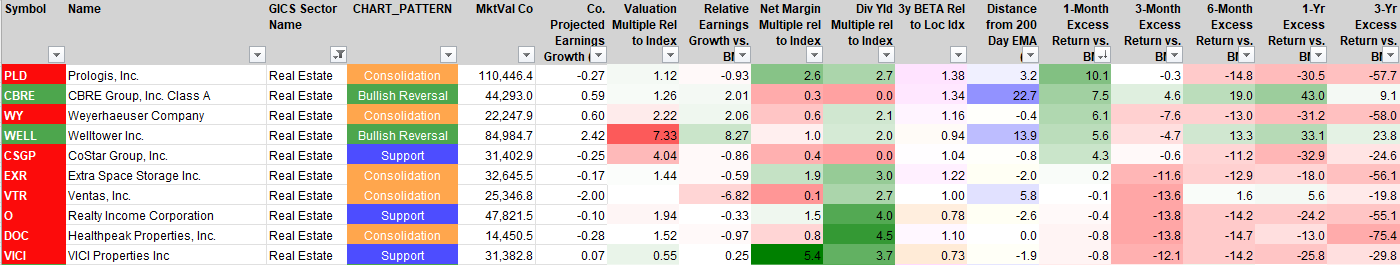

S&P 500 Real Estate Sector Top 10 Stock Performers

Longer-term outperforming stocks in the Real Estate sector are few and far between. Inflationary plays PLD and WY perked up in January. CBRE and WELL were also strong and chart well compared to the rest of the sector.

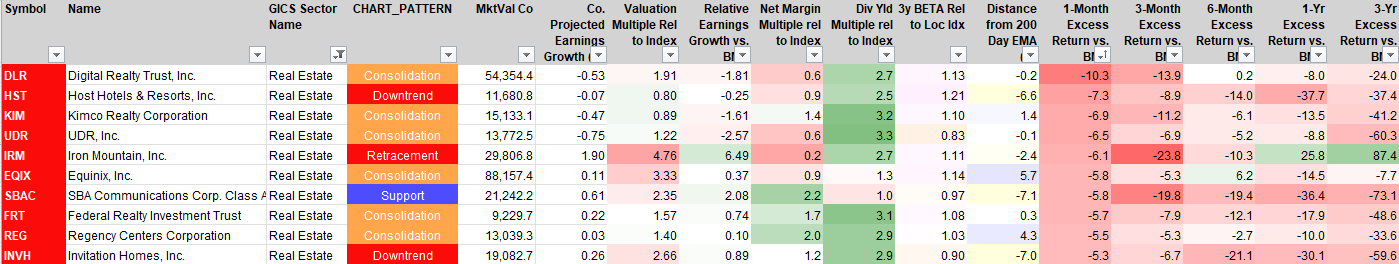

S&P 500 Real Estate Sector Bottom 10 Stock Performers

IRM continues to be under pressure. It was one of the few strong performers in the sector until December. Otherwise these are weak stocks getting worse.

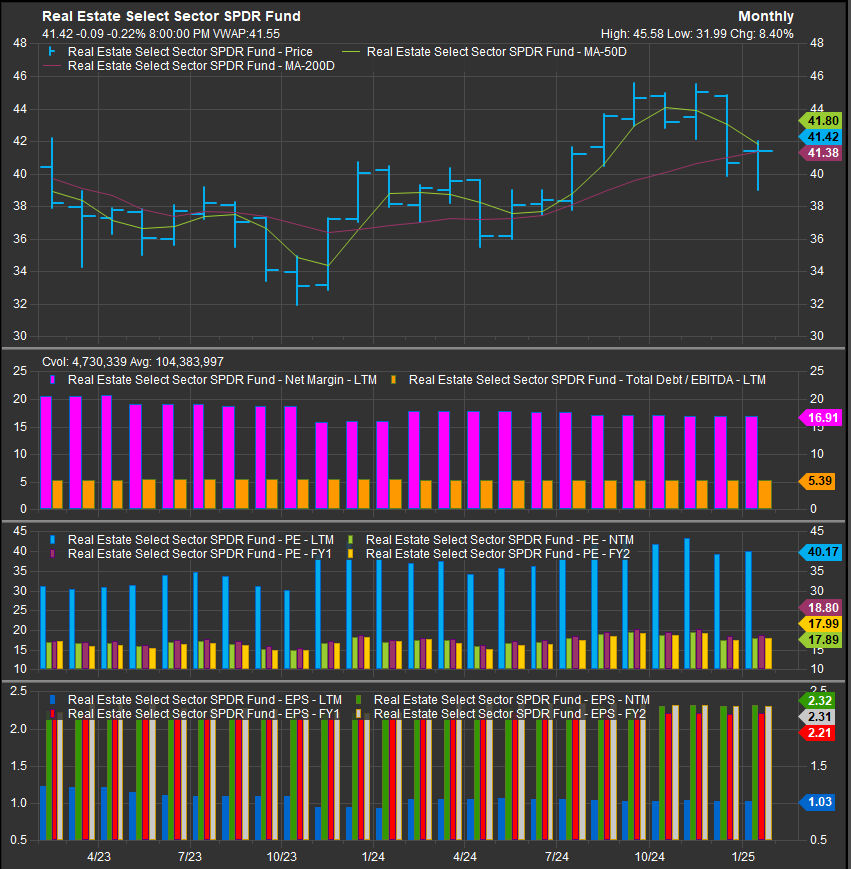

S&P 500 Real Estate Sector Fundamentals

The chart below shows S&P 500 Real Estate Sector Margin, Debt/EBITDA, Valuation and Earnings. The picture here is very similar to the Utilities sector where out year earnings and valuations are favorable while present levels are unattractive. This begs the question of whether consensus is too optimistic with >50% EPS growth projected over the next 12 months.

Economic and Policy Developments

The Real Estate sector saw mixed earnings results in January, with residential and logistics-focused REITs benefiting from resilient demand, while office and retail operators faced continued headwinds. AvalonBay (AVB) and Equity Residential (EQR) reported steady rent growth and low vacancy rates, supported by tight housing supply and wage growth. Prologis (PLD) continued to post strong results, with demand for industrial space tied to e-commerce and supply chain restructuring remaining robust.

In contrast, office landlords such as SL Green (SLG) and Boston Properties (BXP) struggled amid rising vacancies, slower leasing activity, and tenant downsizing. The office sector remains in a secular decline, though recent discussions about converting underutilized office buildings into residential units gained traction. In January, New York City and Washington, D.C., introduced new incentives for office-to-residential conversions, though developers cautioned that high costs, zoning restrictions, and outdated building structures remain major obstacles.

The mezzanine lending market showed further signs of strain, as rising defaults and tighter lending conditions squeezed highly leveraged CRE owners. Borrowers with loans originated in 2021-22 at historically low rates are now struggling to refinance at 7-8% rates. Several banks reduced exposure to mezzanine lending, while private credit firms and alternative lenders stepped in to provide bridge financing, albeit at significantly higher costs.

Regulatory & Policy Updates

The Trump administration’s early executive orders and policy discussions signaled a shift in real estate-related regulations. The White House moved to roll back certain environmental and housing affordability mandates, which could benefit developers but slow progress on ESG-driven projects. Additionally, Trump’s proposed 25% tariffs on Canadian and Mexican steel and lumber could raise construction costs, further pressuring new development projects. The National Association of Home Builders (NAHB) warned that such tariffs would increase the cost of housing construction and exacerbate affordability issues.

One of the biggest concerns for commercial real estate is uncertainty around tax policy. The Trump administration has floated extending 1031 exchanges, which allow investors to defer capital gains taxes on property sales, and reintroducing aggressive depreciation incentives for CRE. However, potential changes to property tax deductions and limitations on federal housing grants could offset these benefits for some segments of the market.

Meanwhile, the Federal Reserve’s policy stance remains key for REIT valuations. FOMC commentary suggested rate cuts could come later than expected, with markets now pricing the first cut in June rather than March. This weighed on interest-rate-sensitive REITs, particularly those in retail and office properties.

February Outlook

Important developments in February will include the Federal Reserve’s next meeting and economic data on inflation and employment and the pace of office-to-residential conversions. While policy incentives are growing, conversion costs and regulatory hurdles remain high, making widescale adoption unlikely in the near term.

Earnings reports from key players like Simon Property Group (SPG), Vornado (VNO), and Public Storage (PSA) will be key. These reports will provide insights into consumer spending, leasing trends, and industrial demand.

New policy announcements from the Trump administration on housing, infrastructure, and tax policy are expected. The potential for expanded tax breaks for developers or higher tariffs on construction materials will have significant implications for valuations.

While the long-term outlook for industrial and residential REITs remains solid, commercial office properties continue to face structural challenges. The sector’s performance in February will depend heavily on Fed rate expectations, policy clarity, and earnings trends in key subsectors

In Conclusion

The Real Estate sector performance stabilized in January but couldn’t make much headway to the upside. We start 2025 short the Real Estate Sector with an underweight position of -0.53% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Note: We have modified our sector fund selection criteria to use the largest US-based sector funds by AUM in our portfolio construction process. For Technology and Real Estate we use Vanguard Funds which include a slightly broader MSCI benchmark to replicate the sectors as compared to Sector SPDR funds which are bench marked to Standard & Poors Indices. However, our analytic process for the sector uses data from provided by S&P and we site the different headers as “S&P 500” and “Large Cap.” to reflect the difference.

Data sourced from Factset Research Systems Inc.