ETF Insights | January 1, 2025 | Real Estate Sector

Large Cap. Real Estate Sector Price Action & Performance

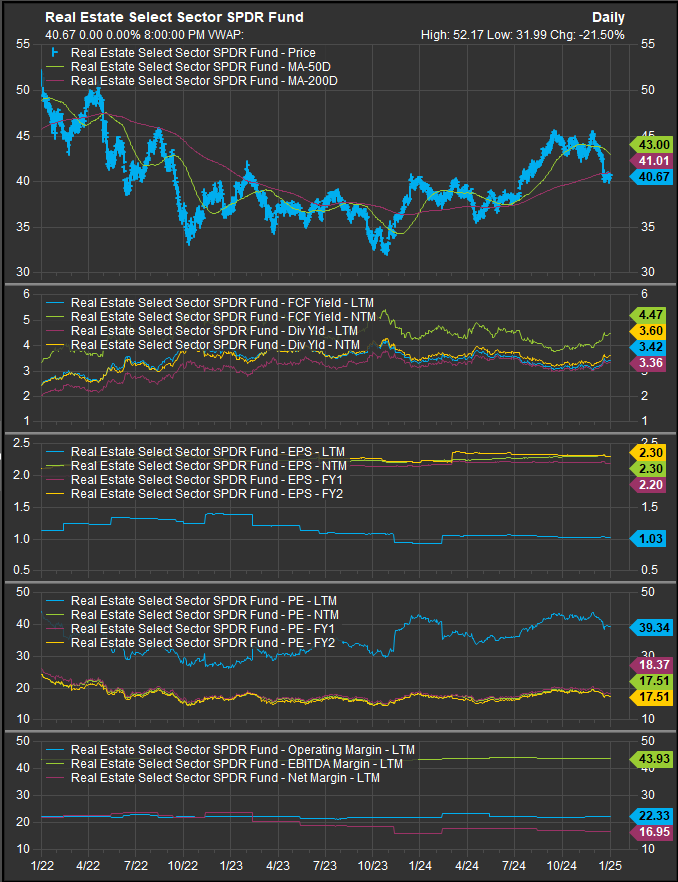

The Real Estate Sector finished 2024 with a price gain of 0.81% despite an ongoing bull market that saw the S&P 500 gain >20% for the 2nd consecutive year. The relative curve finished the year near worst levels and an attempted upside reversal in in the middle of the year ended up falling flat as the Fed’s dovish policy sparked interest rates higher in Q4. The chart below shows price has round tripped from July/August gains and sits at longer-term support, consolidating price below its 200-day moving average. This is a negative development, and the buyer needs to step in soon if this is to be seen as an accumulation point. We are skeptical of this occurring.

S&P 500 Real Estate Sector: Industry Performance Trends

With the sector selling off in the 2nd half of 2024, none of its industries was able to outperform over the 12-month period. Healthcare REITs were the best performers, but weakness in Q4 was pervasive.

S&P 500 Real Estate Sector Breadth

Shorter-term breadth measures (% of stocks above the 50-day m.a.) have reached wash out levels below 10%, while just over 50% of stocks remain above their 200-day m.a. There is potential for a bounce here, but we are skeptical Real Estate would bounce higher than the broad market. Given challenges in the Office and Commercial Real Estate market and a lack of affordability in residential real estate generally, the drivers of future growth are cloudy and market behavior reflects that. The depth of the wash out has us the sector in a potential “so bad, it’s good” scenario which has kept it out of the bottom of our monthly rankings.

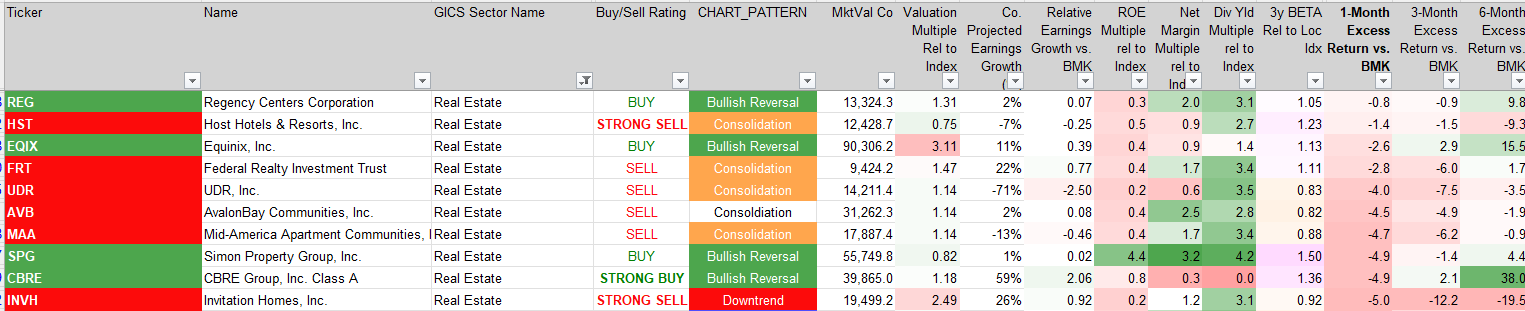

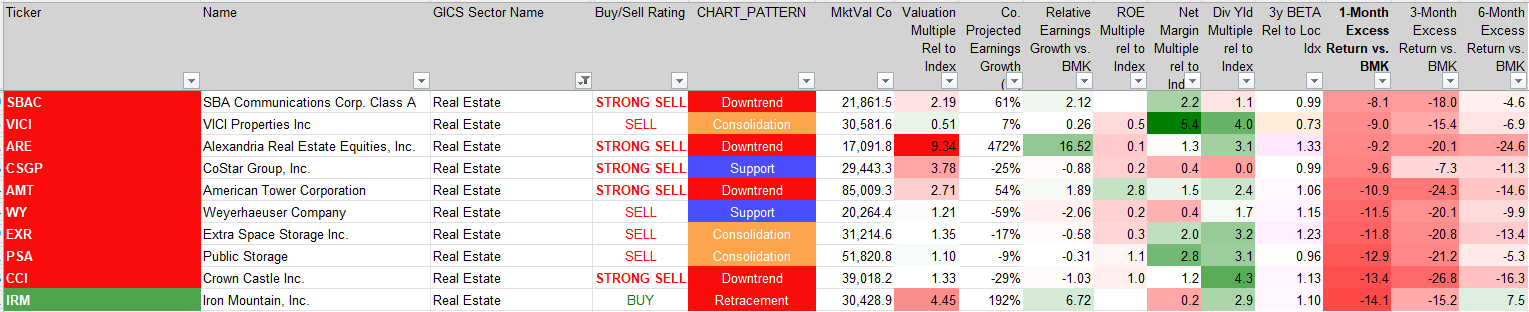

S&P 500 Real Estate Sector Top 10 Stock Performers

Similar to Utilities, not a single stock posted a gain vs. the benchmark in December.

S&P 500 Real Estate Sector Bottom 10 Stock Performers

IRM which has been a positive standout throughout the bull cycle finally saw some profit taking to the tune of a 14.1% decline in December. We would be tempted to accumulate there if we see the buyer step in early on in January.

S&P 500 Real Estate Sector Fundamentals

The chart below shows S&P 500 Real Estate Sector FCF yield, and Dividend Yield as well as projected earnings over the next 3 years, valuation and trailing margins. Consensus forecasts continue to project significant EPS growth over the next 3 years, but given the pace of earnings in 2024, that seems complacent at this point. Present valuations given the collapse in present year earnings remain elevated relative to the broad market. A lot relies on the fundamentals going right. We are skeptical due to high rates and a sluggish “back to the office” dynamic. We remain convinced that much existing Office and Commercial Real Estate needs to be repurposed to residential, which would take a significant amount of investment. This is only going to be a boon if financing costs come in.

Economic and Policy Developments

Interest Rates and Financing: The Federal Reserve’s easing cycle began in late 2024 but was accompanied by cautious guidance, with market participants anticipating a gradual reduction in rates throughout 2025. Mortgage rates remained elevated near multi-year highs, significantly impacting housing affordability. According to recent data, pending home sales rose 2.2% month-over-month in November, but the pace of recovery remains constrained by high borrowing costs.

Homeownership Incentives and Rental Subsidies: Policymakers have expressed interest in expanding homeownership programs and rental assistance to address housing affordability. Tax credits for first-time homebuyers and expanded Section 8 subsidies for low-income renters were highlighted in federal budget discussions, though specific proposals are pending legislative approval.

Rental Market Trends: With housing affordability under pressure, the rental market continued to tighten, particularly in urban areas where vacancy rates declined. Reports indicated a steady increase in rental prices, partially offset by higher construction of multifamily units aimed at easing supply constraints.

Commercial Real Estate: Office and retail real estate remained under pressure due to changing work habits and cautious consumer spending. Meanwhile, industrial properties benefited from strong demand driven by logistics and warehousing needs, partially mitigating the sector’s broader challenges.

2025 Outlook

The US Real Estate sector recovery would likely resume if moderating interest rates ease financing conditions and support housing activity. Homebuilders may benefit from improved affordability if rates decline, though the timing and magnitude of rate cuts will be critical. The rental market is likely to remain robust, underpinned by strong demand and constrained supply, while government incentives aimed at improving affordability could provide a tailwind for multifamily REITs and developers.

Commercial real estate, particularly office and retail properties, is expected to face continued challenges as businesses and consumers adapt to post-pandemic trends. Industrial properties remain a bright spot, with strong fundamentals driven by e-commerce growth and supply chain optimization. ESG considerations and sustainability initiatives will also play a larger role in real estate investment strategies, with energy-efficient buildings and green certifications increasingly prioritized.

Overall, the sector’s performance in 2025 will hinge on macroeconomic developments, including the Fed’s policy trajectory, inflation trends, and legislative outcomes tied to housing and urban development. Investors are likely to favor high-quality REITs with diversified portfolios and resilient cash flows as they navigate a complex and evolving landscape. Interest rate trajectory will be critical for the sector.

In Conclusion

The Real Estate sector couldn’t sustain positive momentum into year end. With the sector continuing to be impaired post-pandemic, we don’t even have conviction that it would act as a safe haven as a legacy high div/low vol. sector. The best that can be said is a lot of bad news is already priced in and there is potential for an oversold bounce. We start 2025 short the Real Estate Sector with an underweight position of -1.46% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Note: We have modified our sector fund selection criteria to use the largest US-based sector funds by AUM in our portfolio construction process. For Technology and Real Estate we use Vanguard Funds which include a slightly broader MSCI benchmark to replicate the sectors as compared to Sector SPDR funds which are bench marked to Standard & Poors Indices. However, our analytic process for the sector uses data from provided by S&P and we site the different headers as “S&P 500” and “Large Cap.” to reflect the difference.

Data sourced from Factset Research Systems Inc.