ETF Insights | February 2, 2025 | S&P 500 Utilities Sector

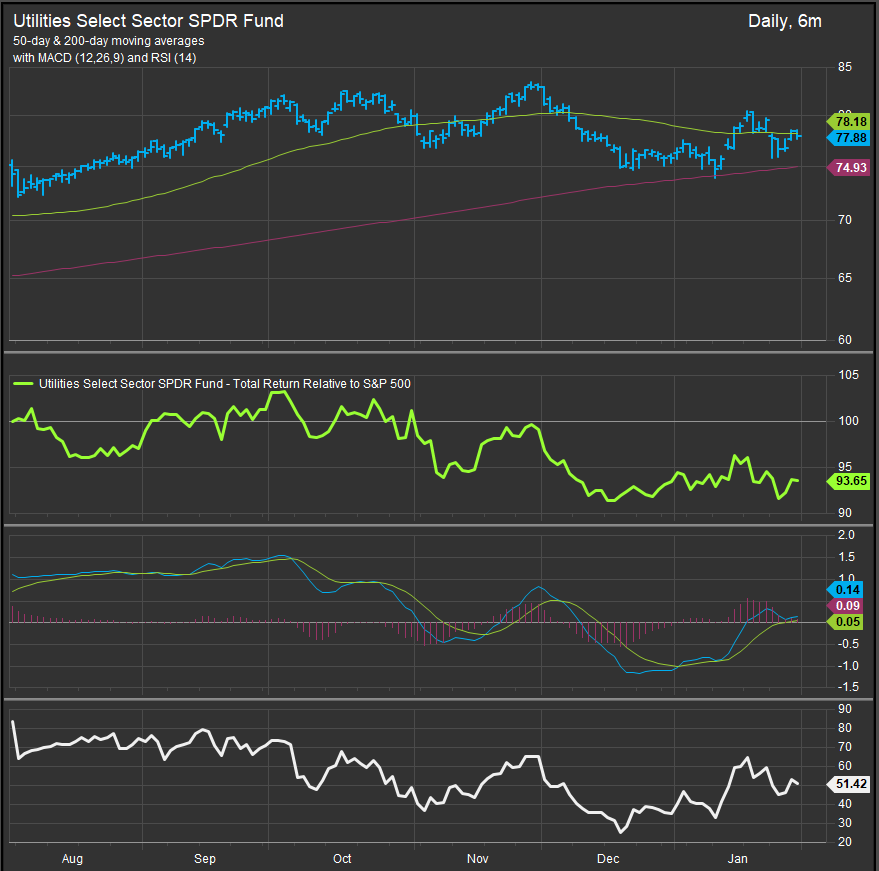

S&P 500 Utilities Sector Price Action & Performance

The Utilities Sector had a volatile January, starting out strong and then fading in the back half of the month as concern about inefficiencies in the domestic AI complex surfaced. The XLU chart shows the sector consolidating just above its 200-day moving average while the performance curve touched 6-month lows at the end of the month. Oscillators rolled over at lower highs and the bullish reversal that was developing into October has now fallen flat.

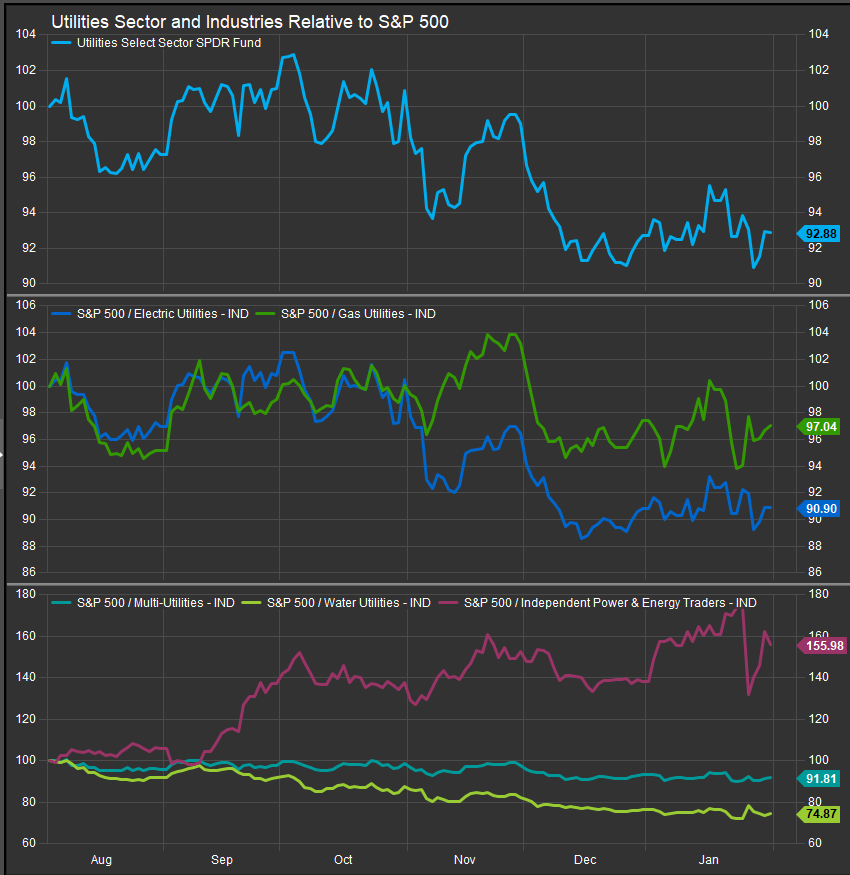

S&P 500 Utilities Sector: Industry Performance Trends

The sector has been carried the last 6-months by the Independent Power & Renewables Industry, particularly VST. Gas Utes have perked up in the near-term, but every industry besides Indy/Renewable has been a laggard.

S&P 500 Utilities Sector Breadth

December saw a decline in broad demand for the sector as positioning for a hard landing dissipated after the Fed came in to support equities with its interest rate policy measures and Donald Trump won the US Presidential Election. >90% of sector constituents had been trading above their 200-day moving averages and that fell to >70% in December and has stayed there. Our constituent stock chart reviews show only 3 standout performers in the sector at present.

S&P 500 Utilities Sector Top 10 Stock Performers

Only 3 stocks in the sector exhibit positive long-term excess returns vs. the S&P 500, CEG, VST and NRG. Those stocks rebounded sharply after being sold hard in December. The rest of the sector perks up when equities move lower and generally lags when equities are moving higher.

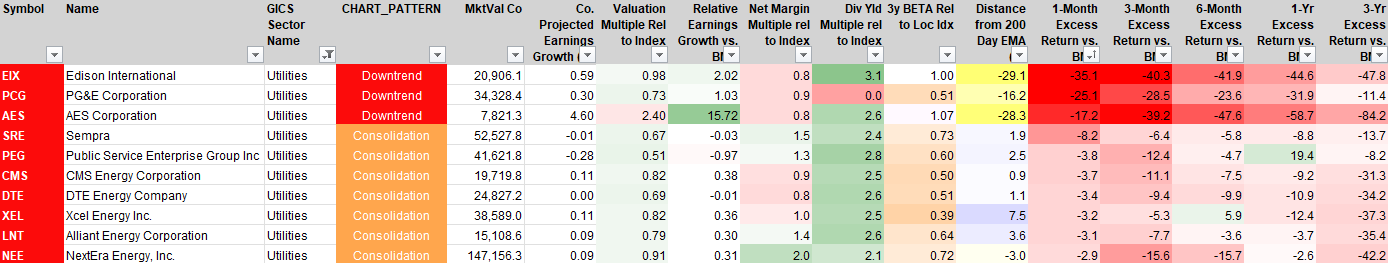

S&P 500 Utilities Sector Bottom 10 Stock Performers

PCG is back in the crosshairs as potential installation of price controls is back in the news. As we can see looking out to 3yrs of past performance, there aren’t many positively trending stocks in the sector, though dividend yields remain 2x-3x above the S&P 500 index yield.

S&P 500 Utilities Sector Fundamentals

The chart below shows S&P 500 Utilities Sector Margins, Debt/EBITDA, Valuation and Earnings. Valuations got heady for the sector in September as Utilities stocks were bid up to a 22x multiple. Margins are expanding, but historically the sector does well when it is starting from a down and out position and is at a valuation discount to the market as it was in early 2024. That’s not where we are right now.

Economic and Policy Developments

The Fed’s stance on holding rates steady until at least mid-year reinforced demand for defensive assets, helping utility stocks maintain stability. Meanwhile, winter storms in key regions like Texas and the Midwest drove temporary spikes in electricity and natural gas demand.

Earnings were mixed, with utilities navigating rising costs and shifting energy policies. Duke Energy (DUK) and NextEra Energy (NEE) reported in-line earnings, citing steady demand and regulatory tailwinds from renewable energy initiatives. Exelon (EXC) and Southern Company (SO) highlighted strong grid modernization efforts, but warned of regulatory cost pressures affecting margins.

A major theme was the impact of AI-driven energy consumption. Data centers, particularly those supporting AI workloads, have significantly increased electricity demand. Some reports suggested that AI training models require 10-40x more power than traditional computing, prompting questions about whether utilities can meet this surge in demand. Morningstar analysts noted that while AI will drive long-term electricity needs, the near-term impact may be overstated, as utilities gradually scale up infrastructure. This is where revelations around “DeepSeek” and its, supposedly cost-efficient capabilities have shaken the fundamental projections for the sector.

Regulatory & Policy Updates

The Trump administration’s energy policy added uncertainty to the sector. Executive orders signed in January included easing environmental regulations on fossil fuel production, revisiting federal clean energy incentives, and withdrawing from the Paris Climate Agreement. While utilities with large natural gas and coal assets saw some near-term relief from deregulation, clean energy developers faced uncertainty over potential cuts to renewable subsidies.

Regulatory scrutiny on pricing also emerged as a concern. California utilities, including PG&E (PCG) and Edison International (EIX), faced mounting pressure over rate hikes as consumer advocacy groups pushed back against higher transmission and wildfire mitigation costs. The Biden administration’s focus on curbing energy price inflation could further limit the ability of utilities to pass on costs, squeezing margins.

February Outlook

Looking ahead, utilities will be closely watching the next batch of economic data, including inflation readings, which could impact rate expectations and valuations. AI-driven electricity demand will remain a key topic, as investors assess whether utilities can profit from the long-term growth in data center power consumption.

On the policy front, potential tariffs on energy infrastructure imports, updates to the Clean Power Plan, and state-level rate adjustments will shape the sector’s outlook. Earnings reports from Dominion Energy (D), Consolidated Edison (ED), and Xcel Energy (XEL) in February will provide further clarity on regulatory risks and demand trends.

While the sector remains attractive for income investors, regulatory uncertainties and rising infrastructure costs could create headwinds.

In Conclusion

The Utilities sector couldn’t sustain positive momentum throughout the month of January as new concerns around the AI complex dampened enthusiasm. We start February with the Utilities Sector as one of our three zero-weight positions resulting in an underweight of -2.64% vs. the S&P 500 in our Elev8 Sector Rotation Model Portfolio.

Data sourced from Factset Research Systems Inc.