September 17, 2025

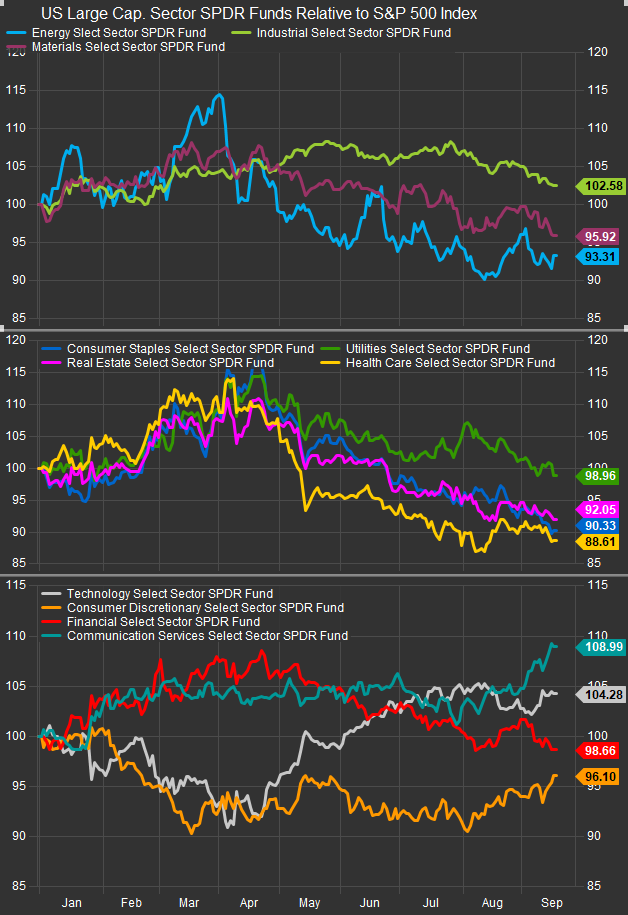

Global equities continue to print all-time highs with EM shares leading in the near-term, US shares leadership for the longer-term cycle and EAFE shares typically functioning as the lagging safe haven trade when the tape comes under pressure. At the sector level, the dynamic has been even more exclusive with Tech and Comm. Services the only sectors that have gained vs. the S&P 500 this year (chart below).

As consensus firmed around a dovish policy intervention in the second half of the year, we’ve seen some firming in Discretionary shares and some bottom-fishing in Energy and Healthcare sectors, but overall, slowing economic growth hasn’t spurred any material rotation from leaders to laggards at the sector level. Given falling rates, softening economic data and continued developments impacting global trade we would expect more investor interest in defensive positioning. However, the macro environment is a challenging one for these business lines. We think the following drivers are keeping investors away from low vol. in the near-term. Investors should think about these dynamics when considering positioning.

- Policy backdrop and Fed expectations

- Weak data is being interpreted not just as risk, but as increasing odds of Fed easing. Rate-sensitive, growth-oriented equities (tech, cyclicals) benefit more directly from lower discount rates than defensive, bond-proxy stocks.

- Low-vol names tend to trade more like long-duration bonds; if long yields are still sticky (because of supply concerns, fiscal policy, term premium), then defensives don’t get as much of a tailwind as high-growth equities.

- Sector composition of “low vol”

- The S&P Low Volatility index (SPLV) is heavily tilted toward utilities, staples, and REITs — all bond-like, regulated, or slower-growth.

- Those sectors face headwinds from tariffs, input costs, and regulatory uncertainty, which offset the classic “safety bid.” For example:

- Utilities: weighed down by capital-intensive transition spending, grid investment, and higher financing costs.

- Staples: margin pressure from private label substitution and tariff-related input costs.

- REITs: still digesting higher funding costs and commercial property stress.

- Flows and positioning

- Institutional flows remain concentrated in AI, tech, and growth proxies. Even when macro data weakens, investors may see “Fed cuts = tech rally” and rotate away from low-vol.

- There’s been persistent crowding in momentum/growth, leaving low-vol underowned. Weak data isn’t enough to shift that until you see real credit stress or earnings downgrades in cyclicals.

- Earnings dynamics

- Low-vol sectors haven’t been delivering earnings surprises — they’re defensive but not growthy. Meanwhile, tech, semis, and select cyclicals are producing strong beats and guidance tied to AI capex, reshoring, or consumer strength. That gap widens performance.

- Cross-asset competition

- With front-end yields still elevated, investors can park in T-bills or money market funds at 4–5%. That makes bond-like equities less compelling compared to actual bonds. Low-vol sectors get hit by this substitution effect.

Conclusion:

Weak data isn’t enough on its own to trigger a rotation into low-vol. You need a risk-off shock (credit stress, geopolitics, sharp equity drawdown) or a collapse in yields before defensives outperform. For now, Fed easing expectations + tech/AI earnings strength mean weaker data is paradoxically bullish for cyclicals/growth, not for defensives

Data sourced from Factset Research Systems Inc.