August 19, 2025

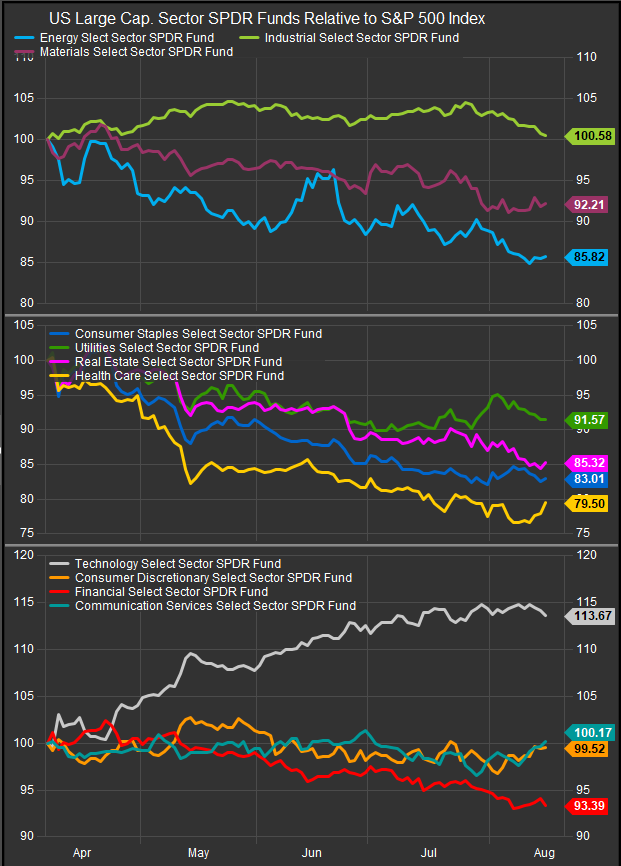

Low vol. stocks have lagged since equities have put in their low in early April of 2025. While we can see from our sector performance chart (below) that this has affected the performance of traditional low vol. sectors in a negative way, it has also had a deleterious impact on the Financial Sector.

Insurance stocks (and we’ll include Berkshire even though it’s technically a Diversified Financial) have been a drag on the sector. Bigger banks have held their own as JPM continues to be the best banking stock in the large cap. universe from our view while regional banks have been their usual lackluster selves. These dynamics have combined to make the sector a laggard off the equity lows despite it historically outperforming in longer-term bull trends. However, there are some pockets of strength that we think are worth highlighting, and seen in a global context, may represent a strong thematic opportunity.

US Asset Managers are Showing Strength Despite Sector Weakness

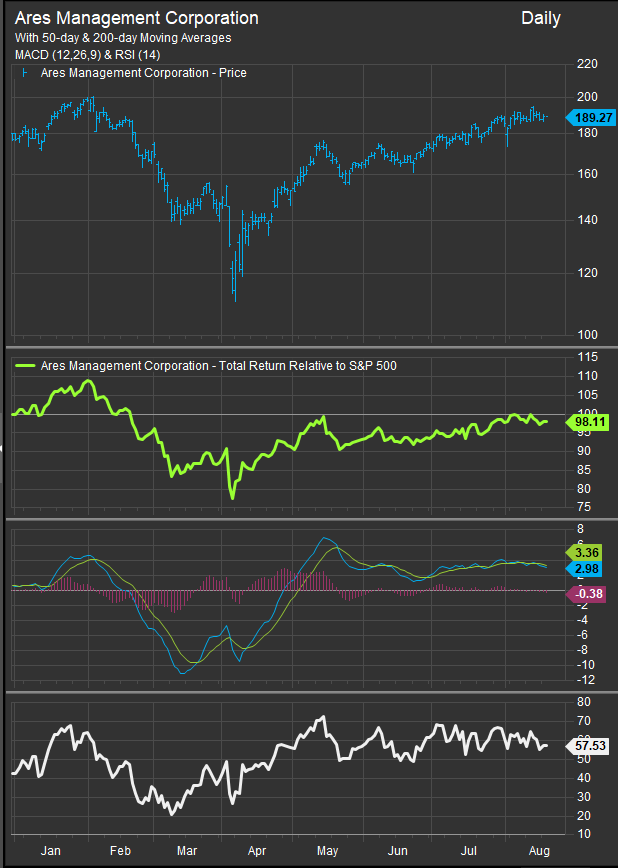

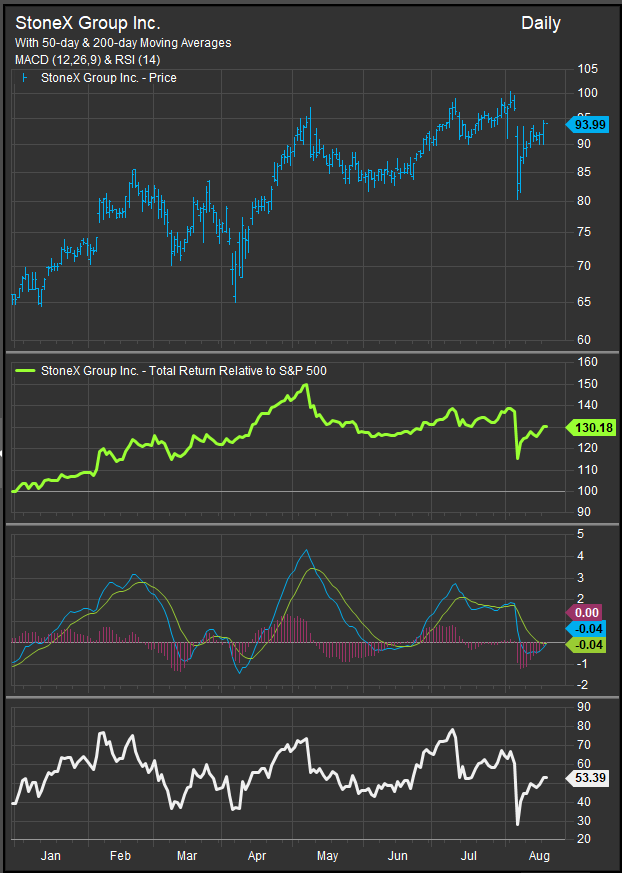

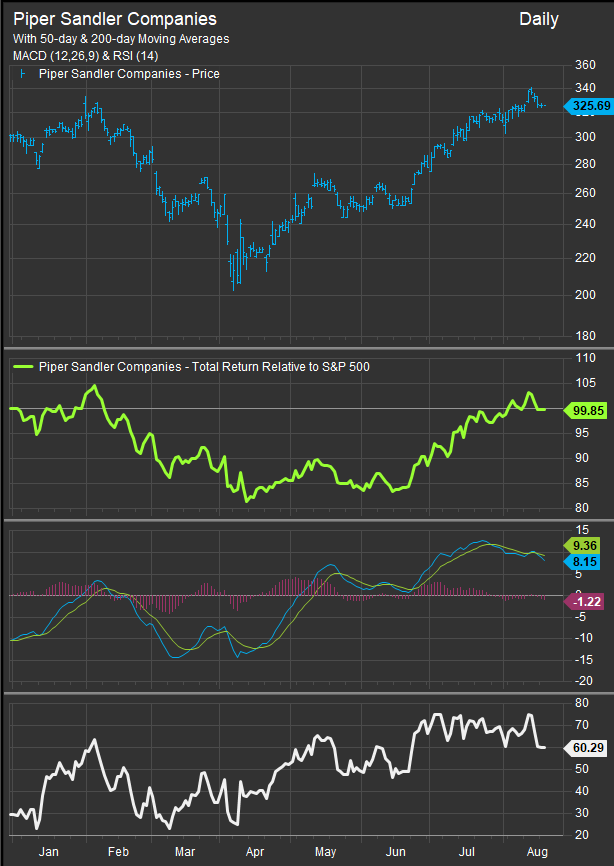

Asset Managers and Investment banks have made steady progress vs. the S&P 500 since equities inflected positively in April. Infrastructure build-outs, increased M&A activity in the midst of global trade re-alignment and increased demand for capital projects are likely to be tailwinds beyond the near-term. Asset managers as a conduit between the structural demand for US infrastructure upgrades and the stores of private wealth that have accumulated over decades of stock market expansion are also a longer-term tailwind. Some of our favorite names in the space are below.

GS

ARES

SNEX

PIPR

Globally, Financials Have Been Consistent Outperformers

Ex-US preference for financials is more robust. We have talked about the setup in the past. Big European banks are reflating after years in the wilderness following the Global Financial Crisis. The Ukraine war has been a backstop for demand and we can see through the performance of Financials and Heavy Industry stocks that the “Banks and Tanks” theme is underpinning ex-US equity strength, particularly in Developed Market Geographies. While these trends are not new, we should keep in mind that Euro financials have been unloved for more than a decade. Typically when an out of favor group like that finally demonstrates momentum, the reflation ramp can be very long.

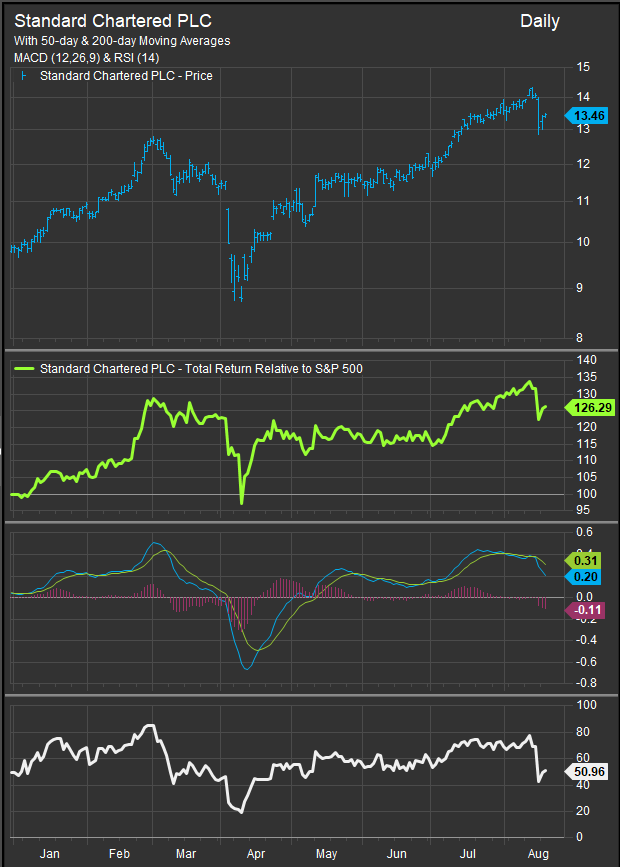

STAN

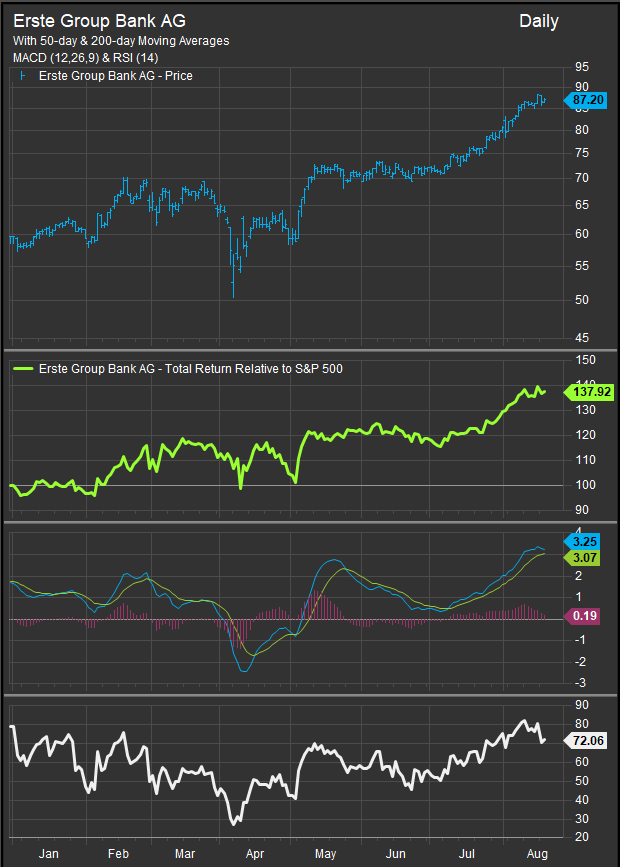

Erste Group (Austria)

Santander

Sumitomo Mitsui Financial | 8316-TKS

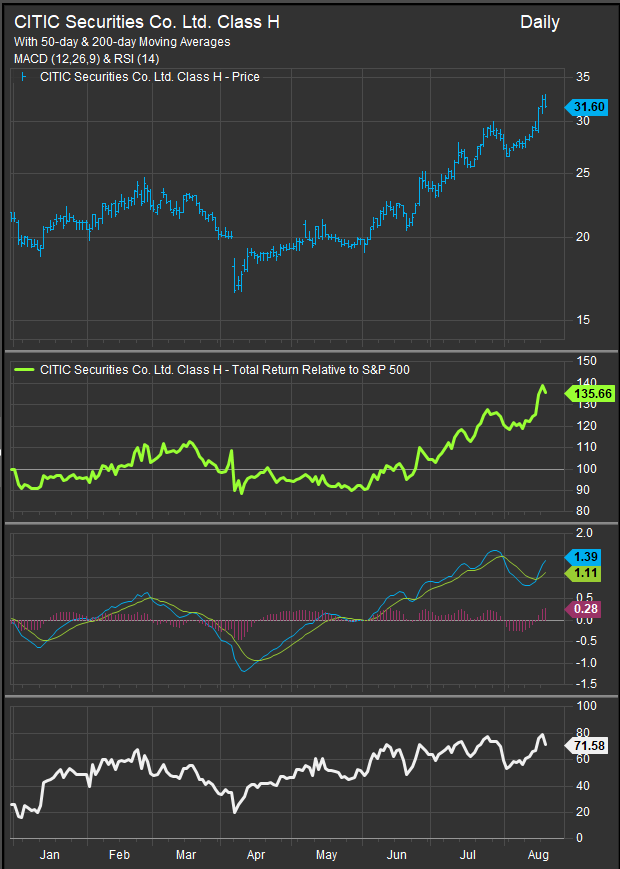

CITIC Securities | 6030-HKG

Conclusion

Our investment process looks for strong trends with broad participation, known catalysts and we favor setups that show bear-to-bull trend transition over the long-term as those trends can often sustain forward momentum beyond their previous highs. We think globally, Financials are in a strong position. We are seeing that strength in pockets of the US Financials sector, but overall it speaks to strength and we certainly favor US asset managers and investment banks as a thematic trade.

Data sourced from Factset Research Systems Inc.