March 25, 2025

The S&P 500 has now rallied back above its 200-day moving average (chart below). We continue to believe this rally represents the second (counter-trend) leg of an A-B-C correction where we would look for signs of selling exhaustion on the 2nd leg lower. We are expecting the current rally to fail in the vicinity of the 50-day moving average which currently resides at 5912, near the bottom of the December-February congestion zone for the Index.

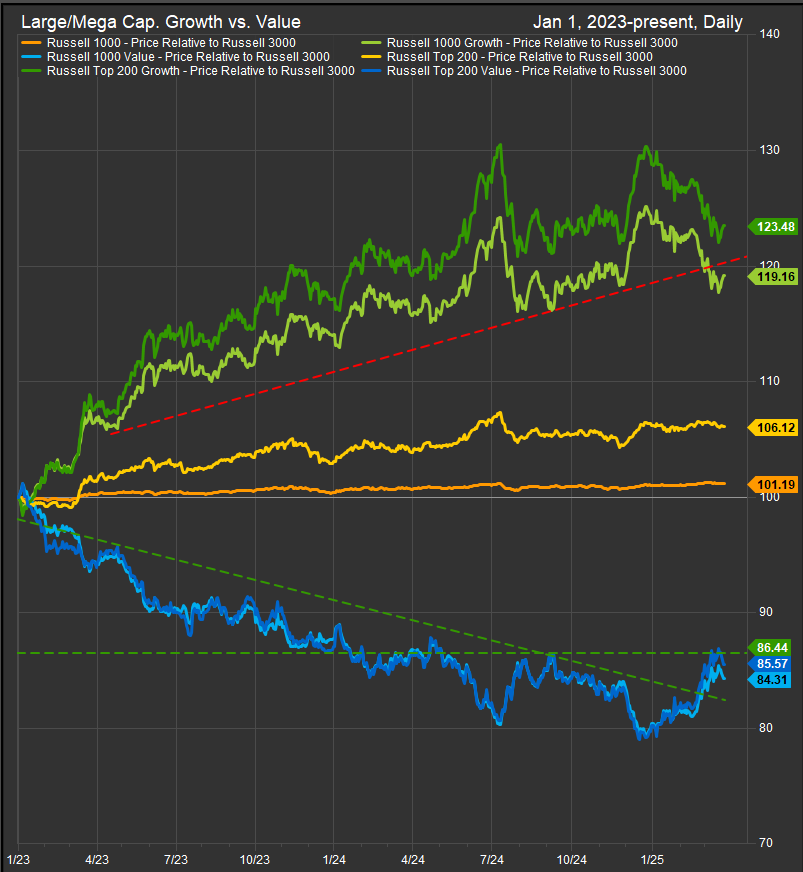

Our near-term negative view is informed by sharp rotation into Value and other factors associated with de-risking like dividends, size and low volatility. The factor chart below shows the long-term performance trends for Growth vs. Value since the beginning of the bull cycle in early 2023. The gradual loss of upside momentum for Growth (chart below) has us expecting a more significant clearing event is needed for investors to perceive a durable low for the Growth trade. We’re expecting Growth factor exposures to leg lower vs. the broad market with any continued correction. Positive divergence for Growth factor performance (it outperforms while equities move lower) would be a sign that investors are accumulating, and the bull market will resume sooner.

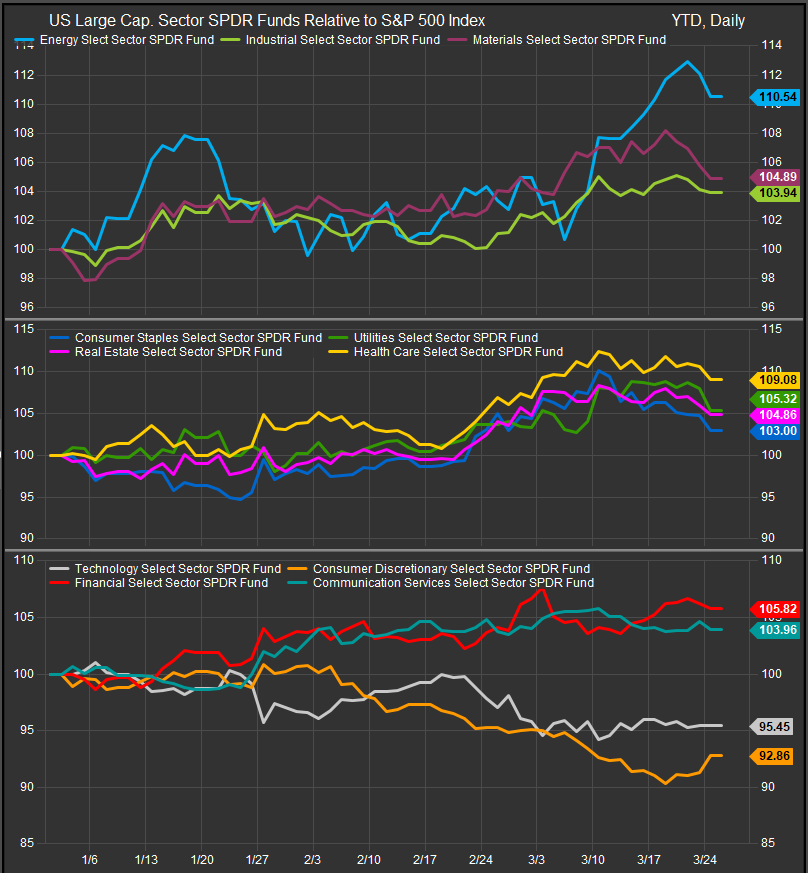

Sector performance is also likely to give us clues on a continuing correction vs. a sustainable low. Long story short, we’d expect defensive sectors to be bought by the end of this week if the bear is still in control of the tape. The chart below shows a pause in accumulating defensive exposures over the past 2-weeks. After some buying across commodities exposures and some sale shopping in consumer names, we’d expect a defensive tone to re-emerge in the near-term.

Conclusion

Equities are rallying as we wait for the next shoe to drop regarding reciprocal tariffs. We would expect investors to move back towards Value and Low Vol. positioning by the end of this week absent any new bull catalysts for equities. We haven’t seen any positive divergences firm in our stock level or index level momentum gages yet and we expect that is a pre-requisite for a durable low.