June 10, 2025

The S&P 500 continues to build value above our neckline level of 5786 (chart below). As US equities continue to reflate, we’re looking for accumulation opportunities among near-term laggards. In our last Tactical Tuesday Report, we covered weakness in the housing market. We think those stocks remain unpalatable for investors due to the relatively high level of interest rates. High rates create affordability issues at a time when the Consumer is already facing cost pressures.

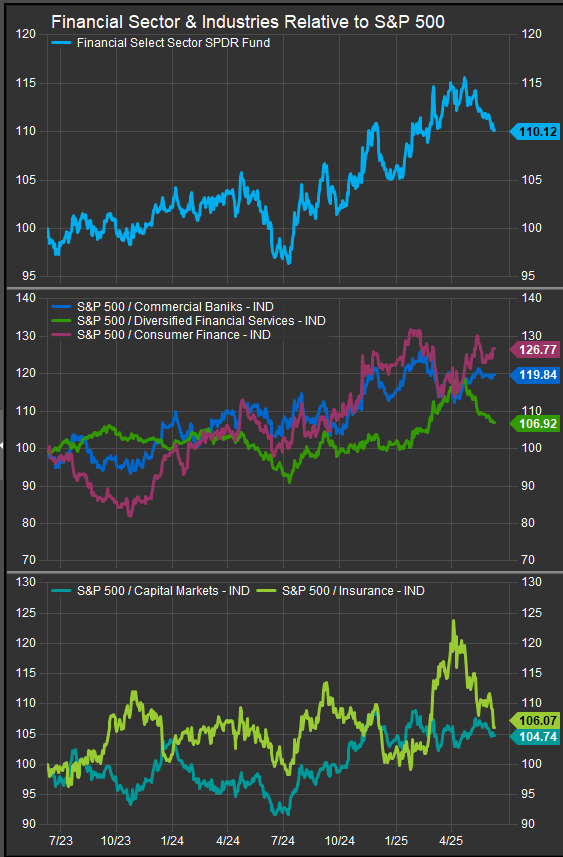

This week, we take a look at potential opportunities in the Financial Sector. Financial stocks had shown strong performance through Q1 of 2025 (chart below) but have retraced relative gains since equities pivoted to the upside.

At the industry level, rotation out of Insurance stocks and Diversified Financial Services co.’s (Berkshire Hathaway etc.) has been a headwind to performance as rotation into Consumer Finance, Banking and Capital Markets stocks hasn’t been strong enough to offset outflows. Are we seeing a deterioration at the sector level, or a potential opportunity. We have a hunch it’s the latter.

Rebound in BDCs

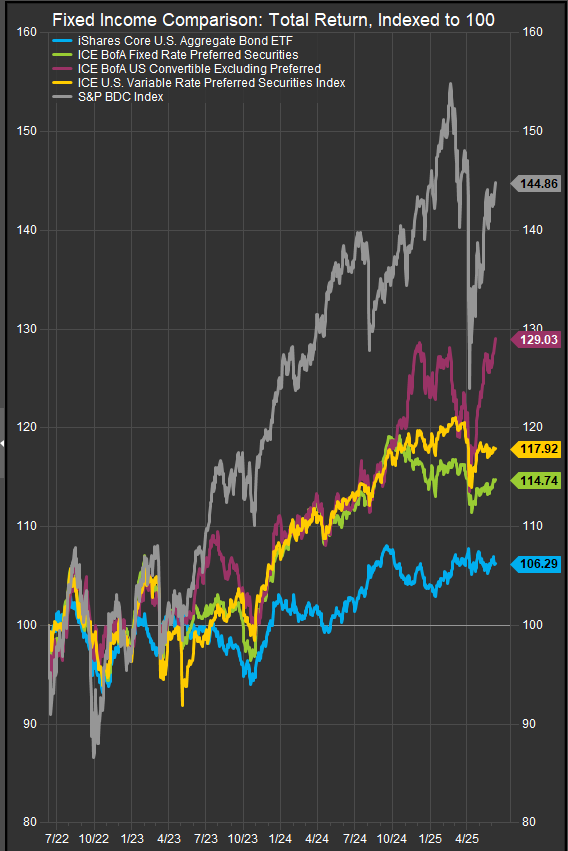

One of the drivers of asset management outperformance has been the growth of BDCs or Business Development Corporations. These vehicles typically provide capital to small and medium-sized companies either to fund development or to repair distressed balance sheets. They offer pass-through tax treatment like REITs or MLPs and they distribute at least 90% of their income as dividends in order to qualify for the tax benefit. BDCs are publicly traded, offering exposure to private markets and the potential for high yields. BDCs are high risk investments, but they have performed well when equities have risen and rates have remained elevated above 4%. If economic prospects remain firm despite some cost pressures from tariffs, that seems like a strong setup for the BDC trade to continue higher (chart below).

Some Top Bull Market Performers at Longer-Term Support

While traditional investment banks, MS and GS have showed clear bullish reversal with equities off the early April Lows, several private credit focused shops have retraced to support. These are the types of opportunities we’re considering. Two that feature potential accumulation setups in the near-term are APO and KKR (charts below). Both have retraced gains and are back at longer-term uptrend channel support. These stocks are also bellwethers for the bull trend. If they aren’t picked up, it is yet another example of previous leadership themes now facing headwinds. As we remain constructive on equities, that’s not our base case and we think these are likely accumulation opportunities.

APO

KKR

Conclusion

As equities continue in their bullish pivot, we want to see a broad cohort of leadership themes emerge or re-emerge to drive the bull trend higher. To this point we’ve focused on Mag7 and Semiconductor stocks which have underpinned the Growth trade rebound. We need to see life from other areas of the equity market and we think asset managers should participate to the upside given firming risk appetite and positive momentum on global trade.

Data sourced from Factset Research Systems Inc.