June 17, 2025

US Equities have formed a clear bullish reversal off the April lows and the S&P 500 sits within a few percentage points of all-time highs. However, we are noting a more discerning investor. When the bull trend for equities got underway in 2023, upside leadership was characterized by industry level leadership cohorts. Semiconductors, Homebuilding, Software, Building Products, Construction & Engineering, Electrical, Interactive Media and Capital Markets stocks were clear leaders and most stocks in each industry were outperforming. That dynamic lasted through the first half of 2024, but stick rates paused the Fed’s dovish stimulus efforts and we’ve seen some of the leading industries drop out or fracture even as equities approach all-time highs again.

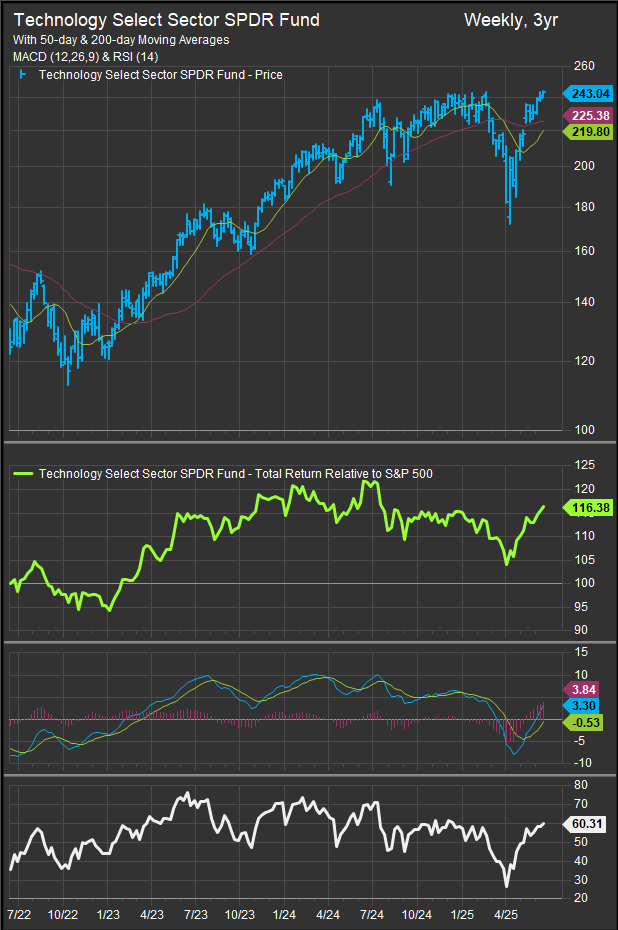

The large cap. Information Technology Sector is notable for this winnowing dynamic. Despite continuing to lead through the cycle (chart below), we’ve seen stock level performance diverge sharply at the stock and industry level.

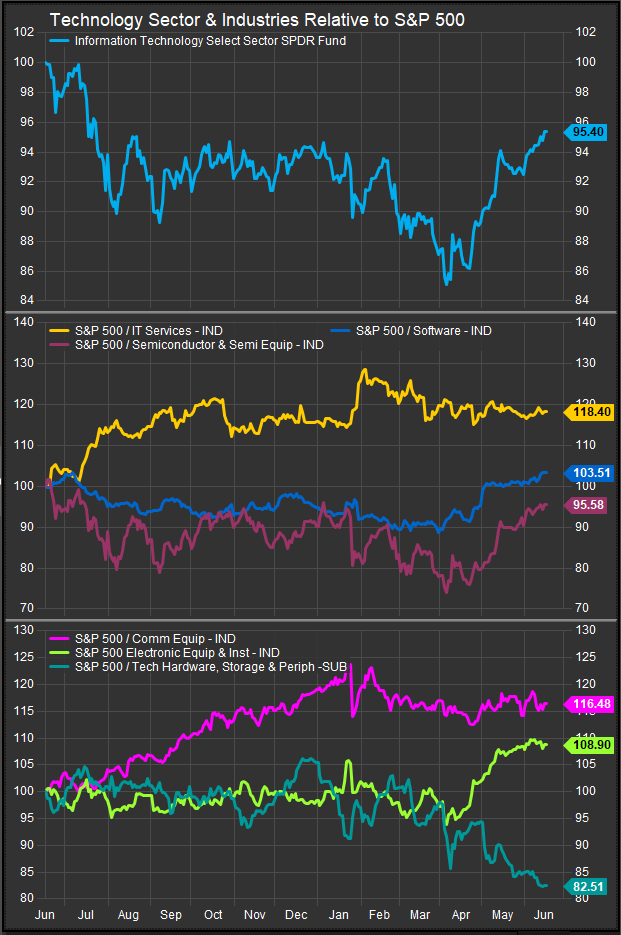

At the industry level (chart below), Hardware stocks have lagged as AAPL has lost upside momentum and is no longer supporting a weaker group of stocks. Semiconductors and Software Industries have improved, but breadth is less robust than it was last year.

AAPL

We can observe this in aggregate by looking at our sector breadth measures. The Tech Sector has seen 78% of stocks trade above their 50-day moving average since the April lows, but only a shade more than 50% of those stocks are above their 200-day moving average. In 2023/24 that longer-term series was routinely reading in the 70-85% range (chart below, middle panel, blue line).

The SOX Index (chart below) shows a similar dynamic at play within the Semiconductor Industry. NVDA and AVGO have maintained strength while the average semiconductor stock hasn’t fared as well. Just 56% of constituents are above their 200-day moving average vs. typical readings >70% at the beginning of the cycle.

Within the Software Industry, MSFT and ORCL have bounced adroitly with the broad market, but a number of former darlings are struggling. The charts of ADBE and CRM (below) have made lower lows since equities established their floor in April.

ADBE

CRM

Conclusion

While equities have been in a clear bullish reversal since April, leadership groups are being winnowed down as exemplified by narrowing upside participation from Semiconductors and other prominent Info Tech. names. We are on the lookout for emerging leadership support the bull and we are seeing improvement from the Industrial Sector in 2025, but the breadth of the advance needs to keep expanding in order for the bull trend to be sustainable. We suspect the consumer will be an important pivot moving forward. If rates stay low, there’s a chance for a rebound in housing and discretionary spending.

Data sourced from Factset Research Systems Inc.