March 4, 2025

Equity consolidation and a loss of upside momentum to start 2025 has resolved into a bearish impulse to start March. The S&P 500 price (chart below) now sits just above our key near-term support level at 5783. That level represents the bottom of the Election Day price gap which kicked off the most recent round of bullish discounting for US equities.

Optimism around a new Trump administration has turned sour as the first impactful policy plank being rolled out is increased tariffs on important global trading partners. This has happened against a backdrop of waning enthusiasm in for the AI trade as we are in a potential “air pocket” between the promise of AI and the enhanced results AI technology implementation is supposed to deliver for operating companies generally.

Given mounting evidence of buyer fatigues we are considering further downside scenarios this week for the S&P 500 and various other important thematic bellwethers.

Our drawdown analysis posits that if support is broken at 5783, the S&P 500 projects downside to the 5418 level which would be a peak-to-trough decline of just over 12%. That would be similar to the August-October decline that took place in 2023 which spanned just shy of 3-months. That’s our base case for the current pullback. We are expecting continued softness in the near-term before investors start looking for deals.

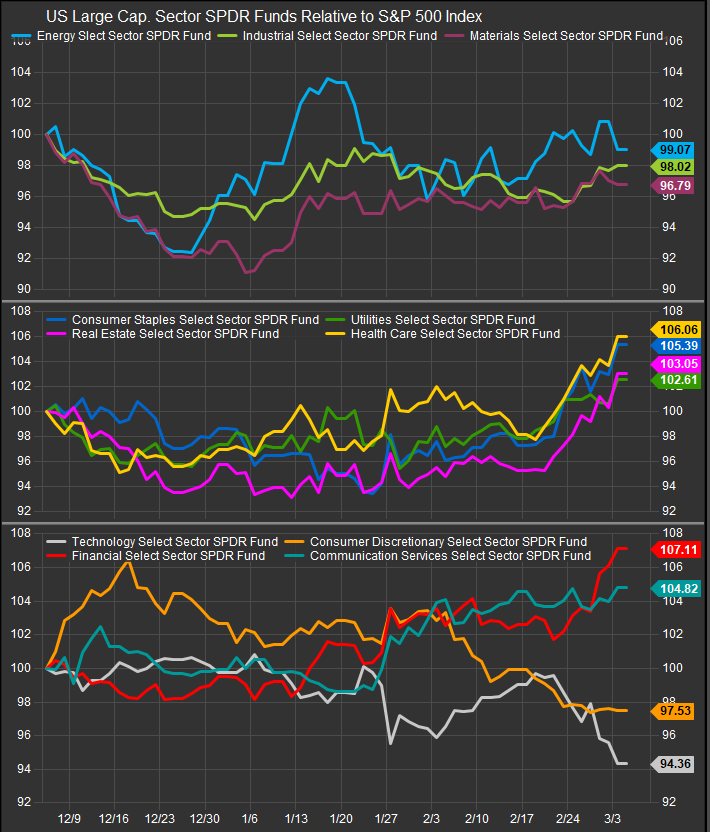

Defensive Sectors Continue to Firm

The chart below shows the relative performance of the 11 Large Cap Select Sector SPDR funds vs. the S&P 500 over the past 3 months. Rotation away from Information Technology shares is clear. Discretionary shares have been under pressure for longer and we think they are losing downside momentum, but investor preference in the near-term is for historically defensive sectors. Among cyclicals, we prefer Financials and Comm. Services sectors over Tech and Discretionary. We think Crude being near-term oversold is a opportunistic setup for Energy if bearish rotation continues despite recent comments on increasing supply from OPEC.

Keep an eye on Support Levels for Mega Cap. Growth Names

Given the strong bull trend that has preceded the current pull-back, there is potential that the current corrective action sets up an accumulation opportunity for Growth exposures. TSLA will be key to watch in the near-term as it has retraced almost all its post-election gains already and price now sits at the top of a multi-year congestion zone. We would expect accumulation near these levels once market turbulence subsides.

Market Breadth Should Help Us ID a Bottom

We are going to be keeping a close eye on Market Internal trends within the S&P 500 (Chart below). October 2023 was a breadth wash-out that led to a buyable low in this bull cycle. We will be watching for a similar setup. A key will be if AI/Growth themes keep getting sold without a clear replacement lined up. As we saw in 2023, investors just sold and sold but there was no real leadership rotation. This time around, weakness is prefaced by more technical uncertainty. Momentum had already been diverging negatively (along with market internal trends) for months before the current bout of bearishness. For now, we’re expecting one more test of breadth lows similar to the end of January 2025 as investors discount more uncertainty.

Conclusion

We think there’s more near-term downside for US equities but given the context of a long-term bull market we should be tactically defensive rather than fully in the bunker. Our technical approach projects an additional 7% downside for the S&P 500 based on the intermediate-term price structure of the index and evidence of buyer exhaustion in the form of negative momentum trends. We are keeping an eye on MAG7 price charts, and we note TSLA has already corrected to long-term price support on its chart.

Data sourced from FactSet Research Systems Inc.