Equity investors were in the holiday spirit until yesterday when some negative news for NVDA, and an in-line but not overwhelming earnings report from ORCL had investors pumping the breaks a bit on recent Technology/AI enthusiasm. We have noted a subtle shift within the Tech sector as Semiconductors have relinquished leadership and investors have been buying more Software, Hardware and concept stocks. We highlighted the nascent break-out in the ARKK ETF in this space last week as a bullish development.

This week we want to switch gears and highlight the bull market oversold condition that our min vol. sectors find themselves in at present. Lower vol. sectors like Utilities, Staples, Real Estate and Healthcare typically underperform in bull markets, but when they reach oversold levels collectively, we know equities are vulnerable to high expectations and a profit-taking motive can materialize and spark rotation away from leadership.

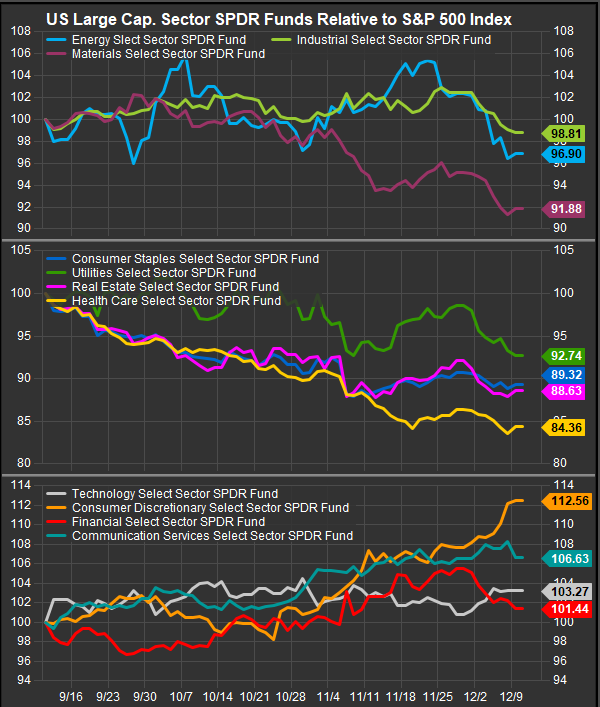

US Min Vol. Sectors all Lagging by > 7% Over the past 3-months

We are a “Santa Claus” rally away from having an extreme near-term spread between bullish higher beta sector exposures and min vol. sector exposures. Already the latter cohort has lagged by < 7% over the past 3-months. On the chart below we are comparing the middle panel which is performance of our historically defensive sectors vs. the S&P 500 against the chart’s bottom panel which are our traditional bull market exposures. The performance spread is widening. Our Elev8 model is currently out of the Healthcare Sector, but has long positions in Staples, Real Estate and Utilities to complement our longs in Tech, Financials, Discretionary and Industrials

Presidential Cycle Seasonality Potentially Bearish

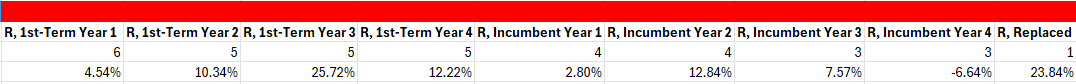

The installation of President-elect Trump to a 2nd term presents an interesting scenario for equity markets. There hasn’t been a scenario like this one since Grover Cleveland won a 2nd term in the 1890’s after not being in office the previous term. Trump, like President Cleveland is a non-contiguous incumbent. The question for investors is whether equity markets will treat him as an incumbent. Below are the average total returns for Republican Presidents by year of their presidency from 1941-present.

We can see that 1st calendar year Republican incumbents have historically seen average S&P 500 gains of just 2.80% which is a below average return for the equity market. We highlight this because of the current enthusiasm surrounding several bullish planks of the Trump agenda. Investors should be careful that the good news isn’t getting priced in too quickly. There is potential that equities spend significant time in 2025 backing and filling the gains from 2024 which has been a banner year for equities.

Conclusion

While the current macro picture is undeniably bullish, there is potential for consolidation and correction after a robust run-up in prices in the 2nd half of 2024. We want to make sure investors have a rotation strategy in place in case markets throw us a curve ball. We think investors should be playing the bull, but keep some resources allocated to lower vol. stocks as they are now oversold and historically generate their best performance when defensive rotation occurs in these circumstances.

Data sourced from FactSet Research Systems Inc.