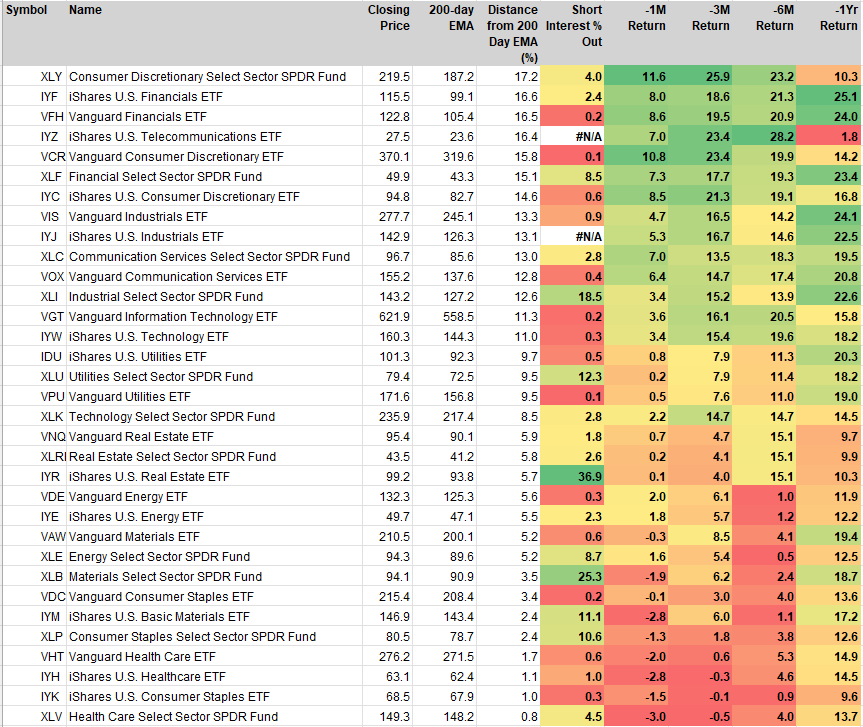

Our Tactical sector report looks at price action and options market indicators to evaluate potential near-term dislocations in price. The table below covers the large cap. US Sector Fund Families from SPDR’s, iShares and Vanguard.

In the wake of our recent US Presidential Election, we look at the most overbought and oversold sectors across the 3 US Sector fund families we evaluate. Typically, we are looking to fade overbought conditions in sectors that historically tend to mean-revert. Those are typically the legacy defensive sectors like Staples, Healthcare, Utilities and Real Estate, along with commodities adjacent sectors Energy, Materials and Industrials. We also look for longer-term signals for trend change which typically are extreme overbought or oversold conditions over weekly timeframes. Our Trend change signals typically are not “tactical” in the traditional sense of the word but establish new context for a sector when they register and inform a new tactical approach going forward. In this week’s report, Consumer Discretionary stocks are triggering this kind of bullish trend change signal at overbought conditions.

Sector Fund Families: Distance from 200-day EMA

We can see in the table below that Financials and Discretionary sector funds populate the top of the overbought/oversold table below. The XLY has seen prices rally to >17% above its exponential 200-day moving average (an exponential moving average weights current prices more heavily than past prices in the look-back period). These cyclicals historically outperform during bull markets, and we are long both at present. The bottom of the list is comprised primarily of commodities-related and defensive sectors. We’ve put on a tactical long in the Energy sector in our Elev8 portfolio due to Trump’s win and generally oversold conditions for Crude over the intermediate term. We are watching the WTI Crude price, and the direction of interest rates proxied by the US 10yr yield to give us signal on the position going forward. If rates roll over to the downside, we are likely to abandon it.

Consumer Discretionary Sector Registers a Long-term Bullish Signal

We mentioned our longer-term trend change signals in the opening. The Consumer Discretionary Sector price action over the past several months has triggered what we think of as a “good overbought” signal. This is a WEEKLY RSI reading over 70 (chart below, bottom panel), and historically this reading is a coincident indicator for bear-to-bull trend change. We can see this reading on the multi-year chart of XLY below. Coincidentally, price has also traded up to long-term resistance and is on the cusp of a new all-time high after retracing a 40% decline from 2022. The technical interpretation of this chart is to expect 40% upside over the forward period corresponding to the width of the previous basing pattern which spanned 2022-2024. We project a price target near $300 for XLY over the next 2+ years.

For those less familiar with technical parlance, the point is we look for securities in uptrends and when a security changes from a sideways to a rising trend structure, it registers extreme overbought signals at the point of transition. It’s not necessarily the best time to buy the security, but it changes the context on how one would want to buy the security moving forward. We would be very interested in adding exposure on a pull-back to the $200 level.

Conclusion

While we generally view tactical signals as near-term oversold opportunities, we wanted to take this opportunity to point out that overbought conditions can also offer opportunity. Discretionary stocks lagged the S&P 500 materially during the 2022-2023 period. Their recent weekly overbought signal augurs positive performance moving forward. We may be in the early innings of a revival in Consumer Discretionary Stocks and we have a positive outlook on VCR, IYC and XLY ETF’s.

Data sourced from FactSet Research Systems Inc.