May 29, 2025

As equities have reflated since early April, investor risk appetite has firmed. Crypto currencies have seen performance vs. USD firm and various thematic ETFs begin to outperform again. Looking beneath the surface, we’ve seen more speculative miners and infrastructure stocks catch bids while some established crypto players aren’t keeping pace.

Coins have flipped to bullish reversal with BTC:USD above previous highs near the $107K level (chart below). We project a target above $140K on the move. XRP:USD (not shown) remains above its key $2.05 support level and is also a buy in our work.

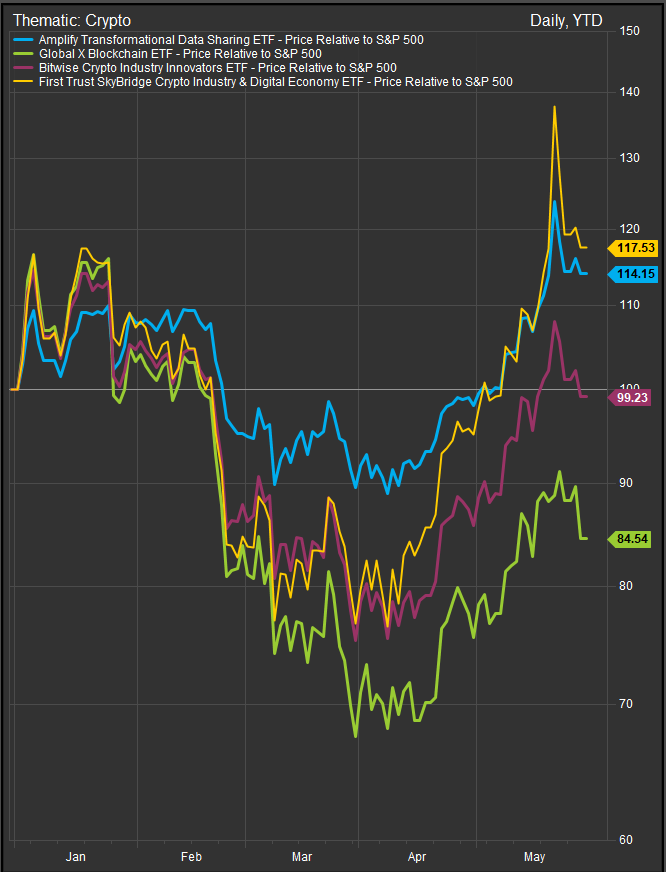

Crypto ETFs (chart below) are in bullish price structures. The recent near-term pullback looks like it’s going to get picked up today with S&P 500 futures up >1% as of this writing.

The juiciest offering in our survey of crypto funds is shaping up to be the First Trust SkyBridge Crypto Industry & Digital Economy ETF (CRPT, chart below). CPRT has a higher beta profile than some other similar funds and when we looked through the holdings we found a number of smaller stocks that are charting well along with the established players in the space.

Smaller stocks that have caught our attention include RUM and BTDR (charts below) which are tracing out early-stage bullish reversals. Other stocks with significant crypto exposure that are buy rated in our work include RBLX, IBM, HOOD, MELI, GME, COIN and MSTR. Stocks that are charting unfavorably include MARA, CIFR, RIOT and XYZ

RUM

BTDR

Conclusion

Crypto stocks since their inception have been a proxy for speculative enthusiasm. The re-emergence of the bullish crypto trade is a confirming piece of technical evidence as to the strength of the bullish reversal underway for broad market equities. We expect some of these speculative themes to pause as the S&P 500 will likely face some consolidation as it retests all-time highs, but the bullish advance is looking legitimate in our process and the path of least resistance for stocks is higher at present.

Data sourced from FactSet Research Systems Inc.